Natural gas futures pared their losses early Thursday as traders prepared to digest the latest round of government inventory data, expected to reveal another lighter-than-average withdrawal to further pad the storage cushion.

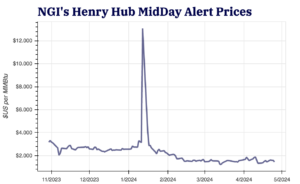

Coming off a 21.6-cent slide in the previous session, the March Nymex contract was up 2.6 cents to $2.494/MMBtu at around 8:50 a.m. ET.

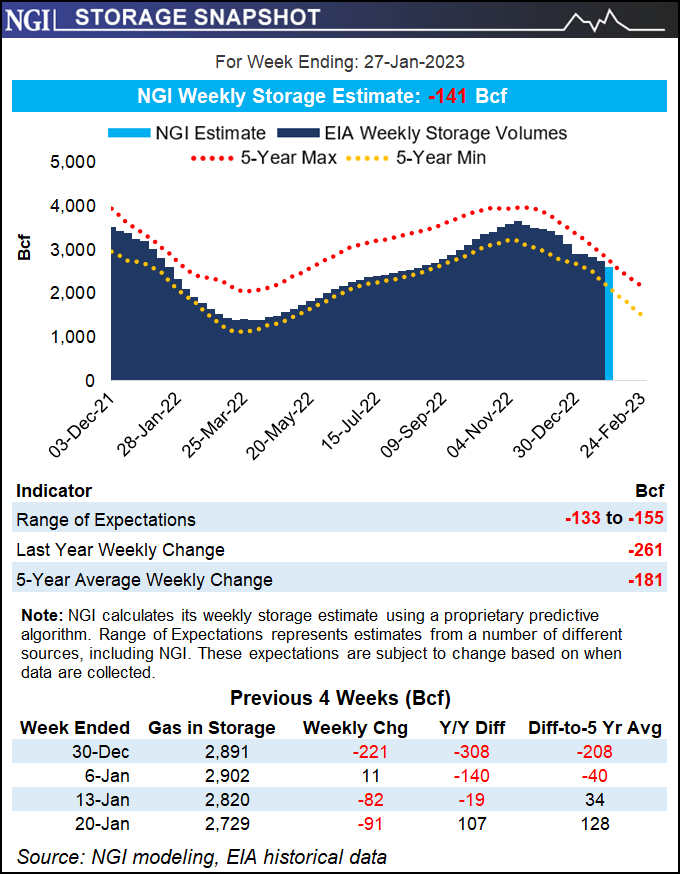

Ahead of the Energy Information Administration’s (EIA) 10:30 ET storage report, which covers changes to U.S. inventories during the week ended Jan. 27, surveys suggest a lighter-than-average winter withdrawal of around 140-145 Bcf.

Withdrawal estimates in a Reuters survey of 14 analysts ranged from 133 Bcf to 155 Bcf, with a median decline in stocks of 142 Bcf. Bloomberg’s survey of eight analysts as of Wednesday had...