Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report | Regulatory

Kinder Morgan Sees Synergies for Natural Gas System from Texas Permian Project

Kinder Morgan Inc.’s (KMI) natural gas business outperformed in the final three months of 2017, driven mostly by growth in transportation volumes, as the midstream giant readies expansions for its oil and gas systems across North America.

Executive Chairman Richard Kinder helmed a conference call Wednesday afternoon to discuss the results, highlighting a strengthening business environment not only in the United States but Canada and Mexico as well.

Equally important, he told investors, “we are living within that cash flow, paying our dividend, which will increase this year by 60%, funding all of our expansion capital expenditures and returning additional value to our shareholders through our stock buyback program while continuing to improve our balance sheet, all with internally generated funds…This seems like a recipe for success, both now and for the foreseeable future.”

Even with setbacks related to Hurricane Harvey’s strike to Gulf Coast energy infrastructure last August, KMI and its related entities thrived in 2017, CEO Steven Kean said. Among other things, the company and its partners in December agreed to move forward on the Gulf Coast Express (GCX), a $1.7 billion proposed project that would carry 1.92 Bcf/d from the Permian Basin to the Texas Gulf Coast.

During the fourth quarter, “we signed up 1.65 Bcf/d of long-term firm commitment on Gulf Coast Express…and expect to sell the remaining 300 Bcf/d in the first quarter of this year,” Kean said. “We believe there’s very strong demand for the remaining capacity, and we fully expect to put it to bed, having fully subscribed under long-term commitments.

“This is a great project connecting growing Permian gas production with our large pipeline network on the Texas Gulf Coast,” the CEO said. The gas would serve a thirsty Texas market, and growing exports, both to Mexico and for liquefied natural gas (LNG).

“This is a significant enhancement to our network and adds connectivity to a rapidly growing basin to supplement our Eagle Ford Shale supply base.”

KMI and its partners are working on local jurisdiction for the Texas intrastate system now, said Tom Martin, president of the Natural Gas Pipelines Group. “That process is getting started as of now. But we have a lot of experience of building pipeline in Texas, and feel really good about our 2019 in-service period.”

Agua Dulce Connections

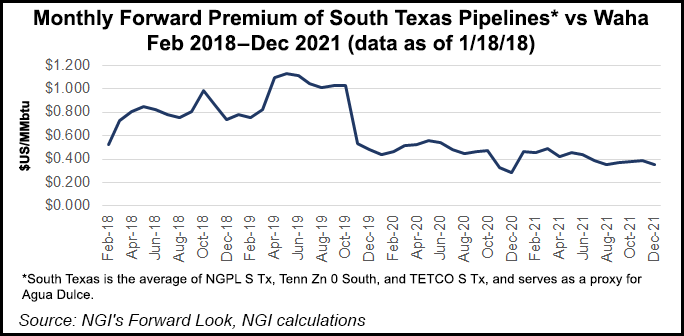

The GCX project offers “synergies” for other Kinder gas systems “as incremental transportation opportunities afford themselves to the project,” Martin said. For example, potential connectivity exists at the Agua Dulce gas hub near Corpus Christi in South Texas “both to our network and to all the growth into Mexico and LNG, I think we’re creating a lot of opportunity for incremental opportunities beyond what we’ve baked into the base project.

“I think layered on top, even beyond that is the storage opportunities as Mexico grows, as LNG goes into service in Texas, I think those will all provide further opportunities to this particular project as well as volatility out in the Permian, and how that translates to Agua Dulce. I think those will all be upside opportunities that will manifest itself in the project.”

KMI’s backlog remained stable at about $12 billion during 2017 with the addition of new projects and offsets going into service, Kean said. Last year the company put into service “just under $1.8 billion worth of projects. And our overall project performance proved quite good…”

Operational performance last year remained strong, and during the recent cold snap, three of Kinder’s largest gas networks were “hitting historical volume highs,” Kean said.

During 4Q2017, KMI’s gas transportvolumes climbed 8% year/year, he said. “Sales volumes on our Texas system were up 4%. And crude and condensate gathered volumes were up 8%. While gas gathered volumes were down 2% year/year, when we look at the sequential quarters…3Q2017 to 4Q2017, our gathered volumes were up in all three of our key basins, the Eagle Ford, the Bakken Shale and the Haynesville Shale.

Haynesville Growth ”Encouraging’

“The Haynesville in particular is an encouraging sign as the activity level of the operational effectiveness of our customers has been improving nicely,” Kean added. The transportation network also is benefiting from higher export demand, both from LNG and Mexico exports.

“We are now delivering 3 Bcf/d to Mexico, which is 70% of the total U.S. exports to Mexico,” Kean said.

Management also is seeing increasing “storage values. Some of that has been driven by the impact of recent weather. But we also think there are some signs of perhaps a lasting improvement there.”

U.S. gas supply and demand is creating a lot of opportunities, Kean said.

“We signed up 2.3 Bcf of new, long-term firm capacity commitments in the fourth quarter, bringing the total for the year to just under 4 Bcf. Of that 4 Bcf, 1.2 Bcf was existing previously unsold capacity. So it drives both the value of the existing network, as well as expansion and growth opportunities.”

The company’s refined products business increased 3.8% year/year in 4Q2017 and 1.2% for the full year.

“We also saw increases in our crude and condensate volumes of 1.7%,” Kean said. The system serving the Eagle Ford is “well-connected and has been gaining in market share. It’s a great system.” However, he offered a note of caution.

“The Eagle Ford remains a challenged basin in terms of the transport capacity overhang out of that basin. So we’re happy with the volumes, but we remain very attentive to the competitive dynamics of that market and look to keep our pipe full.”

For refined projects, U.S. consumption “is on a slow growth trajectory…But refined products exports have continued to grow…One data point, from our Houston Ship Channel refined products hub, had a record month in December, moving 360,000 b/d…”

Last May Kinder spun off its Canadian assets to form Kinder Morgan Canada Ltd. (KML), which includes the Trans Mountain Pipeline that serves the Canadian oilsands. The system is “the only outlet for Alberta crude…to get to the world market,” Kean said.

The expansion is to be completed in phases this year. “From the pipelines perspective, the conditions supporting its construction or the need for it have improved from an economic standpoint. It’s worth repeating that this is a much needed project. It has the key approvals from and the support of the federal government…”

Kean spent a few minutes to discuss the opposition to Trans Mountain’s expansion by some key stakeholders. The National Energy Board (NEB) granted KML’s motion to build, even though the Burnaby municipal government in British Columbia refused to issue construction permits.

“Local governments are not typically in opposition, as we’ve established community benefit agreements covering 90% of the pipeline route,” Kean said. “But it is essential to be able for us to know that we can move forward even when local governments are opposed or are declining to act on permits.”

KML officials “have made some progress working with the provincial authorities in British Columbia on clarifying requirements and time frames on permits and authorizations. We’re still working on this, but we’ve made some progress.”

Awaiting NEB Action

As far as watching for “milestones” in the Trans Mountain process, KML officials are waiting on a “broader motion at the NEB. This is the motion to establish a clear, fair and timely process for dealing with permits and approvals at the provincial and municipal level. Second, we need to see continuing progress…overall on permitting, the numbers of permits coming in and granted.”

Management is expecting early this year to have decisions on the judicial reviews, Kean said. “We believe strongly those reviews should end up affirming the government’s actions to date. And we hope to see that come through in the first half of this year, if not earlier in the first half…

“Bottom line, this project is needed. It’s supported by the federal government of Canada, the provincial government of Alberta and many communities and First Nations along the route…”

The recently enacted U.S. tax reform legislation led Kinder to take a $1.4 billion one-time charge in the fourth quarter. The Tax Cuts and Jobs Act of 2017 “will ultimately be moderately positive,” said Kean, but the reduced corporate income tax rate led to some deferred-tax assets to be revalued at 21% versus 35%.

“The positive impacts of the law include the reduced corporate income tax rate and the fact that several of our U.S. business units, essentially all but our interstate natural gas pipelines, will be able to deduct 100% of their capital expenditures through 2022. The net impact results in postponing the date when KMI becomes a federal cash taxpayer by approximately one year, to beyond 2024.”

KMI reported a fourth quarter net loss of $1.045 billion, versus year-ago net income of $170 million.Distributable cash flow (DCF) rose 4% from a year earlier to $1.190 billion.

For the full year, net income was $27 million, sharply lower from 2016 profits of $552 million. DCF for 2017 totaled $4.482 billion versus 2016 DCF of $4.511 billion.

The decrease in DCF for 2017 was driven by the sale of a half-stake in Southern Natural Gas (SNG) in 2016, negative impacts of Hurricane Harvey, a contribution to KMI’s pension plan, and the KML public offering. Excluding the impact of Harvey, the SNG sale and the KML offering, DCF rose slightly more than 1% from 2016.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |