Shale Daily | E&P | NGI All News Access | NGI Mexico GPI

AMLO Offers Three-Year ‘Truce’ to Oil, Gas Bid Round Winners

Mexican President Andrés Manuel López Obrador said Wednesday that he will offer a three-year “truce” to oil and gas companies that won exploration and production (E&P) contracts through bid rounds under his predecessor, Enrique Peña Nieto.

Based on the investments and hydrocarbon production that these companies contribute during the period, the government will decide whether to continue with new bid rounds, the president said during his daily morning press conference.

As of Wednesday afternoon, national hydrocarbons commission CNH, which conducts the tenders, had not confirmed whether upstream rounds 3.2 and 3.3, which are currently scheduled for February, would in fact be suspended.

National power grid operator Cenace did confirm on Monday, however, that a long-term electric power supply auction originally scheduled for Dec. 18 would be postponed until a yet-to-be-determined date.

The decision, Cenace said, is due to the recent change in government and subsequent personnel changes at the top of Cenace, state power utility Comisión Federal de Electricidad (CFE), and energy ministry Sener.

The postponement will allow the parties to conduct a “revision of the objectives and scope of said process,” and “will strengthen the principles of maximum publicity and transparency with which this organism governs,” Cenace said.

Both the oil and gas bid rounds, and the long-term power supply auctions, are conducted under the framework of Mexico’s 2013 constitutional energy reform, which ended the monopolies formerly held by national oil company Petróleos Mexicanos (Pemex) and CFE over the hydrocarbon and electricity sectors, respectively.

López Obrador has repeatedly blasted the reform as a “betrayal” of Mexico’s energy sovereignty orchestrated by foreign interests and their “neoliberal” Mexican sympathizers, namely Peña Nieto.

Round 3.2 places on offer 37 onshore conventional blocks, of which 21 are located in the Burgos Basin, which is Mexico’s leading non-associated gas-producing basin. To date, 12 firms have begun the prequalification process.

Round 3.3 includes acreage targeting both conventional and shale resources. So far, only Pemex has begun prequalification for this round.

During the transition period after his landslide electoral victory, López Obrador told oil and gas trade association AMEXHI (Asociación Mexicana de Empresas de Hidrocarburos) that his government would respect the more than 100 contracts that have been awarded through bid rounds since the reform, provided that the projects “show results.”

The industry interpreted this message as a veiled threat of the potential consequences if projects are not brought on-stream as fast as possible. Subsequently, two agreements were announced — one between Talos Energy and Pan American Energy, LLC, and the other between Eni SpA and Lukoil — to expedite development of their respective offshore portfolios in Mexico.

DEA to Acquire Sierra

The president’s comments follow the announcement on Tuesday by DEA Deutsche Erdoel AG (DEA) that it has signed an agreement to acquire independent Mexican oil company Sierra Oil & Gas.

Sierra holds interests in six exploration and appraisal blocks totaling 9,400 square kilometers (3,629 square miles) in Mexico’s Sureste basin, DEA said in a release.

This includes a 40% stake in the Talos-operated Zama offshore discovery, which contains an estimated 400-800 million boe of recoverable hydrocarbon resources.

Upon completion, the acquisition of Sierra “will be the largest upstream M&A transaction in the country since the liberalization of the petroleum sector in 2013,” DEA said.

CEO Maria Moraeus added, “The acquisition of Sierra will allow DEA to achieve materiality in the highly strategic and competitive Mexican upstream market and provide us with a high-quality exploration and appraisal portfolio in one of the world’s most sought-after offshore basins, as well as a strong team. The transaction also underlines our confidence in the future of Mexico’s energy industry.”

DEA, which is chaired by former BP plc CEO John Browne, currently operates the onshore Ogarrio field in Mexico in collaboration with Mexican national oil company Pemex.

DEA, a division of financial holding company LetterOne, also holds interests in exploration blocks in the Tampico Misantla and Sureste basins. LetterOne was co-founded by Russian billionaire Mikhail Fridman.

Zama Appraisal Campaign

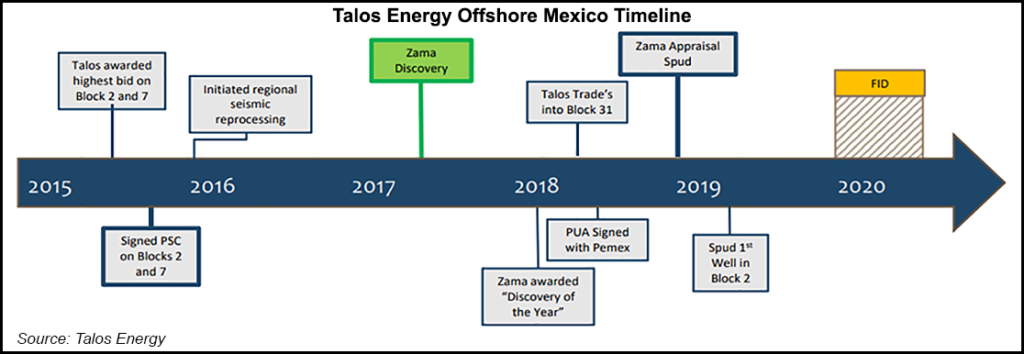

Talos and its joint-venture partners have spudded the first of two appraisal wells at the Zama discovery off the coast of Mexico, Talos said Monday.

The Zama-2 well is located to the north of the discovery, which was announced in 2017 and contains an estimated 1.4-2 billion bbl of oil in place.

The approximately $250 million appraisal program is expected to conclude by mid-2019, Talos said, and will consist of three reservoir penetrations, including two wells and one sidetrack.

Zama-2 “will look to confirm the oil water contact and collect information to better understand the reservoir’s aquifer support,” Talos said, adding that the well “will also be deepened approximately 500 meters below the Zama reservoir to test the Marte exploration prospect.”

The Zama-3 well, meanwhile, “will be drilled to the south of the original discovery well and will help delineate reservoir continuity and quality in the southern part of the field and will be cored to better understand the reservoir geology.”

Zama is part of offshore Block 7, which was awarded to a Talos-led consortium in 2015 through Round 1.1, the first in a series of bid rounds conducted under the framework of Mexico’s 2013 constitutional energy reform.

Despite the president’s skepticism of the reform and the bid rounds, Talos CEO Timothy Duncan said earlier this year that projects awarded through the Round One tenders are expected to deliver one-third of Mexico’s oil output by 2024, citing analysis by Wood Mackenzie.

Talos is the operator of Block 7 with a 35% participating interest. Stakes are also held by Premier Oil (25%) and Sierra Oil & Gas (40%). The consortium is aiming for initial production from Zama by 2022.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 2158-8023 |