Markets | NGI All News Access | NGI The Weekly Gas Market Report

Oil, Gas Prove to Be Drag on GE’s 3Q2016 Results

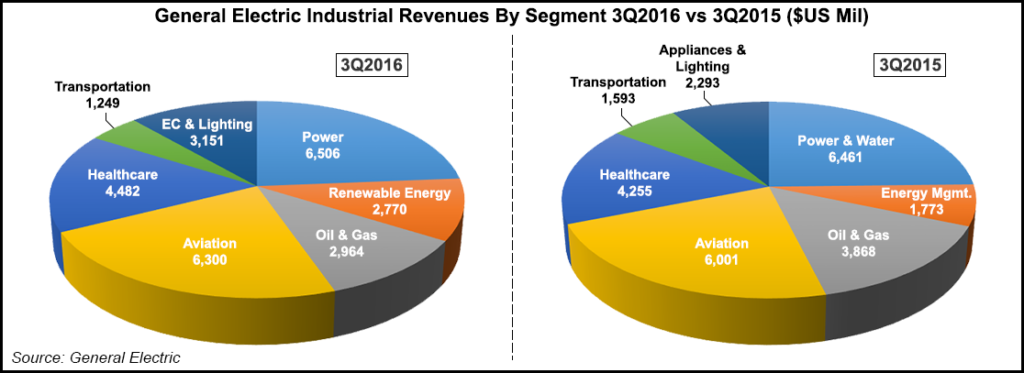

Reflecting low crude oil prices and a weak global economy, General Electric’s (GE) operations showed only modest earnings growth during 3Q2016, with oil/natural gas businesses being the main drag. That could continue in 2017.

Oil/gas orders were down 21% in the quarter, according to CEO Jeffrey Immelt, although he acknowledged there were “still pockets of growth,” such as the Middle East (orders grew by 5%) and Latin America (19%). “We ended the quarter with $22 billion of backlog, and we expect fourth quarter orders to be about flat with what they were a year ago,” Immelt said on a quarterly earnings conference call on Monday.

“We had substantial strength in renewables, healthcare and power. Renewables grew by 59% including our first substantial offshore order at $600 million and $400 million order to repower the installed base.

“The oil/gas team is executing well in a tough environment. We continue to aggressively manage costs while positioning for long-term growth.”

In response to an analyst’s question, Immelt said he sees GE’s oil/gas business “continuing to be a drag as we look forward. Our team is doing a really good job; we’re executing well, taking cost out, but we’re not really forecasting a hockey-stick [earnings increase] in oil/gas.”

CFO Jeffrey Bornstein said orders in GE’s oil/gas business totaled $2.5 billion in the quarter, down 21% from the same quarter last year, including equipment orders down 22% and services down 21%. All of the company’s segments saw equipment orders sag, except for the subsea drilling equipment business, which shot up 33%.

“The industry remains very challenging,” Bornstein said during the conference call. “Some market indicators show a modest sequential improvement in the third quarter; U.S. onshore rig counts were higher by 15% versus the second quarter, and U.S. well counts rose 3% versus the second quarter.”

His report indicated that both rig and well counts remain down about 50% from where they were at the same time last year, and as a result he has revised external forecasts for upstream spending for 2016 “to be less negative and with 2017 slightly more positive.”

For the 3Q2016, GE overall reported consolidated net earnings of $2 billion, compared to $2.5 billion for the same quarter last year. Its oil/gas business was down quarter-over-quarter in revenues (25%) and earnings (42%) — $2.9 billion versus $3.9 billion, and $353 million versus $610 million for the same quarter last year, respectively. By comparison, profits for its renewable energy and power businesses were up 16% and 12%, respectively in 3Q2016.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |