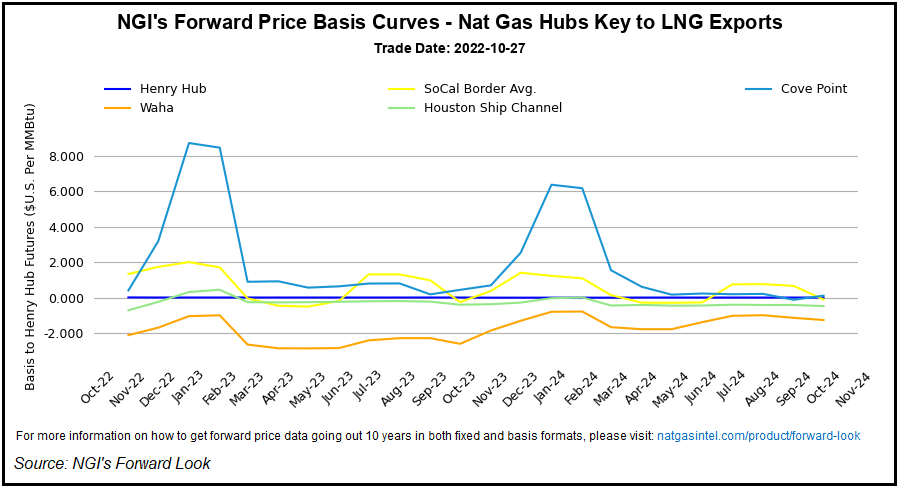

Appalachian Basin pure-play Antero Resources Corp. expects continued strengthening of natural gas basis pricing at locations with access to the global LNG market, management said Thursday.

On a conference call to discuss third quarter earnings, Antero’s Justin Fowler, senior vice president of gas marketing and transportation, touted the company’s “unique ability to avoid the pitfalls of regional capacity constraints and wide basis discounts, which we saw once again during the third quarter.”

He said Antero holds 2.3 Bcf/d of firm transportation capacity – equal to about 75% of its total production – to the U.S. Gulf Coast liquefied natural gas fairway, and to the Cove Point LNG terminal in Maryland.

Looking ahead, Antero expects negative basis differentials to...