NGI The Weekly Gas Market Report | E&P | NGI All News Access

AMLO’s Oil Output Goal for Mexico Tough to Meet, Says Think Tank

Mexican President-Elect Andrés Manuel López Obrador’s goal to increase domestic crude oil output to 2.4 million b/d in 2024 from the current average of 1.8 million b/d will be a tall order even under the most favorable circumstances, according to new analysis by the Pulso Energético think tank.

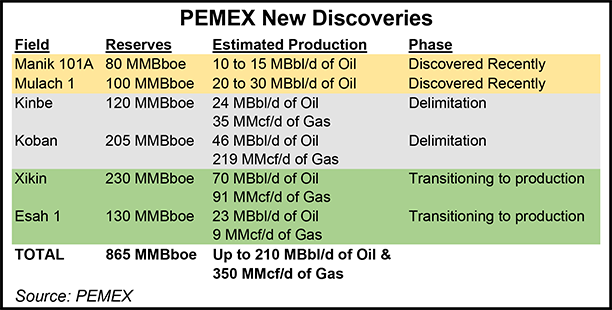

The projection follows the announcement last week by national oil company Petróleos Mexicanos (Pemex) of the discovery of seven shallow-water oil deposits via the Manik-101A and Mulach-1 exploration wells. Concurrently, Pemex announced that its Kinbé and Koban shallow water projects were in the delineation phase, and the Xikin and Esah-1 wells would soon ramp up production.

Pemex CEO Carlos Treviño said the six shallow water projects are expected to supply up to 210,000 b/d of oil and 350 MMcf/d of natural gas production by 2020.

However, even if the projects ramp up, they would amount to a drop in the bucket in the larger effort to reverse freefalling crude and gas production nationwide, Pulso Energético said.

“Just to compensate for the fall in production from [existing] fields and produce 1.8 million b/d in 2024, we need at least six groups of projects similar to the ones Pemex announced last week to launch this year,” said the think tank, which is funded by Asociación Mexicana de Empresas de Hidrocarburos, or AMEXHI, an oil and gas trade group.

To achieve 2.4 million b/d in oil output, the goal laid out in a September presentation by López Obrador’s transition team, would require nine groups of similar projects, Pulso Energético said.

To calculate the forecast, Pulso Energético used average growth rates of similar projects in different phases of development, data which is available from Mexico’s Comisión Nacional de Hidrocarburos (CNH).

Achieving the 2.4 million b/d goal also assumes the expected contribution of 280,000 b/d by end-2024 from exploration and production (E&P) contracts that have been awarded through bid rounds since Mexico’s 2013-14 energy reform, a constitutional overhaul that ended the state’s monopoly over the electric power and hydrocarbon industries.

The challenging scenario underscores the necessity of continuing the bid rounds under the next government, the think tank said.

López Obrador has criticized both the rounds and the reform that made them possible as a ruse to forfeit Mexico’s energy sovereignty to foreign business interests. He also has signaled his intention to suspend the rounds, at least temporarily, after he takes office.

CNH, which oversees the rounds, has said that the next scheduled tenders, Rounds 3.2 and 3.3, remain slated for February.

López Obrador has also pledged to prohibit hydraulic fracturing in the country, although he hasn’t specified the parameters under which such a ban would imply.

The president-elect has said his administration will boost output by increasing Pemex’s E&P budget, and by modifying the energy reform to give Pemex more freedom in choosing its upstream partners.

The transition team’s presentation last month, titled “Evolution of the oil industry in Mexico,” correctly stated that the country’s current oil output is 40% below the 3 million b/d promised for 2018 by current president Enrique Peña Nieto three years ago. It blamed the energy reform for declines in oil and gas production and investment since then.

However, the presentation did not address factors such as the rapid depletion of Mexico’s flagship Cantarell mega-field since 2004, nor the precipitous drop in global commodity prices that began in mid-2014 and extended into 2016.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |