NGI The Weekly Gas Market Report | NGI All News Access | NGI Archives

Another Wrinkle Emerges in TransCanada Mainline Conversion

Discovery of a western devil in the details of an eastern settlement on TransCanada Corp.’s proposed partial conversion of its natural gas Mainline to oil service has ignited a new protest.

The pact saddles western Mainline shippers with C$200 million (US$150 million) in conversion costs that none of TransCanada’s gas delivery customers should have to pay, said Centra Gas Manitoba Inc. in a complaint to the National Energy Board (NEB).

Centra, a subsidiary of provincial government-owned Manitoba Hydro, said the bill was a surprise that surfaced in the fine print of a deal with Union Gas, Enbridge Gas and Gaz Metro that TransCanada revealed in a November filing at the NEB.

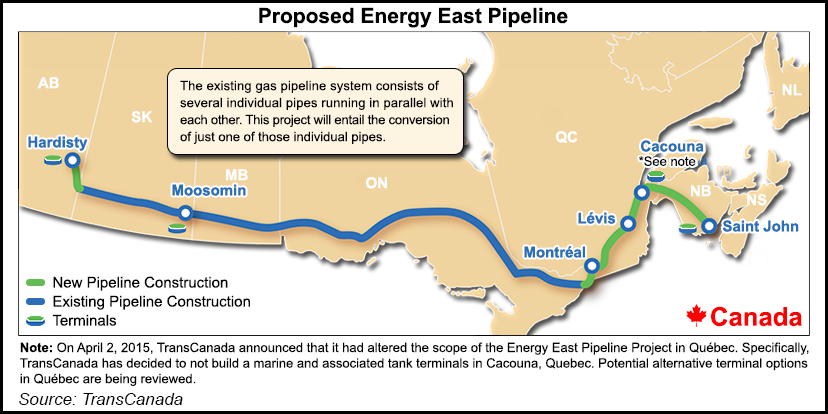

The pact ended a fierce financial squabble with the Ontario and Quebec gas distribution companies that jeopardized TransCanada’s C$12 billion (US$9 billion) Energy East plan to convert part of its Mainline into an Alberta oil sands export conduit for 1.1 million b/d.

The new protest revives prospects of further delay for the mammoth scheme, which is already about two years behind the original schedule. The NEB has not yet accepted the application as complete, a crucial step that would start the clock running on a 15-month legislated time limit for its approval procedure.

Centra did not demand postponement of the completeness ruling but vowed to make fairness towards western gas producers an issue as soon as TransCanada files material needed to start the NEB process rolling.

The settlement with Union, Enbridge and Gaz Metro stopped a TransCanada attempt to make them pick up costs of replacing gas delivery capacity on eastern legs of the half-century-old gas Mainline that would be switched into oil service. The expenses would be for maintaining full service with new facilities called the Eastern Mainline.

Under the heading “adjustment accounts,” the arrangement’s text says C$200 million in Ontario and Quebec conversion costs would be tacked onto the rate base of shippers that use the Mainline’s western legs.

“The substance of the agreement is that the cost of gaining the support of Eastern Canadian natural gas shippers for the Energy East and Eastern Mainline projects is proposed to be borne in part by western Mainline shippers,” Centra told the NEB.

“Natural gas shippers should not be subsidizing the proposed Energy East project in order to help ensure its economic viability.”

In addition to clearing away an obstacle to Energy East, the pact created a positive environment for TransCanada and the Ontario distribution companies to carry out a separate agreement on increasing capacity to import shale gas from the United States. Construction, regulatory proceedings and commercial discussions are under way on a portfolio of eastern Mainline and allied distribution company projects.

Growing imports are another sore spot in relations between TransCanada and its western Mainline customers. The Energy East project grew out of diminishing traffic in TransCanada’s western gas lines due to rising imports of Marcellus and Utica shale production from the U.S. as competition against traditional Alberta supply mainstays. American exports to Ontario and Quebec have jumped from negligible to more than 2 Bcf/d over the past six years.

The scale of change evolving on the “continental” market of Canadian and U.S. flows across the deregulated, open border shows in a forecast released by the Canadian Gas Association (CGA), a voice of distribution utilities.

The CGA document, crafted by Fairfax VA-based ICF International, sets out to prove that Canada’s remaining electric- and oil-heating regions would save C$150 million (US$112 million) per year by changing to lower-cost gas. Much of the potential for fuel switching is in Ontario and Quebec. The ICF calculations include a forecast that 44% of gas consumed in Canada over the next 25 years will be imports from the United States.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |