Global Oil, Natural Gas FIDs On Fast Track Versus 2016, Says Rystad

Operators already have pulled the trigger on more oil and natural gas projects worldwide to date this year than they did throughout 2016, according to an analysis by Rystad Energy.

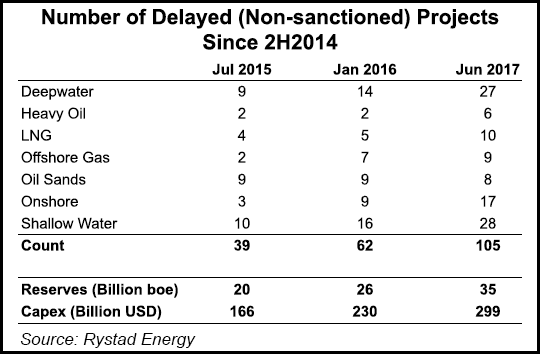

Rystad analysts tracked final investment decision (FID) delays since the second half of 2014 to post-appraisal pre-sanctioned upstream projects.

“We find 17 of these delayed projects have since been launched, accounting for an estimated $78 billion of development spending,” analysts said. About 40% of the spending is for Chevron Corp. unit’s Tengizchevroil Tengiz expansion in Kazakhstan, Rystad said.

In the past few days, two big FIDs were announced. On Thursday, Italy’s Eni SpA sanctioned the Coral South floating liquefied natural gas project in Mozambique. Calgary-based Husky Energy Inc. last Monday launched the deepwater White Rose West project offshore Newfoundland. Husky operates and is majority owner (72.5% stake) in the White Rose oilfield and its satellite extensions, which are on the eastern edge of the Jeanne d’Arc Basin.

“This was 2017’s second double-drop week,” Rystad analysts said of late May/early June.

In late February, two big projects were launched, including Royal Dutch Shell plc’s first new development in the Gulf of Mexico (GOM) in 18 months, the Kaikias deepwater field in Mississippi Canyon. Also in late February Noble Energy Inc. launched the first phase of the Leviathan natural gas project in deepwater Israel.

BP plc late last year sanctioned the Mad Dog 2 development in the deepwater GOM, a “leaner” $9 billion project that is to include a floating production platform with the capacity to produce up to 140,000 b/d gross of crude oil from up to 14 production wells. The current platform has the gross capacity to produce up to 80,000 b/d of oil and 60 MMcf/d of natural gas.

In addition, projects in China, Iraq and Vietnam, as well as an oilsands scheme, are expected to reach FID this year.

“In spite of this apparent positive momentum, the FID delay list has continued to grow,” Rystad research analyst Readul Islam said. “Since we last published in January 2016, the list has grown in almost all themes, except oilsands, which is not surprising since oilsands projects are largely confined to one province in Canada, while all other themes have a global candidate pool.

“The ongoing results of the oil price pain is clear to see — still over 100 projects delayed, accounting for nearly 35 billion boe and $300 billion spend estimate at delay,” Islam said.

Earlier this year analysts with Raymond James & Associates Inc. said 2017 would be the first year with some “next-generation” startups post the 2014 industry meltdown. Based on a survey of the industry projects, “2018 will be a trough year, i.e. the year with the lowest amount of new capacity coming online,” analyst Pavel Molchanov said in February.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |