Infrastructure | Markets | NGI All News Access | NGI The Weekly Gas Market Report

Williams Touts Northeast Supply Project in Yet Another Economic Impact Study

Williams Partners LP on Tuesday released an economic impact analysis conducted by Rutgers University that found the company’s Northeast Supply Enhancement Project would generate $327 million in economic activity and nearly 3,200 jobs in Pennsylvania, New Jersey and New York.

The study was completed by researchers from the Rutgers Economic Advisory Service (R/ECON) at the university’s Edward J. Bloustein School of Planning and Public Policy.

Researchers analyzed the effects of the project’s anticipated one year construction phase and the impact of local property tax collections once it’s in service, which is expected in December 2019. The study found the project would directly and indirectly create 3,186 jobs during the construction period and another $234 million in labor income across all three states where it would be built.

Williams commissioned the study, which the company said is a vital part of the planning and development process.

“For larger projects like this, it has become standard procedure to utilize a third party to conduct this type of analysis for the socioeconomic impact section of our FERC application,” spokesman Christopher Stockton told NGI. “However, we’ve also found it to be a very helpful way for us to more effectively articulate local economic benefits in order to assist in garnering third party support.

“These are huge infrastructure investments, and these types of studies really do a good job capturing the project’s economic value.”

Ohio State University’s Edward Hill, a public administration professor who was not involved with the study, said Williams could have underestimated the economic benefits of the project.

“It looks as if they calculated the direct, indirect and induced impact from the construction and longer term tax benefits to state and local government,” he said, noting that he has not yet fully examined the report. “The largest economic impact is likely to come from fuel cost savings in the New York region and uncalculated environmental benefits as people switch from diesel fuel for heat to natural gas.”

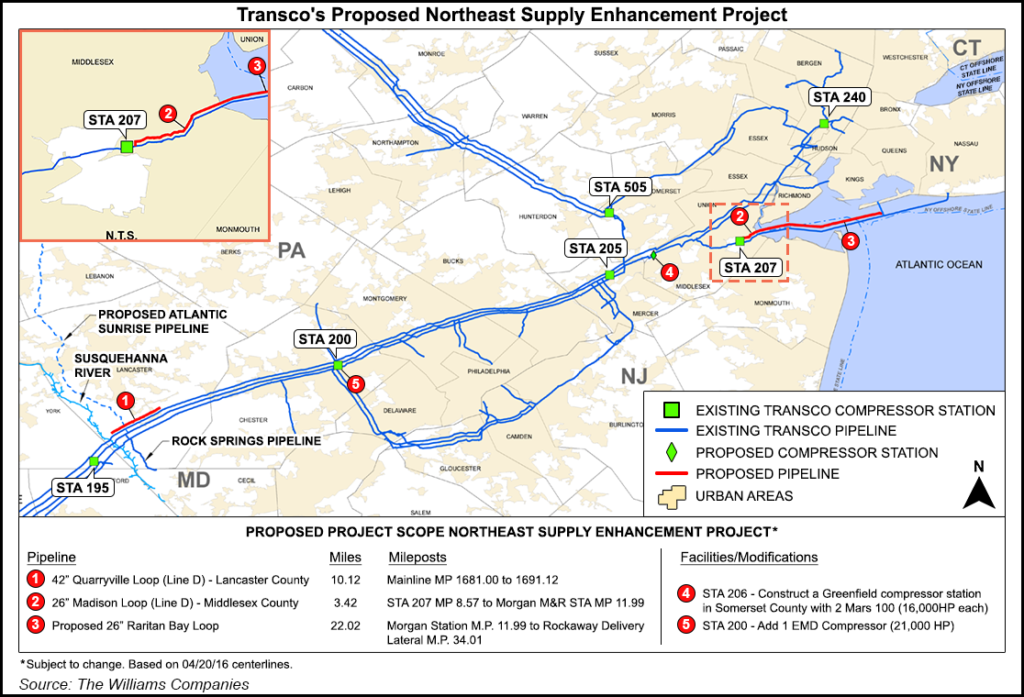

The nearly $1 billion Northeast Supply project would expand Transcontinental Gas Pipe Line (Transco) to increase natural gas deliveries to National Grid — the largest distributor of gas in the Northeast. The project is designed to create 400,000 Dth/d of incremental firm capacity to Northeast markets, primarily to feed the growing demand for natural gas in New York City, which two years ago announced plans to phase out the use of No. 4 fuel oil by 2030 to help curb emissions.

Transco filed for Northeast Supply’s FERC certificate in March. The expansion would include 10 miles of pipe in Pennsylvania, three miles in New Jersey and 23 miles of pipe offshore New Jersey and New York in addition to a compressor station in Somerset County, NJ, and more horsepower at an existing station in Pennsylvania.

The study was co-authored by R/ECON Director Michael Lahr and research associate Will Irving. Ohio State’s Hill, who has worked with the Bloustein school in the past and conducted similar economic impact studies examining the economic effects of the shale industry, had high praise for the university’s work. Not everyone greeted the study warmly, though.

“These studies are just so blatantly biased with alternative facts and misinformation,” said Jeff Tittel, who directs the New Jersey Sierra Club. “They try to say if they’re going to have this many workers that buy that many sandwiches it’s going to create that many jobs at a deli. Really? It’s not. But that’s what they do. Their economic studies are full of more hot air than they can put in their pipelines.”

The study uses an input-output model developed at Rutgers. The form of economic analysis examines the interdependencies between economic sectors and was popularized in the 20th century after it was developed. The R/ECON model shows how sectors of an economy interact. For a given industry, according to the service’s website, the model shows the “production recipe” for the goods and services the industry sells and the shares of its revenues that are consumed by other industries in the economy.

Researchers found that the project’s design and construction in Pennsylvania would generate $63.6 million in additional economic activity, or gross domestic product (GDP); 499 direct and indirect jobs, and another $45.6 million in labor income. In New Jersey, it would generate $239.9 million in GDP, including 2,411 direct and indirect jobs, and $171.9 million in labor income. Likewise, in New York, the analysis said the project would generate $23.7 million in additional economic activity; 276 direct and indirect jobs and $16.6 million in labor income.

Once the pipeline expansion is operational, its economic impact is forecast to result in $11.1 million of annual local property taxes paid by Williams to local and county governments.

Tittel fears that instead of economic benefits, the region’s consumers will be paying more for natural gas as more pipelines come online. Despite the sustained low gas prices customers have enjoyed across the Mid-Atlantic and elsewhere in recent years, he pointed to three New Jersey utilities that are raising their rates slightly this winter.

PSEG, New Jersey Natural Gas and Elizabethtown Gas, all affiliates of sponsors backing a separate project that the New Jersey Sierra Club has been critical of, the PennEast Pipeline, have announced rate increases for their customers. PSEG Power LLC completed the sale of its interest in PennEast on Wednesday, but it remains a customer on the pipeline. Although rates are still far lower than they were about 10 years ago, those increases are in part because of the demand that has been stoked by more shale gas coming from the Appalachian Basin.

“There’s a lot of these assumptions that are just not true,” Tittel said of Rutgers’ study and others like it that have been released during the infrastructure build-out. “What we find is happening is that instead of the [pipelines] lowering prices, they’re actually now increasing prices because of all the gas being drawn out of the Marcellus Shale in different directions.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |