Infrastructure | NGI All News Access

Kinder Morgan Takes Partner in Ohio Ethane Pipeline Project

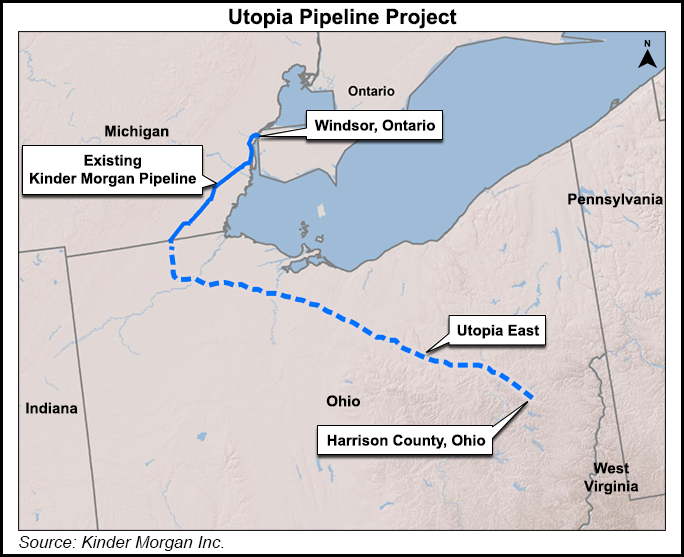

Kinder Morgan Inc. (KMI) is selling a 50% stake in its Utopia Pipeline Project, which when complete will be a conduit for ethane from Ohio to the Sarnia, ON, petrochemical market. The buyer is Riverstone Investment Group LLC.

Riverstone agreed to an upfront cash payment consisting of reimbursement to KMI for its 50% share of prior capital expenditures (capex) related to the project and a payment in excess of capex to recognize the value created by KMI in developing the project to its current stage, KMI said.

Riverstone also agreed to fund its share of future capex necessary to complete the project. The total project cost is estimated at $500 million (excluding capitalized interest), and is supported by a long-term contract with Nova Chemicals Corp. (see Shale Daily, Sept. 30, 2014; Dec. 16, 2013).

KMI has been working to strengthen its balance sheet and fund capital projects from cash flow in response to the downturn in commodity prices. “This is another step towards achieving our stated goals of strengthening our balance sheet and positioning the company for long-term value creation,” said KMI CEO Steve Kean.

During a first quarter earnings conference call in April, Kean discussed a reduction in the company’s backlog of capital projects (see Daily GPI, April 21).

Utopia is a common carrier project that would include 215 miles of 12-inch diameter pipeline constructed entirely within Ohio from Harrison County to Fulton County. The pipeline would connect with an existing KMI pipeline and associated facilities in order to transport ethane and ethane-propane mixtures to petrochemical companies operating in Ontario.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |