E&P | NGI All News Access | Permian Basin

NGP-Backed Centennial Considering IPO For Permian-Focused E&P Operations

Centennial Resource Development Inc., which owns 61 horizontal wells concentrated in the Permian Basin’s Delaware sub-basin, is planning to launch an initial public offering (IPO) to raise up to $100 million, becoming the first potential offering by a U.S. onshore explorer in two years.

The expected filing date was not announced in the U.S. Securities and Exchange Commission filing, which said the Denver-based producer would be listed on Nasdaq under the symbol “CDEV.” According to Dealogic, no producer has debuted on a major U.S. stock exchange since June 2014.

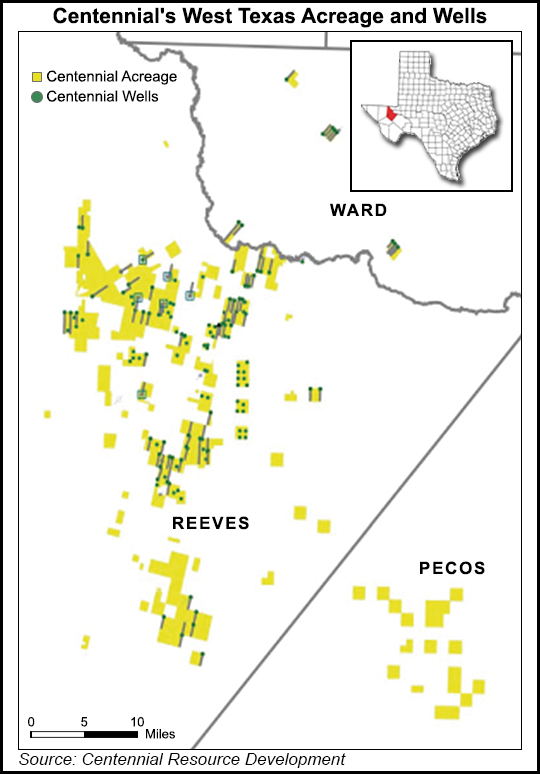

Centennial Resource Development LLC, run by former Tudor, Pickering, Holt & Co. executive Ward Polzin, was formed in 2013 with backing by an affiliate of Natural Gas Partners (NGP), a family of energy-focused private equity investments funds. Centennial’s focus is the southern Delaware of West Texas, where it has acreage in Reeves, Ward and Pecos counties. To date the company has leased or acquired close to 42,500 net acres in the play, 83% operated.

“We have assembled a multi-year inventory of horizontal drilling projects,” management said in its prospectus. As of June 15, the company had identified 1,357 gross horizontal drilling locations in portions of the Bone Spring and Wolfcamp formations.

“Of the initial 1,357 identified horizontal drilling locations, 64 are in the Third Bone Spring Sandstone, 398 are in the Upper Wolfcamp A, 329 are in the Lower Wolfcamp A, 300 are in the Wolfcamp B and 266 are in the Wolfcamp C.” The drilling inventory includes 366 extended lateral locations “of either 9,500 or 7,500 lateral feet,” with the near-term drilling program focused on the Wolfcamp A zones.

During 1Q2016, average net output was 7,212 boe/d, 71.7% oil, 17.7% natural gas and 10.6% natural gas liquids. Production included 470,000 b/d of oil, 698 MMcf/d of natural gas and 70,000 b/d of liquids. During 2015, net production averaged 7,317 boe/d. Estimated reserves are 71% oil, 17% natural gas and 12% liquids.

“After temporarily suspending drilling activity at the end of March 2016 to preserve capital, we added one horizontal rig in June and expect to add a second horizontal rig in the fourth quarter of 2016,” management said. Last year it operated on average one rig and placed 13 horizontals on production. Reeves County, where most of its acreage is located, had the “second most horizontal rigs of any U.S. county” as of June 17, with 21 rigs operating.

As of mid-June, 75% of the net acreage in Reeves and Ward counties was either held by production (HBP) or under continuous drilling provisions. Most of the operated net acreage in Reeves and Ward is expected to be HBP or under continuous drilling provisions by the end of 2017. In May and earlier this month Centennial completed completed two acquisitions in Reeves that added 2,400 net acres and 250 boe/d of production. To date in 2016, it has spent $44 million on acquisitions.

“As a result of this horizontal drilling, the Delaware Basin is the only region in the United States that has experienced sustained fourth quarter-to-fourth quarter production growth rates greater than 25% for the past three years,” the prospectus said. “Based on recent well results and significant decreases in drilling and completion costs, we believe the Delaware Basin represents one of the most attractive operating regions in the United States.”

Centennial’s lease operating expenses in 1Q2016 already have fallen sharply from full-year 2015 to $6.16 /boe from $7.93, while general/administrative expenses declined to $3.87 from $5.32.

“We experienced a significant decrease in our drilling and completion costs during 2015, which has continued into 2016,” management said. “This trend has been driven by efficiency improvements in the field, including reduced drilling days, the modification of well designs and reduction or elimination of unnecessary costs. Additionally, overall service costs have declined as a result of reduced industry demand.”

Between January and March, “the spud-to-rig release for our three single-section horizontal wells was approximately 22 days, compared to 28 days and 46 days for all single-section horizontal wells we drilled in 2015 and 2014, respectively. We expect that further optimization in the field (including the increased drilling of longer laterals, pad drilling, the use of shared facilities and zipper fractures), reduced rig rates and lower service costs will improve our well economics.”

This year’s capital budget for drilling, completion and recompletion activities and facilities costs is $87 million, excluding leasing and other acquisitions. About $72 million is allocated for drilling and completion of operated wells, with $8 million is for nonoperated wells.

During 1Q2016, Centennial entered into a crude gathering and transportation agreement with privately held Oryx Southern Delaware Oil Gathering and Transport LLC to build and operate a system to transport most of the crude from the Permian to market (see Shale Daily, Sept. 30, 2015). The system is expected to be operational in 3Q2016. Under the agreement, Centennial dedicated most of its operated acreage but it has no volume commitments to the system.

For the first quarter Centennial reported a net loss of $14.46 million, versus a year-ago loss of $5.94 million. During 2015 the company lost close to $38.9 million. Net cash from operations was $18.55 million in 1Q2016, versus $27.63 million a year earlier.

Total revenue in 1Q2016 was $15.12 million, compared with $24.42 million in 1Q2015. Last year’s revenues totaled $90.46 million. During 1Q2016, oil sales totaled $13.23 million, natural gas sales were $1.31 million and liquids sales totaled $582,000. Proved reserves at the end of 2015 totaled 32.457 million boe, including 23.2 million bbl of oil, 32.44 Bcf of gas and 3.85 million bbl natural gas liquids.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |