Leaner Alberta Oilsands Operations Raising Output, NatGas Burn

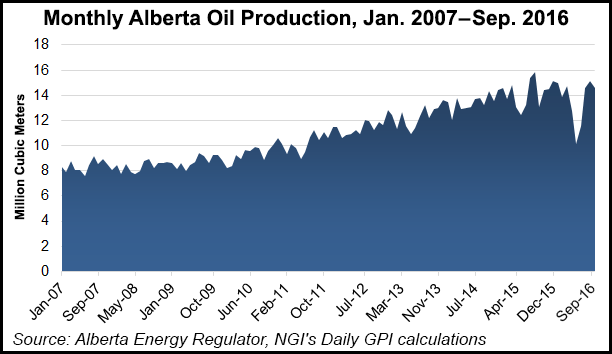

After two years of weaning off triple-digit prices by emphasizing cost control, Alberta bitumen output is on the rise, increasing Canadian natural gas consumption as well as sustaining strong oil exports.

Plans to produce more for less stand out in annual fall corporate budget guidance statements for 2017 to stock markets by senior oilsands producers Cenovus Energy Inc., Canadian Natural Resources Ltd. (CNRL) and Suncor Energy Inc.

Production forecasts for next year are up by 14% at Cenovus to 223-240,000 barrels per day, nine% at CNRL to 550,000-590,000 b/d and 13% at Suncor to 680,000-720,000 b/d. Although the firms have varying levels of conventional production, oilsands projects are their mainstays and chief growth drivers.

A combination of firming oil prices and growing volume propels a 24% budget hike for 2017 by Cenovus to C$1.2-1.4 billion (US$900 million to $1 billion) and enables CNRL to raise profit hopes while maintaining a C$3.9 billion (US$2.9 billion) 2017 capital program. Suncor expects to achieve its 2017 production gain while cutting annual expenditures by C$1 billion (US$750 million).

CNRL’s guidance statement adds that the manufacturing-like stability of oilsands plants, which tap reserves measured in billions of barrels, will enable increased drilling into shale and tight geological formations.

The company’s budget includes up to C$525 million (US$394 million) for exploration and production outside the oilsands, to the extent that energy commodity prices firm in 2017. CNRL adds that the flexible budget for conventional field activity could also be cut by as much as C$900 million (US$675 million) if prices fall.

While applauded by investors, the Canadian industry’s emphasis on cost control darkens the outlook for wage earners. Grim employment data has become a barometer of success by corporate financial discipline in Alberta, Canada’s main oil- and gas-producer province.

Oilsands employment will drop while production rises, according to a new forecast by Canadian Petroleum Labor Market Information (Petrol LMI), an arm of the industry’s co-operative Enform skill and safety training network for field personnel.

Petrol LMI has cut its projection of oilsands operations, maintenance and construction worker requirements as of 2020 by 3,365 or 7% to 49,750. Despite rising production, 2,530 jobs have been lopped off the plant operating staff forecast.

“Motivated by lower construction costs, companies have accelerated projects, resulting in shorter construction timelines and earlier completion of on-site construction jobs,” Petrol LMI said.

“In an effort to stay profitable, all hiring in the sector is expected to undergo deeper scrutiny than in previous years, and oilsands companies are expected to rely more heavily on independent and third-party contractors for their operations and maintenance work.”

The labor outlook contrasts starkly with the production picture. The current oilsands projection by the National Energy Board (NEB), which canvassed the industry, forecasts continuing growth to 4.3 million b/d as of 2040, up 70% from the 2015 average of 2.5 million b/d.

Oilsands plants consume an average of about 1 Mcf of natural gas/bbl of production. Mining and upgrading complexes, such as CNRL’s Horizon project, use less, but in-situ underground thermal extraction with steam injections burns more.

NEB’s current gas outlook forecasts Canadian production will rise by 20% to 17.7 Bcf/d as of 2020, with oilsands growth and limited liquefied natural gas exports powering recovery from a 2020 low of 14.8 Bcf/d because of poor prices and shrinking exports into the United States.

Raising production with efficiency drives and technology improvements through periods of low energy commodity prices is nothing new for the oilsands.

During 1986 through 2003, when oil averaged US$19.78/bbl, output from the northern Alberta bitumen belt grew 2.7-fold to 744,936 b/d from 278,546 b/d, according to records kept by the Canadian Association of Petroleum Producers.

The oilsands sector’s hard-times growth record was almost as strong as the 3.2-fold growth to 2.5 million b/d chalked up during the 2004-2015 fat years, when prices averaged US$79.31/bbl and peaked at almost US$150/bbl.

The 1986-2003 pattern of economizing and spreading costs thinner over rising output is returning.

“During the past two years, oilsands companies have responded to exceptional economic conditions by engaging in activities designed to reset their capital and operating costs,” Petrol LMI said. “ They have closely examined their investments, assets, organizational structures, processes, and people to determine which elements are essential in order to sustain themselves in an environment of low oil prices and increased environmental policy and regulations.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |