Infrastructure | NGI All News Access

Alberta’s ‘Gas City’ Blames Low Prices in Shuttering Most Natural Gas Wells

Chronic low prices have prompted the elder dean of Canadian natural gas producers to scrap three-quarters of its wells.

Medicine Hat’s 118-year-old, city-owned energy company announced that about 2,000 of its 2,600 wells would be abandoned, otherwise permanently shut down, sealed and reclaimed.

“A sustained pricing recovery in natural gas is not expected in the foreseeable future,” said Medicine Hat Energy and Utilities Commissioner Brad Maynes. “We have worked hard for years” to make the gas production division profitable, “but this is a market phenomenon happening across North America. This is the new normal.”

Like investor-owned peers in Canadian gas, the city on the southeastern Alberta plains has struggled to survive a severe case of the price slump inflicted by a North America-wide supply glut.

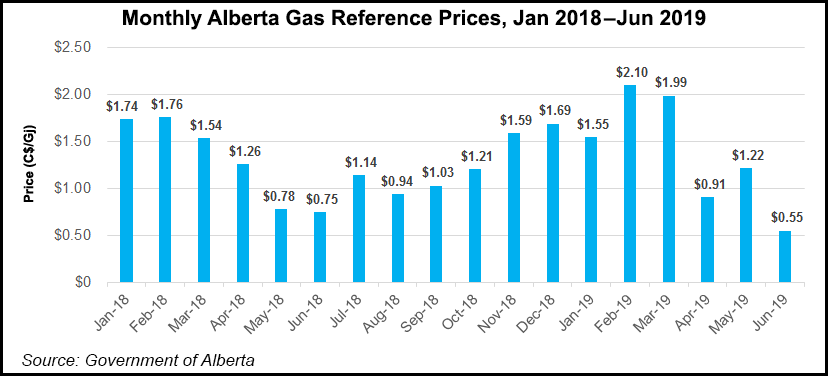

The Alberta Reference Price (ARP), a monthly index compiled by the provincial government, only averaged C$1.39/gigajoule ($1.09/MMBtu) so far this year.

The discarded Medicine Hat production is a legacy from pre-unconventional drilling days, when generations of multiple shallow, low-output wells earned the community its nickname as Canada’s Gas City.

The old gas fields fueled industries such as pottery and brick making. The fiery activity inspired the British Empire’s roving poet laureate Rudyard Kipling to make Medicine Hat world-famous in 1907 as the spot with “all Hell for a basement.”

As Medicine Hat’s gas-based prosperity grew to include fertilizer and petrochemical plants, its civic drilling and production earned the city treasury profits of more than C$600 million ($450 million).

However, the community profits ended in 2014 as the shale revolution increased supplies and eroded prices across North America. The Medicine Hat well shut-in followed a review triggered by city gas company annual losses of C$30 million ($22 million).

“We’ll always be the Gas City,” Maynes said. “It’s an integral piece of our history, and the city’s oil and gas accomplishments will leave a lasting legacy for generations.”

A pipeline rule change to moderate summer price declines is under review by the Canada Energy Regulator. The proposal seeks priority for shipments into storage on TC Energy Corp.’s supply collection grid Nova Gas Transmission Ltd. (NGTL) during traffic interruptions by maintenance and construction.

The NGTL tariff amendment is forecast to prevent repetitions of an ARP plunge to C55 cents/GJ (43 cents/MMBtu) when the 2019 summer pipeline work season and annual gas demand lull arrived in June.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |