Markets | LNG | NGI All News Access | NGI The Weekly Gas Market Report

Forecasts Undersell Future of North American LNG, Say Terminal Backers

North American liquefied natural gas (LNG) export developers are taking the long-term view, setting aside the pessimism that has characterized the outlook for exporting gas since the collapse of oil prices in 2014.

According to a panel of LNG executives presenting at the North American Gas Forum in Washington, DC, Monday, analysts have understated the future growth opportunities for LNG exports given the fundamentals. If anything, they said, more investment will be needed as early as next year to avoid a supply gap in the next decade.

“It’s easy to get caught up in the headlines,” said Golden Pass Products project executive Bill Davis. “You’ve got this revolution in the upstream making gas really abundant, making it low cost. You’ve got a whole bunch of projects in the pipeline. You’ve got global underperformance economically, and you bring all those together the outcome’s pretty easy to discern.

“Near term, you’ve got a low price environment situation where you have a bunch of projects coming online bringing big chunks of volume into the market, and the market’s going to take some time to absorb that. But I think the lesson for all of us here is you can’t run the LNG business on near-term headlines alone.”

Golden Pass LNG Terminal near Sabine Pass, TX, is a joint venture formed by affiliates of Qatar Petroleum (70%), ExxonMobil Corp. (17.6%) and ConocoPhillips (12.4%). Originally designed as an import terminal, Golden Pass received a favorable environmental impact statement in July for an expansion that would add export capabilities to the facility (see Daily GPI, July 29). That expansion would include three liquefaction trains, each having a nominal throughput of 5.2 million tonnes per annum (mtpa). Permitting is expected to be completed in 2017, at which time a final investment decision would be made. It is expected to cost about $10 billion over five years to build the liquefaction facilities.

Davis used ExxonMobil’s Outlook for Energy to 2040, which was issued in January, to demonstrate his point about LNG (see Daily GPI, Jan. 16). ExxonMobil forecasts “see LNG demand tripling out to 2040, up to 100 Bcf/d,” Davis said. “We’re bringing a lot of volume into this market, but when you look at that demand curve you realize that by 2030 you’re still going to need another 175 mtpa of additional” supply “to avoid a boom/bust cycle…”

“It means some of these projects are going to have to get greenlighted now in tough times, so look beyond those headlines to the long-term.”

Davis’s views reflected the consensus from Monday’s panel.

“Some argue that the LNG demand is weak,” said Sempra LNG & Midstream President Octavio Simoes. “Actually, I think the opposite is true, but prices are weak for a number of reasons.” Simoes referred to forecasts from Wood Mackenzie that show “a lot of pessimism about the ability of natural gas to replace coal” in markets such as China and the Indian subcontinent. “There’s practically no demand growth [forecast] in the residential/commercial sector except in China. We believe the growth in gas demand is underestimated.”

Sempra is involved in three LNG projects, including Cameron LNG, Port Arthur LNG and Costa Azul LNG, a potential partnership with Mexico’s Petroleos Mexicanos that officials began evaluating last year (see Daily GPI, Feb. 19, 2015).

This summer, DOE authorized Cameron LNG in Louisiana to export an additional 1.41 Bcf/d of LNG, allowing it to export up to 3.53 Bcf/d, or 24.92 mtpa. Construction of the first phase of the $10 billion project (trains No. 1-3) began this year, and the facility is expected to begin initial operations during 2018 (see Daily GPI, July 18).

Earlier this year, executives were aggressively seeking long-term contracts beginning after 2020 for Port Arthur LNG, a proposed joint venture export facility to be sited along the Houston Ship Channel (see Daily GPI, Feb. 29).

LNG Ltd. CEO Greg Vesey said the world-class gas reserves in North America would help limit price volatility in the long-term and help reassure overseas customers. Assuming the U.S. regulatory climate doesn’t get in the way, he said for customers “looking to invest in LNG exports from North America…it’s a very, very comfortable resource to look at.”

He pointed to recent estimates of roughly 800 Tcf of gas recoverable at a $3/MMBtu breakeven price, with another 500 Tcf recoverable at breakevens of $3-3.50. That kind of supply resource means “there’s kind of a natural ceiling on things that’s going to keep that price band very tight as we go forward,” Vesey said. “I think that’s huge for customers to look at and gives them a lot of comfort.”

Vesey added, “We view the window of demand exceeding supply in that 2021-2025 timeframe, so if you work the math backwards…you really need to be making a decision” to invest in LNG exports next year.

Australia-based LNG Ltd. is backing the Magnolia LNG and Bear Head LNG export projects. Magnolia LNG proposes to construct and operate up to four liquefaction production trains in Lake Charles, LA, each with a capacity of 2 mtpa or more. Construction and operation is to include two 160,000 cubic meter full containment storage tanks, ship, barge and truck loading facilities, and supporting infrastructure (see Daily GPI, April 18).

Meanwhile, Bear Head LNG Corp. and Bear Head LNG (USA) LLC want to export 440 Bcf per year (1.2 Bcf/d) from the United States to Canada via pipeline. They also want to export 8 mtpa of LNG from a planned terminal in Nova Scotia (see Daily GPI, March 2, 2015).

Cheniere Energy Inc.’s Anatol Feygin, senior vice president of strategy and corporate development, said his company, which has been the U.S. LNG export pioneer, has “had absolutely no issue” placing the volumes it has brought online to date at its Sabine Pass LNG terminal.

“Now, are they at prices that we saw in 2014? Of course not. Are they at prices that are sufficient to underwrite incremental liquefaction? Unlikely, but they are still healthy margins, and we believe will remain so as long as the fundamental premise…that North American gas prices will remain moderately priced and less volatile, as long as that fundamental premise is true, we think there’s a very attractive home and certainly agree…that the forecasts for gas and LNG demand are conservative today.”

Earlier this year, Cheniere’s Sabine Pass terminal became the first to ship LNG from the Lower 48 states (see Daily GPI, Feb. 24). As of the end of 2Q2016, Cheniere reported that it had exported a total of 22 cargoes from Sabine Pass, with LNG delivered to destinations including South America, Europe, Asia and the Middle East (see Daily GPI, Aug. 10).

GHG Reductions And Coal-to-Gas Switching

According to Simoes, coal-to-gas switching in overseas markets represents a major growth opportunity for North American LNG not reflected in today’s projections. Continued pressure on countries to curb carbon dioxide (CO2) emissions and reduce greenhouse gas (GHG) emissions would be “positive for gas demand.” He also noted the benefits of gas generation in helping to bring renewables into the grid.

“…In the areas that are growing in population and demand, coal is still projected to have a huge role, and we think we have an opportunity to replace that with gas. It’s not captured in just about any forecast, but the commitment the United States can make in maintaining production and allowing exports…is required so that our counterparties can rely on U.S. supply for their energy demands going forward,” he said.

If North America can sustain LNG exports on a low-cost basis, then it can sell other nations on the opportunity to lower their greenhouse gas emissions economically through coal-to-gas switching, as the United States has done in recent years, Simoes said.

“Coal-to-gas substitution is one of the fastest and most economic ways of reducing carbon. We proved it in this country by being the only country that met the Kyoto Protocol, even though we didn’t sign it, just because the price of gas is low…It’s the kind of thing we need to promote,” he said. “We need to really talk about it. We need to create a single voice…because our experience shows how powerful it can be to reduce carbon emissions simply by switching to gas.”

Feygin agreed. The fundamentals are in place for what happened in the United States in 2012 to happen overseas, he said.

“When the right price signal was sent, a grossly underutilized natural gas-powered fleet in the U.S. turned on, displaced a massive amount of coal-fired generation…What opening up this constraint allows is for the rest of the world to avail itself of this lower carbon intensity fuel at attractive prices, and we very clearly see this playing out,” Feygin said, pointing to carbon pricing in the UK as an example.

“We’re very optimistic about the flexibility of the U.S. model supplying this very large demand function that’s starting to grow…Without the world’s ability to access these attractively priced molecules, it would have a very tough time meeting [climate] goals,” Feygin said. “But if we are right on the fundamentals of North American gas and Henry Hub, this is a tool that will continue to challenge coal dispatch globally…further enabling the absorption of renewables as those tools start to be largely adopted by economies that have rapidly growing energy demands.”

Regulatory Uncertainty

To fully capture LNG export opportunities, FERC and the Department of Energy (DOE) will need to play their part, according to the panelists.

An application for Jordan Cove LNG’s export project out of Coos Bay, OR, was rejected by the Federal Energy Regulatory Commission earlier this year based on problems with its Pacific Connector pipeline and a lack of contracts (see Daily GPI, March 14). CEO Elizabeth Spomer said she would like policymakers to understand “that LNG’s hard. It’s got long lead times. The development costs are incredibly expensive…we wouldn’t be spending tens of millions of dollars a quarter if we weren’t highly confident that we had a commercial project.

“So to arbitrarily limit the timeframe under which that determination was made without notice, we suggested, is not appropriate for this space. Historically, FERC has always allowed the market to pick winners. We all remember the mad real estate dash for import terminals. We think that’s still the appropriate model, but maybe a little more time needs to be given, especially in the face of today’s weak market.”

Spomer said “one of the big selling points for U.S. exports had been regulatory certainty, and this really put a wobble in a lot of people’s thinking about this space.” She suggested “some kind of construct that recognizes global markets as distinct from domestic markets, that global markets function differently and may lag FERC’s environmental review process.”

Calgary-based Veresen Inc., backers of Jordan Cove, have continued to move forward with new contracts and agreements for the facility while petitioning FERC for a rehearing (see Daily GPI, Aug. 5).

Davis, meanwhile, criticized FERC and DOE for taking too long to approve LNG export terminals.

“Though the United States is trying to outpace foreign competitors to market opportunities, we’ve become a veritable case study in regulatory burden and continued uncertainty, so projects are enduring years of costly permitting at FERC with no meaningful way to improve upon the pace that the agency sets,” Davis said.

The application for Golden Pass “has sat at the DOE for almost four years now, and we’re still waiting on our license to chill. We’re waiting even though we had the final [environmental impact statement] come out a couple months ago…so this is clearly a process that takes an eternity, but the DOE won’t even guarantee it’ll be that fast.”

Davis welcomed provisions in a Congressional energy bill currently in conference that would impose “a shot clock” on terminal review decisions, saying a clearly defined timeframe would send “a much-needed signal to markets around the world that U.S. LNG can be part of their future.”

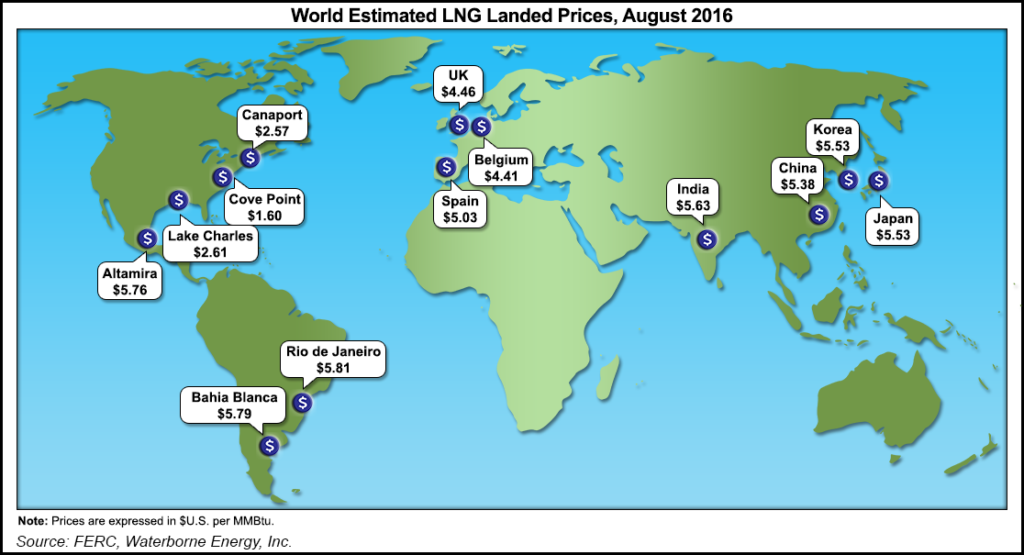

Global LNG Pricing And The U.S. Model

The panelists also offered their thoughts on how the emergence of U.S. LNG is likely to change the way the market prices natural gas on the world stage. Feygin said global LNG would move toward “destination flexibility…catalyzed by the U.S. model.

“We think now that the genie’s out of the bottle, it will be very hard to put back in…spot and short-term volumes become a lot of truly spot and truly liquid volumes with a fair amount of price discovery. Now, that will help trade,” he said. “That will help clients get comfortable with what this North American hydrocarbon renaissance means for them. But ultimately…we will need term contracts in order to finance these very large projects. We think the market will see the best of both worlds.”

Vesey said “with the amount of ships being built, the way the trading world is comfortable with a liquid universal market, I’m one of those who feels like you’re going to see a global LNG market where at some point in the future you’ll have a hub or hubs, and you’ll be able to risk manage and trade around them. I just think we’re headed in that direction.”*

For his part, Simoes suggested that move away from oil indexation is besides the point.

“To me the competition is not what oil linkage is going to be…that’s not the competition that the gas industry’s facing around the world,” he said. “When we’re visiting places that are looking for additional demand, the competition is coal, and that’s something as industry we have not grasped and dealt with.

“If we cannot work through the value of gas that emits 60% less greenhouse gases than coal, if we cannot work through what Europe has done with certain carbon costs or a carbon tax or whatever you want to put in place, we’re not going to compete with coal, and you’re going to continue to see places like India and Pakistan and even Japan” burn coal instead of gas.

“That is where I think the gas industry needs to focus on, not whether the price is going to be oil linked or Henry Hub,” he said. “Because the price will be what it is. There’s a price that the market will produce, and there could be a ceiling or a floor depending on the circumstances, but I think it’s a stable price dictated by the U.S. model.”

*Correction: In the original article, a comment regarding the move to a global liquefied natural gas market was incorrectly attributed to Golden Pass Products project executive Bill Davis. The comment was actually made by LNG Ltd. CEO Greg Vesey. NGI regrets the error.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |