Markets | NGI All News Access | NGI Data

Prospect of Pipeline Delay Rattles Physical, Futures Markets; June Gains 6 Cents

Physical natural gas for Thursday delivery shot higher in both physical and financial circles as traders focused on the potential delay of a major Midwest pipeline project that shippers were originally counting on to finish its first phase by July. The NGI National Spot Gas Average jumped 9 cents to $2.99 and virtually all market points were solidly in the black.

Futures also responded to the reports, as well as supportive petroleum inventory figures, and at the close June had added 6.5 cents to $3.292 and July had advanced 6.5 cents to $3.380. June crude oil surged $1.45 to $47.33/bbl on the heels of bullish oil inventory numbers.

Energy Transfer Partners LP has been ordered to halt new horizontal directional drilling along some segments of its $4.2 billion Rover Pipeline by the Federal Energy Regulatory Commission (FERC) pending an independent review of a 2 million gallon spill of drilling fluids near the Tuscarawas River in Stark County, OH.

“This is certainly going to slow them down or add to the cost quite a bit,” said a Houston-based pipeline veteran. “You saw it coming for they had a big spill recently.”

In mid-April Rover filed two incident reports of drilling fluid spills in wetlands areas of Ohio. Rover received notices of violation (NOV) from the Ohio Environmental Protection Agency for a spill of 50,000 gallons of drilling fluids from its drilling operation in a wetland area in Richland County, OH, and for the spill near Tuscarawas River.

In the latter incident, the NOV reports that “the drilling fluids accumulated within an estimated 500,000 square foot area of the wetland. The drilling fluids, which included bentonite and cuttings from the natural formation, coated the area with a layer of mud and impacted water quality.”

“A lot of gas is being tied to Rover from gathering systems and that kind of thing and there are a lot of producers with capacity on Rover,” the pipeline veteran said. “They are going to have to try and fill it somehow. Rover has continued to say that they are going to have this thing done and the engineers here are saying they are wishing they could get it done.

“I think it’s going to be done later in the year.”

Futures opened trading 3 cents higher at $3.26 as traders focus on forecasts of higher 2017 prices more so than moderating weather outlooks.

Overnight weather models edged ever so slightly warmer. “While a cooler pattern still persists over the Midwest and East through the short-range one- to five-day, changes edged slightly warmer [Wednesday],” said Matt Rogers, president of Commodity Weather Group, in a morning report to clients. “Also, warmer changes prevail next week with slightly faster/stronger re-warming.

“The six- to 10-day covers Monday-Friday next week now and the main ensembles agree on a middle U.S. warm look and a cool West. The East Coast is near normal, thanks to a cool start and warm finish to next week, but occasionally the operational models try for something faster/stronger into the East (like the overnight European operational).”

Market technicians see no reason to take any action. “[We are] still stuck in neutral,” said Brian LaRose, a market technician with United ICAP, in closing comments Tuesday. “Bulls need to bust through the $3.347 and $3.422 highs to confirm a spring-to-summer seasonal advance is still in progress. Bears need to take out $3.016-2.999-2.988 support to signal the spring-to-summer advance ended at $3.347 and a summer-to-fall decline has begun. Until the highs can be exceeded, support is broken, or the technicals tell us otherwise, we prefer to sit on our hands.”

Market bulls take heart. The bold, prescient Energy Information Administration (EIA) has your back. Henry Hub natural gas spot prices will average $3.17/MMBtu this year, and new export capabilities, combined with growing domestic consumption, will help drive prices even higher, to $3.43/MMBtu next year, according to the EIA’s latest Short-Term Energy Outlook (STEO).

The 2017 price forecast is up 2.3% compared with EIA’s previous STEO, when it said it expected spot prices to average $3.10/MMBtu this year.

The physical market also responded to reports of the Rover delay, and Midwest locations surged well over a dime. Gas on Consumers rose 11 cents to $3.11 and gas on Michcon was up 12 cents to $3.10. Deliveries to Alliance were higher by 13 cents to $3.08, and gas at the Chicago Citygate was quoted 14 cents higher at $3.08 as well.

Other market centers couldn’t match the Midwest gains. Gas at the Algonquin Citygate fell 2 cents to $3.17 and gas bound for New York City on Transco Zone 6 added a nickel to $2.98.

The Henry Hub was quoted 8 cents higher at $3.11 and packages on Dominion South rose 7 cents to $2.88.

Deliveries to El Paso Permian changed hands 9 cents higher at $2.76 and gas on Panhandle Eastern gained 8 cents to $2.74. Kern River receipts ran 9 cents higher at $2.81 and gas priced at the SoCal Border Average came in a dime higher at $2.88.

[Subscriber Notice Regarding NGI’s Market-Leading Natural Gas Price Indexes]

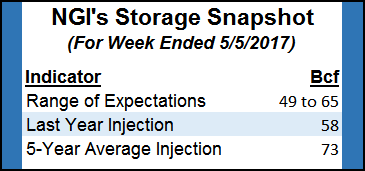

Traders are expecting a thin build when EIA announces storage figures Thursday. Last year 58 Bcf was injected and the five-year pace stands at 73 Bcf. Stephen Smith Energy calculates an increase of 50 Bcf and Tradition Energy is looking for an injection of 55 Bcf. A Reuters survey of 23 traders and analysts revealed an average 53 Bcf with a range of +49 Bcf to +65 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |