Markets | E&P | Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

Mexico Will Need to Have Its Own NatGas Price Indices, CFE Official Says

No one in the natural gas industry disputes the bounty of shale gas available from Texas or the need for that gas south of the border to fuel Mexico’s expanding power generation and industrial demand. Where that gas ultimately ends up getting priced when the Mexican market is developed remains to be seen.

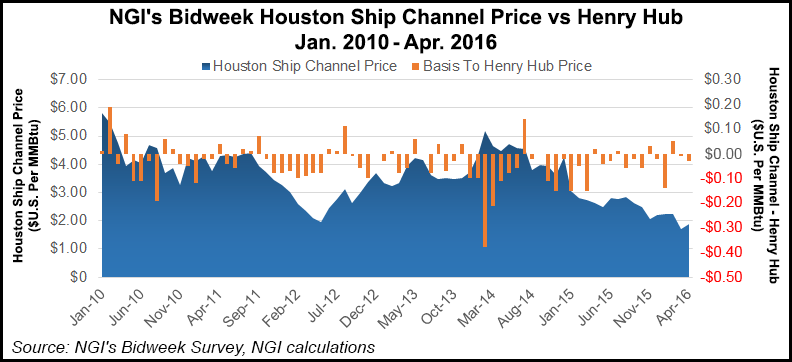

Typically, gas that Mexico sources from the United States is priced off of indexes at Henry Hub or the Houston Ship Channel with transportation added in. At least one South Texas producer thinks that’s just fine, but an executive with Mexico’s Comision Federal de Electricidad (CFE) — which is developing multiple pipelines to feed its power plants — thinks otherwise.

The Mexican market will need its own price indices, to be established at pipeline headers, points where multiple pipelines converge. Exactly where and how many indices come to be remains to be seen, but Mexico has got to have them, CFE’s Javier Gutierrez Becerril, deputy director for modernization, told NGI on the sidelines of the 2nd Mexico Gas Summit in San Antonio Thursday.

“I think the idea is to try to move it more toward the U.S. model,” Becerril said. “We want to have indices where they’re going to start sending signals to everyone when it comes to the supply, when it comes to the infrastructure…We already have the Henry Hub and the Houston Ship Channel; we have all those. It doesn’t make any sense for someone who wants to produce gas or wants to move gas in Mexico to be kind of based on those indices.”

Glenn Hart, CEO of South Texas producer Laredo Energy, said his company recently did a deal with an end-user in Mexico using NGI‘s Houston Ship Channel index, and it worked just fine. It was the best price he’s seen in South Texas in a while, he said. Mexico doesn’t need its own price indices, Hart told NGI.

“Let’s think about it,” he said. “The entire world benchmarks off of WTI and Brent for crude oil. And yet we all know the reality is that…transactions are made in other places, but they’re all bench marked off of those two big indices. So if there develops a liquid hub in Agua Dulce, TX, for example, that’s fine for things to be trading there.”

Oil/gas bankers, shareholders and boards of directors all will want to know how the price of the commodity being sold in Mexico relates to Henry Hub or the Houston Ship Channel, Hart said. “You’re never going to get away from that, so why would you fight it?”

For his part, Becerril said there are certain spots within the country where it will be a natural place to have an index, wherever multiple pipelines converge, perhaps La Laguna. For instance, according to CFE documents, the La Laguna-Aguascalientes pipeline will supply gas to the CFE’s power plants in the states of Durango, Zacatecas and Aguascalientes, as well as the central and western regions of the country. It is to be interconnected with the El Encino-La Laguna pipeline and the Villa de Reyes-Aguascalientes-Guadalajara pipeline.

With pipeline construction under way and other projects in development by CRE and Petroleos Mexicanos, it will take time for the Mexican market to develop. Becerril said. “I don’t know, hopefully in the next five years we’re up and running, I mean we’re full-throttle. In the next year or so we start getting the first steps of moving toward that place. A lot of things have to happen. It’s difficult to say, to answer a timeframe.”

Hart is watching the development south of the border and waiting for an expanded market for Laredo Energy gas. “I think so far everybody’s been focused on getting the gas to Monterrey,” he told NGI. “I think people are missing the boat with what happens with the rest of the country. I think the intra-Mexico pipes are going to be a very important piece of the puzzle about having an efficient marketplace for buyers in Mexico.”

For now, Hart said his more immediate concerns rest to the north of the border, where he says some Mexico border-bound pipeline tariffs are unattractive.

“We’re getting there on what’s north of the border to feed the system that needs to happen in Mexico,” Hart said, adding, though, that some pipelines are gouging customers. “…[T]hat is flat-out happening…A U.S. transportation rate that’s too high or out of the market can kill the economics of Mexicans being able to buy gas in Mexico,” he said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |