Markets | NGI All News Access | NGI Data

Another Bullish Miss in EIA Storage Report Leads to Modest Rally

Another bullish miss on Thursday from the Energy Information Administration’s (EIA) weekly natural gas storage report failed to spark much of a rally as the market continues to count on production replenishing stockpiles once summer heat subsides.

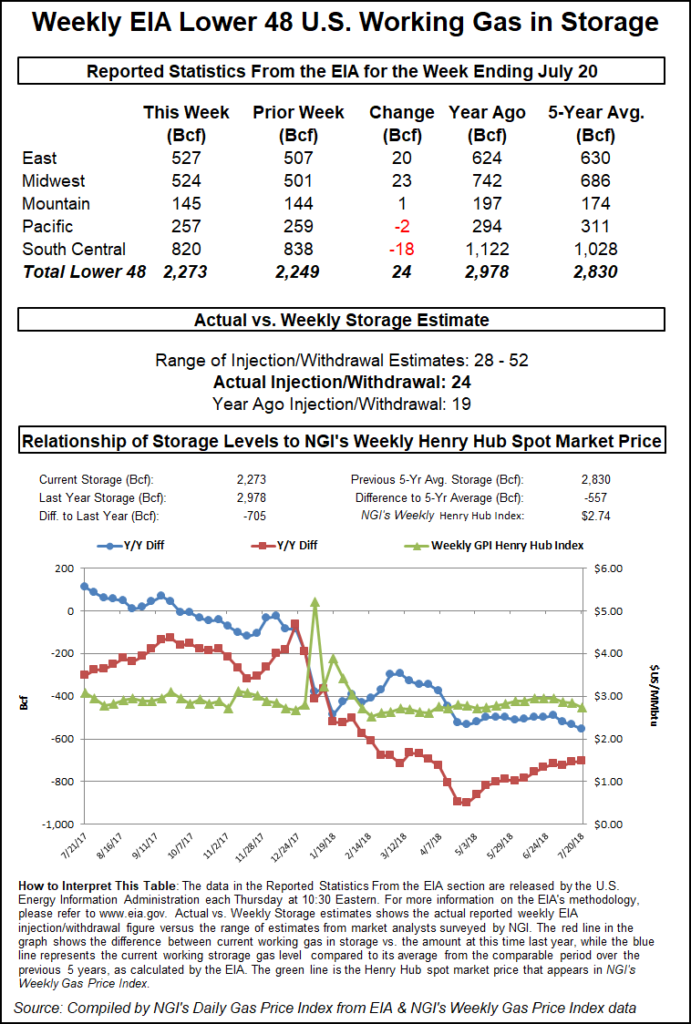

EIA reported a 24 Bcf injection into Lower 48 gas stocks for the week ended July 20, lower than most estimates and well below the five-year average 46 Bcf. Last year, EIA recorded a 19 Bcf injection. Last week’s EIA report covering the week ended July 13 also missed to the bullish side of estimates at 46 Bcf, as surging production has kept a lid on prices but can’t seem to shrink deficits.

Wednesday’s 4.3 cent rally for the front month suggested the market was anticipating a tight EIA report, which may help explain why the immediate price response Thursday was muted. When the number was published at 10:30 a.m. ET, the August Nymex contract picked up about 2.0 cents to trade up around $2.790. By 11 a.m. ET, August was trading around $2.794, up about 1.9 cents from Wednesday’s settle. September, set to take over as the prompt month once August expires Friday, was trading around $2.776, up about 2.1 cents from Wednesday’s settle.

Prior to the report, consensus estimates had the market looking for a build about 10 Bcf higher than the actual figure. A Bloomberg survey had produced a median 36 Bcf injection, with a range of 28 Bcf to 52 Bcf. Intercontinental Exchange EIA Financial Weekly Index futures came closer to the mark, settling Wednesday at an injection of 25 Bcf.

Bespoke Weather Services said the figure came in about 9 Bcf below its estimate, largely because of a “massive draw” reported for the South Central region.

“We had been looking for a small implicit revision from last week’s very tight print, but instead today’s print seemed to confirm last week,” Bespoke said. “The result is a natural gas strip that is remaining quite firm, with December leading in early post-print trading.

“Any winter leadership would be quite bullish moving forward, and short-term we see $2.85 in play off such a supportive print, especially with options expiry today. Any rebound in production will result in a rather quick reversal, though.”

Total working gas in underground storage stood at 2,273 Bcf as of July 20, versus 2,978 Bcf last year and five-year average inventories of 2,830 Bcf. Week/week (w/w), the deficit to last year narrowed from 710 Bcf to 705 Bcf, while the year-on-five-year deficit increased from 535 Bcf to 557 Bcf, EIA data show.

By region, the South Central saw an 18 Bcf withdrawal for the period, including 16 Bcf pulled from salt and 2 Bcf pulled from nonsalt. The Pacific also posted a w/w withdrawal of 2 Bcf, while 1 Bcf was refilled in the Mountain region. The Midwest and East saw injections w/w at 23 Bcf and 20 Bcf, respectively, according to EIA.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |