Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

Access Northeast Isn’t Like Northeast Energy Direct, Spectra CEO Says

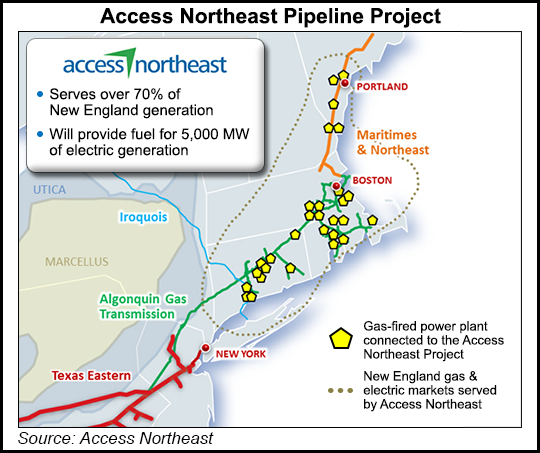

Northeast power generation demand provides more than enough support to advance the Access Northeast project of the Algonquin Gas Transmission and Maritimes & Northeast (M&NE) pipelines, Spectra Energy Corp. CEO Greg Ebel said Wednesday.

Access Northeast, a project under development by Spectra with Eversource Energy and National Grid, is focused on the New England gas-fired power market. It’s not the same market that was targeted by the recently abandoned greenfield Northeast Energy Direct (NED) project of Kinder Morgan Inc. (KMI) (see Daily GPI, April 21), Ebel told analysts during an earnings conference call.

“Remember…the other project that was being pitched up there [NED] was not really a direct competitor,” Ebel said. “I know the sell side [analyst] community and others often talked about that. But remember, we have AIM [Algonquin Incremental Market] and Atlantic Bridge that are largely serving the type of customers that they were going to serve, i.e., local distribution gas companies [see Daily GPI, May 2].

“Access Northeast…is designed to meet the generation needs…[T]here is no doubt that the generation needs and the need for gas infrastructure are there. There is no doubt that people sign long-term contracts to support that. I think that’s what you see going through the regulatory process. And as with most of our projects around the country now, pretty well all of that is done on a negotiated rate basis…What we do continue to see is a real need for infrastructure…”

NED was targeting power generation customers, too, and it had signed up some. Last November, a KMI executive told NGI that she saw enough demand in the region to support NED as well as Access Northeast (see Daily GPI, Nov. 20, 2015). In the eyes of staff of the New Hampshire Public Utility Commission (NH PUC), NED and Access Northeast were clearly seen as competitors.

“…[W]e view Access Northeast [see Daily GPI, Feb. 19, 2015] and Northeast Energy Direct [see Daily GPI, Sept. 3, 2015] as two very cost-effective projects that will moderate future winter electricity prices, though the numbers clearly indicate that NED will provide the greatest benefits to regional electricity customers,” NH PUC staff said in a report last September (see Daily GPI, Sept. 18, 2015).

During the conference call, Ebel emphasized that Algonquin and M&NE directly connect to more than 60% of the existing ISO New England gas-fired electric generation capacity and more than 80% of the new capacity that recently cleared the ISO-New England forward capacity market. He also talked about the brownfield nature of Access Northeast, which would make use of existing right-of-way. “That’s what really drives us forward on Access Northeast,” he said.

Spectra said Access Northeast has executed contracts with electric distribution companies in New Hampshire and Massachusetts totaling more than 50% of the 0.9 Bcf/d project design capacity. Contract approvals are being sought from state regulators, and additional contracts in Connecticut, Rhode Island and Maine are anticipated. In April, the Federal Energy Regulatory Commission said it would prepare an environmental impact statement for the project. Access Northeast execution is expected to begin later this year for a late 2018 initial in-service date, Spectra said.

An analyst asked Ebel whether would-be customers of NED had been in contact with Spectra about capacity on Access Northeast. He said it would be correct to assume that discussions had been initiated in both directions but added that NED is a different project whose customers potentially have different needs than those that would be served by Access Northeast. “Let’s agree that we’re having a good discussion with all the various parties…” Ebel said.

Spectra Energy Corp. reported first quarter net income was $238 million (35 cents/share), compared with $274 million (41 cents) in first quarter 2015. Quarterly earnings before interest, taxes, depreciation and amortization (EBITDA) was $757 million, compared with $788 million in the prior-year quarter. Distributable cash flow for the quarter was $523 million, versus $578 million in the same quarter last year. EBITDA from Spectra Energy Partners was $473 million in first quarter, compared with $464 million in first quarter 2015. The 2015 period excludes a noncash special item expense of $9 million.

The latest results reflect increased earnings from expansion projects in the natural gas transmission business, partially offset by lower interruptible and short-term contract transportation revenue due to warmer weather and the absence of equity earnings from the Sand Hills and Southern Hills natural gas liquids pipelines, which Spectra Energy Partners owned until last October. Earnings from these interests are now reflected in the field services segment.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |