WhiteWater Midstream and MPLX LP announced Wednesday the completion of a substantial natural gas pipeline expansion in the Permian Basin that delivers gas to the Waha hub in Texas for production.

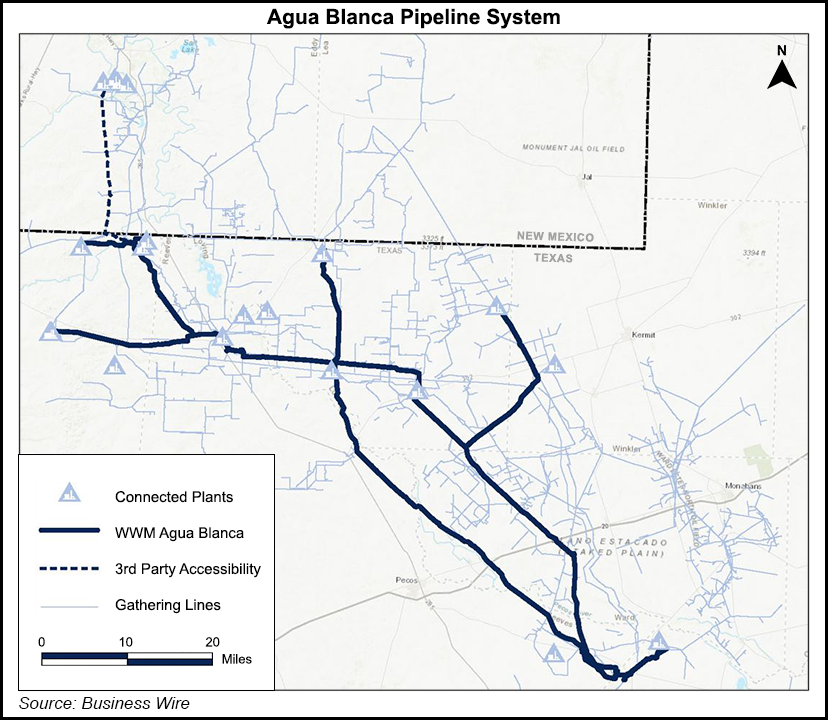

The 1.8 Bcf/d Agua Blanca expansion has entered commercial service and connects nearly 20 gas processing sites in the Delaware sub-basin of the Permian, WhiteWater said. It is transporting gas to Waha from Culberson, Loving, Reeves, Pecos, Winkler and Ward counties in Texas, as well as in Eddy and Lea counties in New Mexico.

The Agua Blanca expansion includes a 42-inch diameter trunkline that provides incremental takeaway options for plants servicing Texas and New Mexico gas producers, Austin, TX-based WhiteWater said. The expansion lifts the system’s total capacity to more than 3...