Markets | NGI All News Access | NGI The Weekly Gas Market Report

Industry Continues to Debate Mandatory Price Reporting for NatGas Marketers

In written comments following a FERC technical conference on the transparency and liquidity of natural gas price indexes, participants reiterated their support for the current system of voluntary price reporting and their confidence in the reliability of indexes.

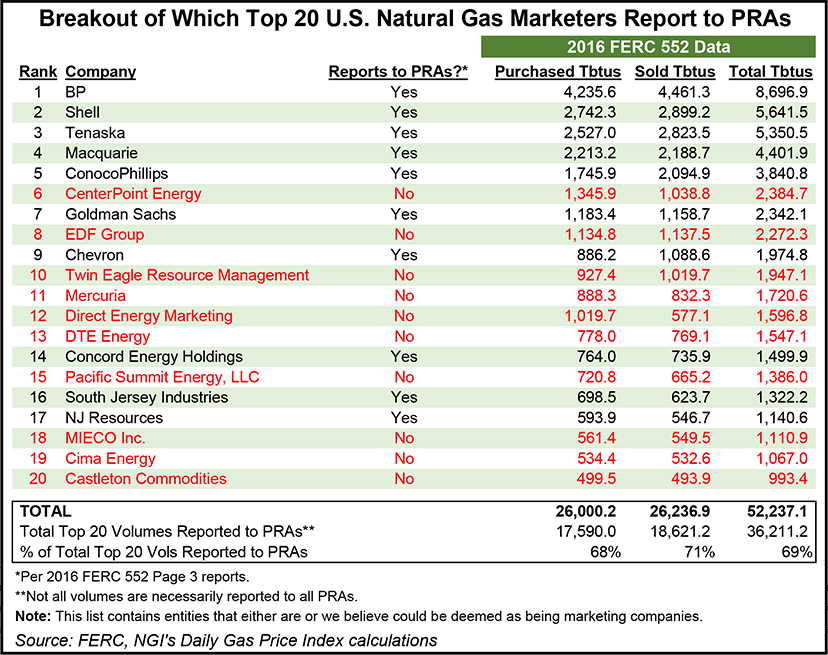

However, as it brainstorms ways to encourage more companies to report fixed-price and physical basis trades amid growing numbers of indexed deals, the industry still is debating the pros and cons of a system of partial mandatory reporting focused specifically on large natural gas marketers.

While most in the industry suggested only minor adjustments in the current voluntary price reporting system, two major price-reporting natural gas marketers, BP Energy Co. and Tenaska Marketing Ventures, said the Federal Energy Regulatory Commission should potentially consider requiring other marketers to report as well. The suggestions came in the form of post-technical conference comments filed earlier this week at FERC.

The concept was raised during the July technical conference, when BP Energy CEO Orlando Alvarez, calling for an way to encourage price reporting with “more teeth to it,” suggested the Commission require top marketers — companies that focus on buying and reselling gas — to report to index publishers.

FERC held the technical conference to discuss the factors that have contributed to declines in fixed-price deals observed since 2008. Those declines have stabilized in the past few years, especially in the day-ahead market. However, overall trends in FERC Form 552 data show higher numbers of transactions tied to price indexes and smaller percentages of traded volumes reported, prompting the Commission to look at how it can incentivize more companies to report.

[Editor’s note: NGI is an index publisher directly impacted by this issue, and it participated in the technical conference.]

Tenaska, in its post-conference comments, encouraged FERC to “take a limited wait and see attitude on the subject of mandatory reporting.” The marketer pointed to Cheniere Energy Inc.’s stated plans to begin reporting soon, and suggested the Commission evaluate changes in reported volumes through 2017 before potentially taking action in 2018.

“If volumes reported…stabilize or increase through 2017, as Tenaska expects, the Commission should continue to monitor this situation but not adopt mandatory price reporting,” Tenaska wrote. “If reported volumes continue to deteriorate, as feared by Mr. Alvarez and others, Tenaska would support the limited mandatory reporting proposed by BP.

“…BP did not provide a specific definition” for the types of larger marketers covered by its proposal, “but Tenaska supports the concept and believes a definition could be crafted that would include larger firms that make a market in natural gas and exclude firms that trade just to address an inherent long (i.e., a producer) or short (i.e., utility or industrial/generator) position.”

In its post-conference comments, BP, which has raised this issue in the past, made a case that FERC should act sooner rather than later.

The company wrote that “the perceived regulatory risk is increasing for the few, like BP, who support market transparency and continue to voluntarily report transactions. Until more participants report, the risk is greater for the few willing to report. Further, the longer this perception remains, it is less likely that more market participants will voluntarily report and even more importantly, it is more likely that the existing pool of voluntary reporters could shrink even further.”

BP said it still supports the concept of requiring larger marketers to report to index publishers.

“BP does not support mandatory reporting for all entities,” the company wrote. “However, there is no question that inclusion of all reportable trading activity from marketing companies that are in the business of buying natural gas for the purpose of reselling (such as BP), who engage in multiple transactions each day, would be beneficial to the process.”

Other commenters, while reiterating various suggestions for how FERC can reduce the perceived regulatory risks associated with voluntary price reporting, cautioned against requiring companies to report.

The Natural Gas Supply Association (NGSA) wrote that “the voluntary nature of the price reporting process must be maintained, despite the recent decline in foundational data reflected in the 2016 FERC Form 552s. The voluntary approach works.”

NGSA warned of potential side effects from the “regulatory distortion” that could occur with mandatory reporting, which it argued would harm liquidity.

“A regulatory mandate for price reporting may result in a disincentive for engaging in reportable/fixed price transactions,” NGSA said. “Put simply, mandating that companies price report their fixed price transactions may drive some entities to avoid those types of transactions. This would have the perverse effect of negatively impacting the normal functioning of the market by limiting liquidity.”

NGSA said it “has confidence both in the indices by which the members buy and sell natural gas in the U.S. and in the mechanisms that the market provides to ensure that the indices continue to be robust. The indices are an accurate representation of the price at which sellers and buyers agree to transact and thus represent the market value for the natural gas traded. Importantly, the indices are one of many tools contributing to natural gas market transparency and facilitating sound transaction decisionmaking.”

Regarding mandatory reporting, the American Gas Association (AGA) wrote that its “membership reflects a mix of companies, with many reporting…while others do not. Reporting members indicate that costs, risk and benefits had been weighed internally, and the decision to report and contribute to liquidity was determined to outweigh the associated costs and risks. Non-reporting members indicate that among the main reasons behind the decision not to report include internal system costs and regulatory compliance.”

AGA said in “weighing the costs, risks and benefits of whether to report, non-reporting parties determined that the costs and time associated with setting up and administering a price reporting program that would generate and verify data, ensure compliance and participate in audits was unduly burdensome at this time. Additionally, some members expressed the view that the need to report transactions was already accommodated by the inclusion of information regarding” Intercontinental Exchange transactions by index publishers.

AGA said its members “do not feel that the Commission needs to make changes” to the current system, given an overall confidence that price indexes “sufficiently reflect the locational value of natural gas at most points to permit decision making.” The association’s “members believe that the natural gas industry currently achieves and can continue to provide transparent and accurate price indices on a voluntary basis.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |