E&P | NGI All News Access | NGI The Weekly Gas Market Report

Anadarko Raises Production Guidance as Expanded Offshore Arsenal Fuels Onshore Growth

Anadarko Petroleum Corp.’s advantages in the Gulf of Mexico are stacking up, providing cash flow to fund a plethora of U.S. onshore opportunities, as the super independent eyes a stronger production growth rate over the next five years.

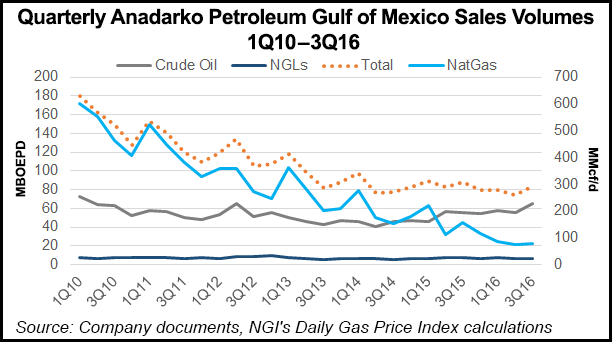

The producer last week completed its $2 billion acquisition of Freeport-McMoRan Inc.’s deepwater portfolio, which not only lifted GOM production to more than 160,000 boe/d net, but doubled ownership in its operated Lucius development to 49% and increased by three its total offshore-operated facilities to 10. As important, the bigger arsenal offshore is paving the way for enhanced cash flow destined for two major onshore holdings: the Denver-Julesburg (DJ) Basin and the Permian’s Delaware sub-basin.

“As a result of closing this transaction, Anadarko now operates the largest number of floating production facilities in the deepwater Gulf of Mexico, which provides a competitive advantage to leverage this infrastructure into attractive new investment opportunities,” CEO Al Walker said. “This region continues to play a key role in our portfolio by contributing to our higher-margin oil growth profile, while generating substantial future free cash flow to accelerate the growth of our world-class U.S. onshore assets in the Delaware and DJ basins.

“The expanded portfolio of deepwater facilities provides numerous hub-and-spoke opportunities that can generate rates of return of better than 50% at today’s prices. Given our industry-leading capabilities in deepwater project management, production solutions and exploration success, adding these high-quality assets greatly improves our ability to deliver strong performance in a volatile commodity environment.”

When the Freeport-McMoRan deal was announced last fall, Walker said the acquired assets would generate substantial free cash flow over time, allowing increased investment in the U.S. onshore. Management at the time said Anadarko would be positioned to deliver a five-year compounded oil growth rate of 10-12% in a $50-60/bbl oil price environment.

However, the opportunity appears to be even better today. Since the end of September Anadarko has added two rigs each to the Delaware and DJ, with development now in overdrive. Plans now are to increase activity in each play, with expectations by the end of next March to have 14 operated rigs in the Delaware and six in the DJ. That compares to the end of September, when Anadarko was running seven rigs in the Delaware and one in the DJ.

The new investments in the two onshore basins alone generate rates of return of 35-60% — or more — at today’s commodity prices, the CEO said.

“As a result of our large and well located acreage positions, improving cost structure, midstream infrastructure advantages, and commodity-price outlook, we now believe we have the ability to deliver a five-year compounded annual oil growth rate of 12-14%, while investing within expected cash inflows,” Walker said.

GOM discoveries — and opportunities to add more low-cost tiebacks — also are increasing. The company’s Warrior exploration well, about three miles from its operated K2 field, recently encountered more than 210 net feet of pay in multiple high-quality Miocene-aged reservoirs. The discovery is expected to be tied back to the Marco Polo production facility. Anadarko operates Warrior with a 65% working interest and partners with Ecopetrol (20%) and Mitsubishi Corporation Exploration Co. Ltd. (15%).

At the Phobos appraisal well, 12 miles south of the Anadarko-operated Lucius facility, the company also encountered more than 90 net feet of pay in a Pliocene-aged reservoir that it said is similar to the nearby Lucius field. The secondary accumulation was in the Phobos discovery well and is to be evaluated for tieback to Lucius. Meanwhile, drilling is under way toward the primary objective in the Wilcox formation. Anadarko has a 100% stake in Phobos.

Meanwhile, at the Heidelberg field in the deepwater, the fifth production well currently being drilled “has encountered the reservoir sand with more than 150 net feet of oil pay to date,” management said. The well is expected to be brought on production early next year.

“The successes to date at Warrior and Phobos further demonstrate the value of our assets in the deepwater Gulf of Mexico and our tieback strategy,” Walker said. “It also illustrates why we have tremendous confidence in the potential of our ‘3 Ds’ — the deepwater, Delaware and DJ — to drive growth and value for many years to come.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |