Markets | NGI All News Access | NGI Data

Analysts Hint at Scrambled NatGas Storage Data; Futures Ease Nonetheless

Natural gas futures lost ground Thursday morning after the Energy Information Administration (EIA) reported a storage withdrawal that was somewhat less than what traders were expecting.

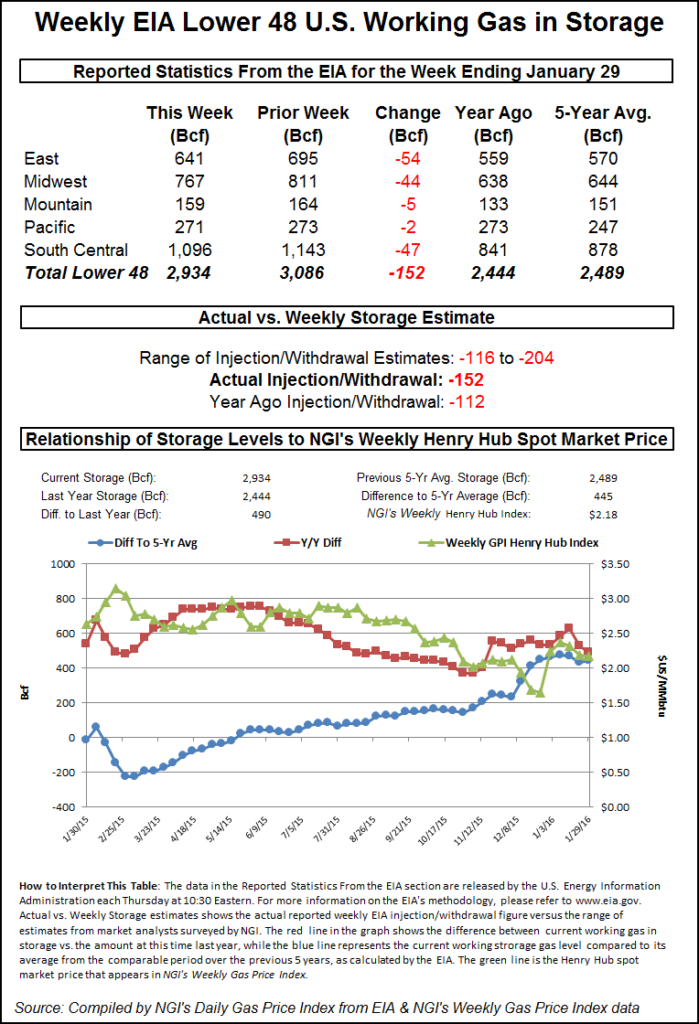

EIA reported a 152 Bcf withdrawal in its 10:30 a.m. EST release, and the withdrawal put inventories at 2,934 Bcf. March futures fell to a low of $1.984 following the release of the storage data, and by 10:45 a.m. March was trading at $2.015, down 2.3 cents from Wednesday’s settlement.

Prior to the release of the data, analyst estimates were in the upper-150 Bcf area. IAF Advisors was looking for a pull of 150 Bcf, and a Reuters survey of 23 traders and analysts showed a range from -116 to -202 Bcf with an average -158 Bcf. Citi Futures Perspective calculated a 167 Bcf withdrawal.

“We were hearing a number in the 147 area, and initially prices dropped but later rallied, said a New York floor trader. “We have to see if this trades under $2 and settles under $2 for a couple of days. If we settle above $2, maybe we get a little bounce back.”

Analysts suggested that the eastern snow of last week may have forced a one-time “low” withdrawal. “[I]t does look to us as though a drop in industrial demand off the major Jan. 22-23 East Coast snowstorm may have helped limit withdrawals for last week,” said Tim Evans of Citi Futures Perspective. “If so, that’s a one-off change that may not indicate a weakening of the underlying supply-demand balance. However, we’d still say this is a bearish result, further reducing the chances that storage levels tighten this winter.”

Inventories now stand at 2,934 Bcf and are 490 Bcf greater than last year and 445 Bcf more than the five-year average. In the East Region 54 Bcf was pulled, and the Midwest Region saw inventories fall by 44 Bcf. Stocks in the Mountain Region were down by 5 Bcf, and the Pacific Region was lower by 2 Bcf. The South Central Region shed 47 Bcf.

Salt cavern storage was lower by 18 Bcf to 303 Bcf, while the non-salt cavern figure fell 28 Bcf to 793 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |