E&P | NGI All News Access | NGI The Weekly Gas Market Report

A Bellwether? GOM-Wide Lease Sale, with Lower Royalty Rate, Generates $124.8M in High Bids

A region-wide Gulf of Mexico (GOM) lease sale held Wednesday, which Interior Secretary Ryan Zinke said would be a “bellwether” about future offshore exploration, barely managed to surpass one held last year, even with lower royalty rates for some blocks.

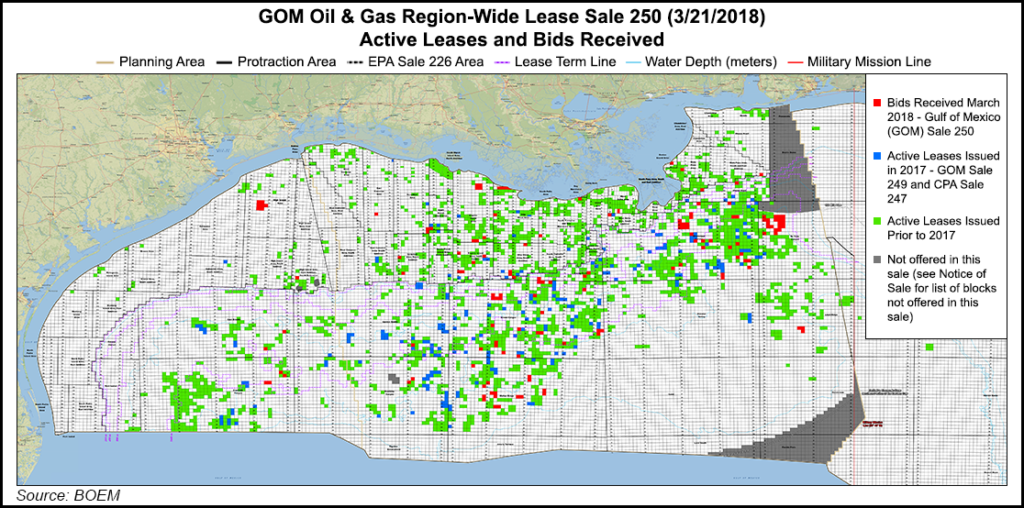

According to preliminary statistics by the Bureau of Ocean Energy Management (BOEM), Outer Continental Shelf Lease Sale 250 received high bids from 33 operators for deepwater and shallow water blocks totaling $124,763,581. There were 148 blocks receiving bids, and 159 total bids.

The highest bid, for about $7.07 million, was by Total E&P USA Inc. for Mississippi Canyon Block NH16-10. The top 10 companies in order, based on total number of high bids submitted, were BP Exploration & Production Inc., 27 bids for $20.068 million; Chevron U.S.A. Inc., 24, $29.45 million; Shell Offshore Inc., 16, $22.93 million; Total E&P, nine, $15.12 million; Hess Corp., seven, $4.52 million; Byron Energy Inc., seven, $2.61 million; Arena Energy LP, seven, $1.21 million; SDB Offshore Energy LLC, seven, $1.05 million; W & T Offshore Inc., seven, $797,700; and EnVen Energy Ventures LLC, five, $4.66 million.

The auction had offered 14,776 unleased blocks in the Western, Central and Eastern planning areas of the GOM, an estimated 77.3 million acres, offshore Alabama, Florida, Louisiana, Mississippi and Texas, and was considered the largest lease sale in history. As a bonus, shallow water (up to 200 meters depth) leases garnered a 12.5% royalty rate for the first time, versus the previous rate of 18.75%.

The latest auction, however, the second overseen by the Trump administration, did not lead to a burst of enthusiasm by operators, as the results barely surpassed the GOM-wide sale held last August, which received $121.14 million in high bids for 90 tracts from 27 operators.

Speaking at CERAWeek by IHS Markit earlier this month, Zinke had said the sale would “be a bellwether in many ways. We’ll see what the future of the offshore is in comparison to the Permian,” the most active onshore basin in North America.

BOEM’s Mike Celata, regional director for the GOM, discussed the results with the media on Wednesday during a teleconference following the auction results. Asked if the auction had met Interior’s expectations, Celata hedged.

“We see some increased interest in terms of the number of bids,” said Celata, but “we need another sale” before determining direction of offshore exploration. “And then we can look at it on a yearly basis.”

He chose instead to compare 2016 to 2017 auctions, although the 2016 auctions only covered the Western and Central Planning Areas, while one held last August covered the entire GOM. The industry also continued in recovery mode during 2016 following the sharp commodity downturn, and it only began to rectify its fortunes last year.

For full-year 2016, BOEM received a total of 172 bids on 142 tracts, while in 2017 it received 288 bids for 253 tracts.

“It’s difficult to compare the last two sales with previous sales simply because we changed to format to go with a Gulf-wide sale versus a Central or Western Planning Area” auction,” he said.

In the latest auction, there was “continued interest from the majors,” with one of the biggest GOM operators, BP plc, “bidding on more tracts than it has in the last couple of sales, and that shows well” for the GOM. There also were new companies participating in the bidding process, indicating stepped-up interest.

The Trump administration is now weighing the potential to unlock nearly all offshore areas of the United States to exploration and development, including politically sensitive areas where drilling is unwanted by coastal residents. Zinke has indicated a draft offshore plan could be ready as soon as this fall.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |