Markets | NGI All News Access | NGI Data

Another Bullish Miss For EIA Natural Gas Storage; May, June Futures Gain

Natural gas futures got a bump Thursday after the Energy Information Administration (EIA) reported a rare April storage withdrawal that came in tighter than expected.

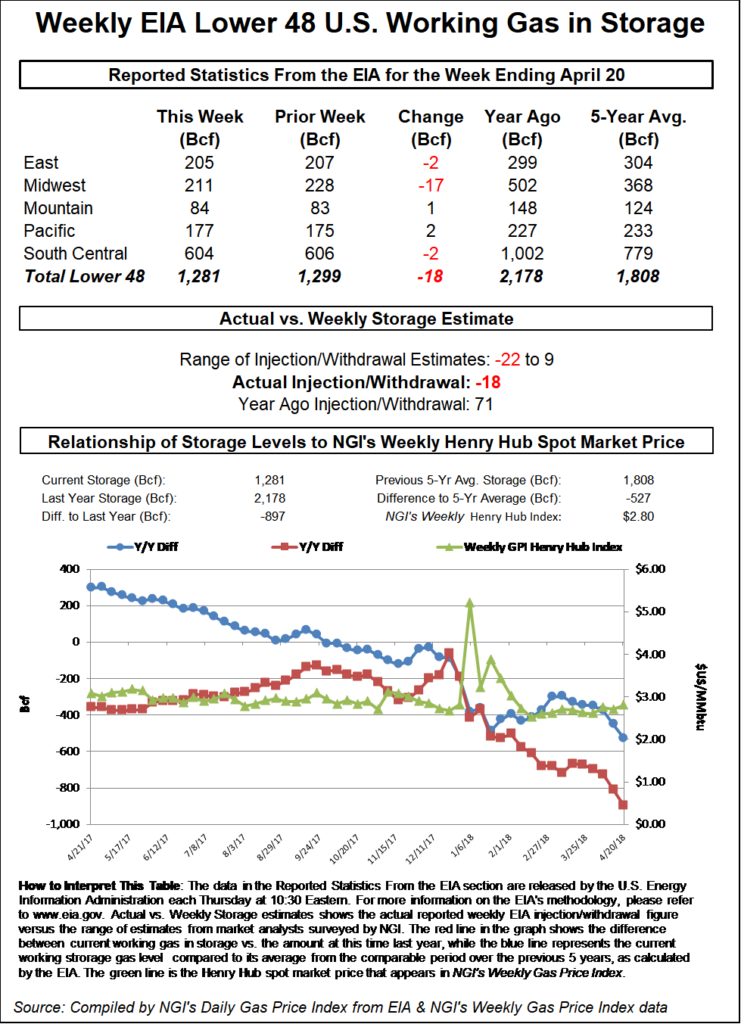

EIA reported an 18 Bcf withdrawal from Lower 48 gas stocks for the week ending April 20, an unusual pull from inventories weeks into the typical start of injection season. Last year, EIA recorded a 71 Bcf build, while the five-year average is a build of 60 Bcf.

The figure beat most estimates to the bullish side, and immediately following the 10:30 a.m. ET release of the number, the expiring May contract shot up around 2 cents to as high as $2.814, while June jumped a couple cents to as high as $2.839. By 11 a.m. ET, May was trading about 3.5 cents above Wednesday’s settle at $2.821, while June was up about 3.2 cents at around $2.839.

Prior to the report, the market had been expecting a withdrawal somewhat looser than the actual figure, with estimates calling for a small injection.

A Reuters survey of traders and analysts on average had predicted a 12 Bcf withdrawal, with responses ranging from a pull of 22 Bcf to a 9 Bcf injection. A Bloomberg survey had produced a median withdrawal of 11 Bcf, with responses ranging from a 22 Bcf pull to a 5 Bcf build.

OPIS PointLogic had predicted an 11 Bcf withdrawal. IAF Advisors analyst Kyle Cooper had called for an 18 Bcf withdrawal, while Price Futures Group senior analyst Phil Flynn had called for an injection of 5 Bcf. Intercontinental Exchange EIA storage futures settled Wednesday at a withdrawal of 14 Bcf.

“The natural gas market continues to be propped up by short-term weather/strong cash and EIA data that shows more tightness than expected,” said Bespoke Weather Services, which had called for an 11 Bcf pull. “We do see this number as modestly looser week/week but still tighter than expected, and this has prevented prices from pulling back off the print.

“The strip is lagging weakly, with strong resistance expected at $2.87 for the June contract (its March high),” Bespoke said. “Even with this tightness any approach of that resistance should be a short opportunity with large injections for May, but short-term support has arrived.”

Total working gas in underground storage stood at 1,281 Bcf as of April 20, according to EIA. That’s versus 2,178 Bcf a year ago and five-year average stocks of 1,808 Bcf.

Week/week, the year-on-year storage deficit increased from 808 Bcf to 897 Bcf, while the year-on-five-year deficit widened from 449 Bcf to 527 Bcf, EIA data show.

By region, the largest net withdrawal came in the Midwest at 17 Bcf, while 2 Bcf was pulled in the East. The Mountain and Pacific regions saw small injections for the period at 1 Bcf and 2 Bcf, respectively. In the South Central, 3 Bcf was pulled from salt for the week, while nonsalt finished flat, according to EIA.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |