Regulatory | Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

Greens to FERC: Wait on Michigan Regulators to Review Nexus Before Issuing Order

The Sierra Club is asking FERC to wait until Michigan regulators rule on capacity commitments to the Nexus Gas Transmission pipeline before deciding on the project’s Natural Gas Act (NGA) certificate.

Counsel for the environmental group on Tuesday filed a motion to introduce three recent orders from the Michigan Public Service Commission (MPSC) into the Nexus docket at the Federal Energy Regulatory Commission [CP16-22]. The orders stem from cases filed by regulated DTE Energy Co. affiliates DTE Gas and DTE Electric that seek approval for costs related to their commitments to the Nexus project.

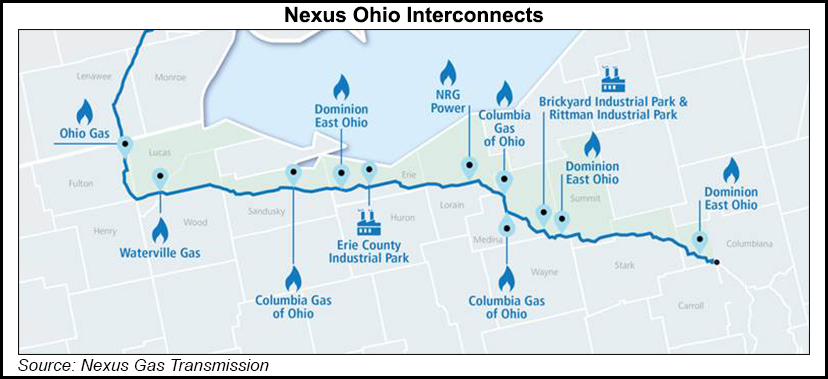

DTE Energy signed on to co-develop Nexus, a 255-mile, 1.5 Bcf/d pipeline designed to transport Marcellus and Utica shale gas to markets in the Midwest and Canada, with Spectra Energy. Enbridge Inc. acquired Spectra earlier this year.

DTE has encountered pushback in Michigan over its proposed commitments to Nexus, including a 75,000 Dth/d commitment from DTE Gas Co. and a 30,000 Dth/d commitment from DTE Electric Co. Regulators and opponents, including ANR Pipeline Co., have questioned the affiliated nature of the transactions and whether DTE Gas or DTE Electric properly considered alternatives, including the competing Rover Pipeline project.

Citing concerns raised by ANR and others, the MPSC concluded in a January cost-recovery order for DTE Electric that “costs associated with Nexus should not be recoverable absent a transparent evidentiary presentation examining the full nature of the Nexus arrangements.”

In its filing, the Sierra Club told FERC that MPSC’s deliberations over DTE’s Nexus commitments “speak directly to the core of the Commission’s need assessment” for the pipeline “and call into question whether” the precedent agreements with DTE’s affiliates “are reliable evidence of market need.”

Citing testimony from ANR, Sierra Club wrote that “the lure of a 14% return on equity has led DTE Energy Co. to commit its captive utility customers to pay for service on its sponsored project when less costly and more reliable alternatives were available.

“…The MPSC has several pending dockets open to address this issue and, as set forth in orders, has expressed a need for a more transparent evidentiary presentation to confirm that the DTE affiliate precedent agreements comply with Michigan’s affiliate code of conduct,” the environmental group added, calling for FERC to wait on a certificate order until after MPSC has ruled on the agreements.

Regardless, FERC should “look beneath the affiliate agreements in this proceeding to ensure they represent bona fide market need…the Commission should apply a higher level of scrutiny to affiliate transactions due to the absence of arm’s length negotiations.”

The Sierra Club also cited a statement submitted by former Chairman Norman Bay, attached to a certificate order issued shortly before his resignation in February. The group pointed to Bay’s comments that FERC should examine “other considerations” beyond precedent agreements, including “whether the precedent agreements are largely signed by affiliates.” FERC should consider Bay’s comments in light of a need to “[protect] against ratepayer-funded overbuild,” the group wrote.

According to FERC filings, Nexus has signed precedent agreements for about 59% of its designed capacity. Minus the DTE affiliate agreements, the pipeline would sit at around 52% subscribed, according to NGI calculations.

FERC issued a final environmental impact statement for Nexus in November, but the project was left out of a series of last-minute certificate orders issued before Bay’s departure left the Commission without a quorum.

Nexus has told NGI that it’s still targeting a 4Q2017 start-up for the project “pending timely issuance of FERC’s certificate authority.”

Some uncertainty remains surrounding the timing of a FERC order given new Commissioners still have to be appointed and approved in order for the agency to resume issuing NGA certificates.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |