E&P | NGI All News Access | NGI The Weekly Gas Market Report

Southwestern’s Fayetteville Assets Still Struggling to Compete With Appalachia

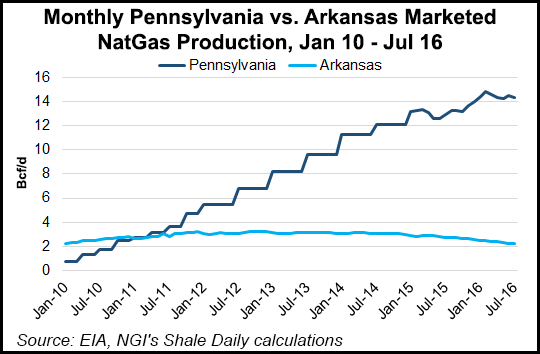

Despite returning a rig to work in the Fayetteville Shale over the summer, Southwestern Energy Co. plans to keep the focus on the Appalachian Basin heading into the end of the year and early next.

After idling all of its rigs in February, the company announced plans at the end of the second quarter to put four rigs back to work in northeast Pennsylvania and northern West Virginia and another in the Arkansas dry gas play (see Shale Daily, July 22; Feb. 26). During a management call on Friday with financial analysts, CFO Craig Owen said there’s not much pushing up estimated ultimate recoveries and production rates in the Fayetteville

“The Fayetteville, with current pricing and current technology, is going to struggle in our capital allocation,” he said. Despite better differentials in the south, Southwestern continues to favor its Appalachian assets, where finding and development costs are lower, liquids lift wellhead prices and the wells are stronger.

The rig in Arkansas, Owen said, is targeting a relatively new formation for the company, testing the deeper Moorefield Shale underneath the Fayetteville. While the company drilled its first horizontal Moorefield well years ago, Owen said the company has had some good wells there and some bad wells, adding that “we have to solve that” in order to help move the needle in Arkansas.

Owen said the company could hold production flat in 2017 with an all-in capital expenditures (capex) budget of $700 million, but said the company plans to announce its formal budget and guidance later this year or early next. Southwestern increased its 2016 production guidance in July by 45 Bcfe at the midpoint after its assets performed better than expected. It’s targeting an exit rate of 865-875 Bcfe with capex of $725-775 million.

Owen said to expect more of the same from the company’s Appalachian assets as it nears the end of 2016: dry gas in northeast Pennsylvania and wetter production in West Virginia. Southwestern was West Virginia’s largest Marcellus Shale wellhead liquids producer last year at 2.5 million bbl, according to a recent analysis of state production data by the West Virginia Geological and Economic Survey (WVGES) (see Shale Daily, Oct. 6). While it was the state’s third largest Marcellus natural gas producer, reporting 111.3 Bcf in 2015, its dry gas production still remains constrained by a lack of takeaway capacity, Owen said.*

Southwestern renegotiated rates for gathering, transportation and processing in West Virginia with Williams earlier this year, which has helped, but more dry gas production from the company in southwest Appalachia depends on infrastructure, prices and the performance of the company’s Utica assets there, Owen said.

Southwestern drilled its first Utica well in the state last year and plans to complete it by the end of the year, but he said it’s still too early to tell how the formation will factor into the company’s Appalachian development plans (see Shale Daily, April 22).

“Dry gas will come as infrastructure opportunities present themselves,” Owen said, “part of that is Utica testing and what we intend to expose. We like what we see, but it’s still early in the game there. We have to continue to work [on the Utica] with the rest of the industry.” Southwestern plans to release its third quarter financial results on Oct. 21.

*Correction: In the original article, NGI’s Shale Daily incorrectly stated that Southwestern Energy Co. was West Virginia’s largest overall liquids producer and its third largest overall gas producer in 2015. It was the state’s largest Marcellus wellhead liquids producer last year and its third largest Marcellus gas producer, according to the WVGES analysis.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |