E&P | NGI All News Access | NGI The Weekly Gas Market Report

STACK-focused Gastar Busy Drilling in Meramec, Has Eye On Osage, Oswego

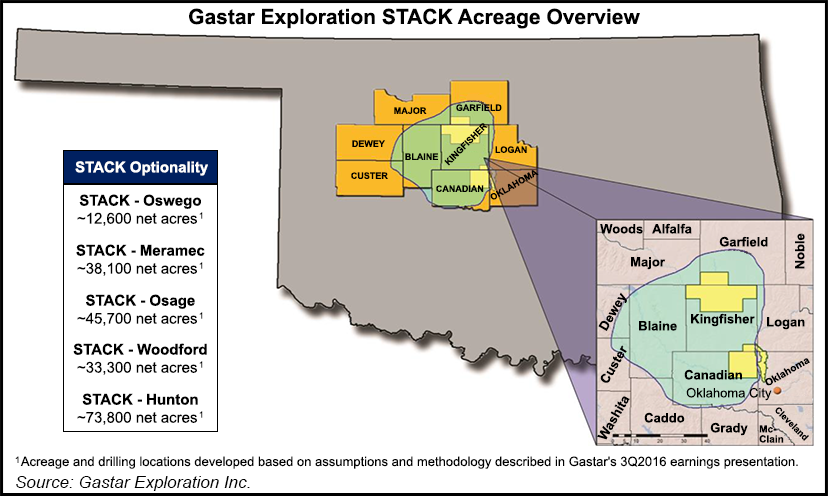

Gastar Exploration Inc. could add a third rig in 2017 as it continues delineating its acreage in the Sooner Trend of the Anadarko Basin, mostly in Canadian and Kingfisher counties (aka, the STACK).

The Houston-based exploration and production (E&P) company left the Appalachian Basin to become a STACK-focused pure-play earlier this year. Last month, Gastar entered into a 60-well development agreement with private equity backers to help delineate its Midcontinent acreage while protecting its balance sheet. At the same time, Gastar announced the sale of noncore assets in Canadian County for $71 million.

Management said during a 3Q2016 conference call recently that the E&P could add a third rig in 2017 focused on developing the Osage and Oswego formations, with the wells under its development agreement focused mostly on the Meramec.

“We currently have two rigs running in the development agreement area and planned to continue running two rigs there until early 2017,” CEO J. Russell Porter said. “At that time, we may either consider moving one of the development agreement area rigs or bringing in a third rig to focus on drilling Osage and Oswego wells outside of the development area as we continue to focus on delineating our STACK potential and HBP [hold by production] our acreage.”

Porter said its results so far from the Oswego suggest Gastar will “probably want” to target the formation “outside the development agreement just for our interest.”

Gastar reported commencing flowback in late September on its first operated Osage and Oswego wells. The McGee 29-1H in the Osage was drilled with a 4,200-foot lateral and a 24-stage completion using roughly 4.6 million pounds of proppant for approximately $4.4 million.

The Tomahawk 7-1H in the Oswego used “a 22-stage nitrified acid completion with very light proppant use” costing roughly $2.7 million.

Management said it’s too early to provide production data for the wells.

The Oswego well was “drilled without any issues,” Porter said. “We saw a lot of matrix porosity in the Oswego. The well is flowing back. It’s making good oil volumes. We just don’t think it’s reached the peak yet, so it’s just not ripe enough to announce. But overall, we’re pleased it. Where we are in the Oswego is just a little bit thinner than where Chesapeake [Energy Corp.] is, but at $2.7 million cost, and even if you’re only at a 250,000 boe-type EUR [estimated ultimate recovery], you’re still going to have” an internal rate of return at current strip pricing “in the 50% range or higher.”

Gastar has already drilled the first five wells under its development agreement and said it could have seven drilled by the end of the year. Porter said the E&P’s “drill time has gotten so compressed to our forecast that we can get all the” development agreement “wells drilled and get the six or seven wells we want to drill outside” the agreement drilled by the end of 2Q2016 using the current two rigs.

“So I don’t know if we’ll bring on the third rig or not…”

Gastar also reported updated production data for its Holiday Road 2-1H that went into production earlier this year in the Meramec. The Holiday Road well reached a peak production rate last month of 654 boe/d (75% oil), Porter noted. “That well is a good lesson that it is easy to draw the wrong conclusion from very early production data in the STACK.”

Production averaged 5,900 boe/d for the third quarter, down from 6,400 boe/d in the second quarter. Production in the year-ago period was 13,600 boe/d, which reflects producing assets in the Appalachian Basin sold earlier this year. Midcontinent production averaged 5,800 boe/d in the third quarter, compared with 5,600 boe/d in the year-ago period.

Realized prices for the quarter averaged $42.55/bbl for oil, $2.48/Mcf for natural gas and $13.22/bbl for natural gas liquids. That’s compared with year-ago prices of $38.89/bbl, $0.99/Mcf and $2.35/bbl, respectively.

Gastar said it expects to see capital expenditures of $13.4 million for the rest of 2016, bringing the full-year capital budget to $60.8 million.

Gastar reported revenues of $13 million during the quarter, compared with $28.4 million in the year-ago period. Lease operating expenses totaled just under $5.2 million, roughly flat with the prior-year quarter. General and administrative expenses totaled $3.9 million, down from $4.7 million in the year-ago period.

Gastar reported a quarterly net loss of $3.8 million (minus $0.03/share), compared with a net loss of $191.8 million (minus $2.47/share) in the year-ago period.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |