NGI The Weekly Gas Market Report | Coronavirus | E&P | Earnings | Markets | NGI All News Access

Apache Switches Most Capital from Permian to International Operations

Apache Corp. has eliminated all of its Permian-centered U.S. drilling and completions work and reduced activity overseas to ensure strong liquidity and wait out the dire impacts to demand from Covid-19.

The Houston-based super independent, like its peers, saw the year begin well, but by March, the die was cast as the pandemic began to rout natural gas and oil operations worldwide.

Apache in early March revised 2020 capital expenditures to $1.1 billion, down nearly 55% from 2019, and it cut the quarterly dividend by 90%.

In addition, it launched a “thorough economic and operational evaluation of all the producing wells across the company,” CEO John J. Christmann IV said. The analysis was done “to inform the methodical and targeted approach we are taking to production curtailments and shut-ins in this price environment.”

[Want to see more earnings? See the full list of NGI’s 1Q2020 earnings season coverage.]

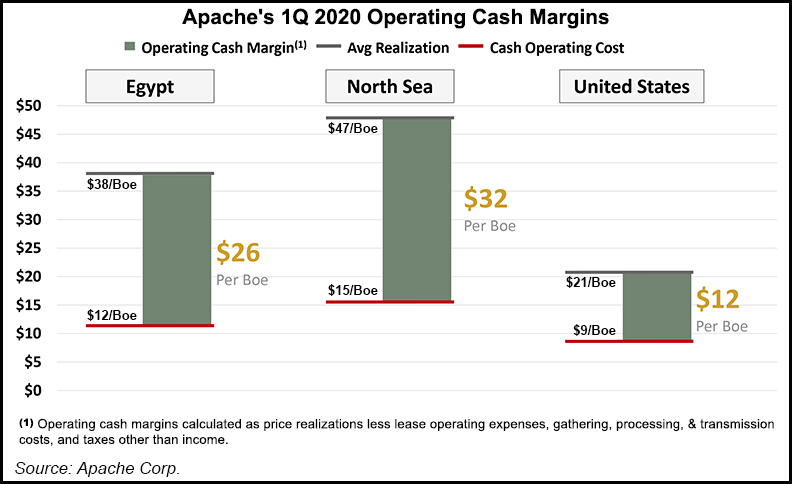

In early March, Apache shut down all of its domestic drilling and completions activity. It also reduced operations in Egypt and the North Sea. With less clarity on the Lower 48, Apache upended its capital plans, shifting most of its spend from the United States, with about 60% directed overseas versus 45% in previous guidance.

“While the 2020 outlook for the global economy and the oil and gas industry, specifically, is uncertain, we have made great strides in this environment to reduce our cost structure, protect our balance sheet, and manage our operations to preserve cash flow,” Christmann said. “When market conditions improve, I am confident we will successfully leverage Apache’s diversified portfolio to differentiate our long term value proposition for shareholders.”

Production between January and March came in at 468,000 boe/d, with 21 rigs in operation and 44 wells completed worldwide.

On average, seven rigs were working in the United States until early March, all in the Permian, where 24 wells were completed with output of 283,000 boe/d.

Permian production in 1Q2020 averaged 273,000 boe/d, mostly natural gas and liquids, with oil output of 97,000 boe/d. Within the No. 1 U.S. project Alpine High in the Delaware sub-basin, production averaged 94,000 boe/d, weighted to natural gas.

However, the Permian rig count now is set to zero for the near term, with one lone rig finishing one well in the Delaware. Apache expects to end the year with about 70 drilled and uncompleted wells combined in the Midland and Delaware formations, including 15 in Alpine High.

In the international operations, production averaged 185,000 boe/d, led by Egypt with 116 boe/d. North Sea output averaged 69,000 boe/d.

For the U.S. operations, all centered in the Permian Basin, oil volumes fell 7% year/year to 101,614 b/d, while natural gas volumes were down 20% to 597,842 Mcf/d. Natural gas liquids volumes were up 38% to 81,381 b/d, with the Permian contributing nearly all of the liquids with a 69% surge to 80,106 b/d.

Apache lost $4.48 billion net (minus $11.86/share) in the first quarter, versus year-ago losses of $47 million (minus 12 cents). Revenue declined to $1.28 billion from $1.66 billion.

As part of its Covid-19 response, Apache closed several offices and implemented work-from-home measures. It also set up operational protocols that led to “minimal business interruption.”

As it begins to reopen some offices, Apache has set up temperature screenings to test employees for potential exposure to the coronavirus. It also has expanded an assessment of all contractor companies/vendors coming onsite to locations, as well as increasing cleaning measures in the field and in office locations.

A phased re-entry plan is in place to eventually reopen the closed offices, following guidance of local governments.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |