Regulatory | Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

Sempra May Challenge Mexico on Gas Pipeline Bid Outcome

Officials at Sempra Energy’s Mexican affiliate Infraestructura Energetica Nova, SAB deCV, or IEnova, said Wednesday they are considering a legal challenge to the Mexican government’s rejection of a natural gas pipeline bid that ultimately was awarded to a unit of TransCanada Corp. (see Daily GPI, April 11).

In bidding assessed on technical and financial bases, TransCanada was awarded a contract to construct, own and operate the 866 MMcf/d Tula-Villa de Reyes pipeline in Mexico Comision Federal de Electricidad (CFE). TransCanada’s Transportadora de Gas Natural de la Huasteca and CFE have a 25-year gas transportation service contract.

TransCanada’s bid beat one by IEnova unit Gas Pipeline Aguaprieta, as well as another bidder, Madrid-based Enagas Internacional. CFE said the Sempra unit’s proposal was disqualified because it did not meet all of the technical requirements of the tender. Sempra officials dispute that assertion.

“Since the result of the bidding process may be subject to litigation we can’t make any further comments,” an IEnova spokeswoman told NGI.

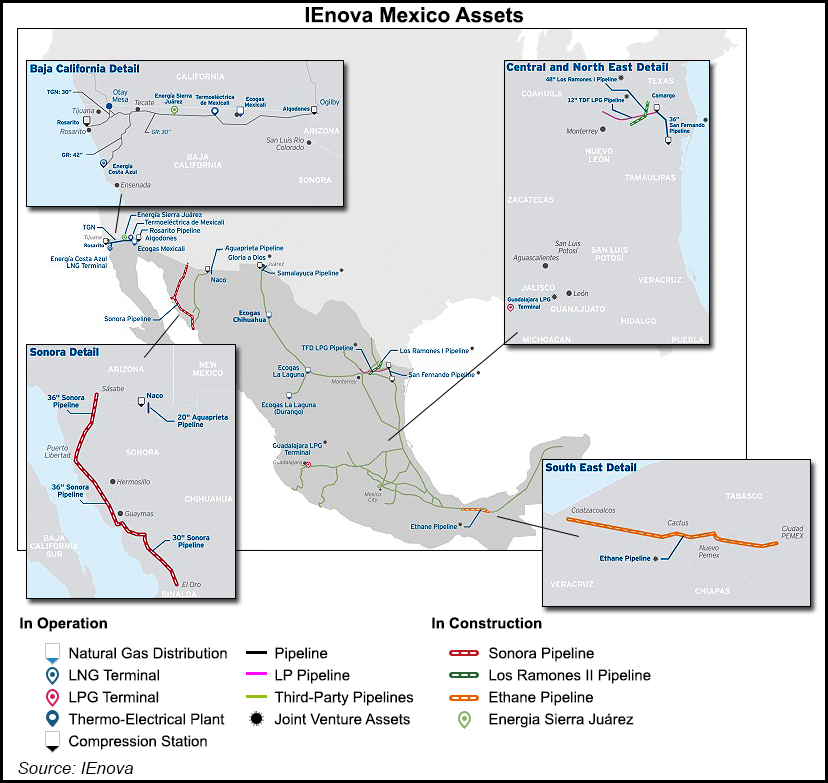

The Tula-Villa project is one of several in Mexico that add up to more than 3,000 miles of new pipelines (see Daily GPI, Oct. 15, 2015).

“IEnova’s technical proposal was approved [by CFE] in the bidding process in as much as CFE qualified it as ‘in compliance’, but on April 8 CFE announced that IEnova’s economic [financial] proposal was rejected, arguing that it did not satisfy the requirements of the bidding process,” the spokeswoman said.

Regardless of the loss in the competitive bidding process, IEnova is dissatisfied with the rejection as it considers the bid “solvent according to the bidding process rules…Therefore, it will be evaluated and, if feasible, [we] will exercise the administrative and legal actions available,” she said.

The latest bidding setback for Sempra’s growing Mexican operations was unusual given its track record in past years for winning lucrative contracts (see Daily GPI,July 15, 2015).

Last November, Sempra CEO Debra Reed said Mexico’s near-term investment opportunity for new gas pipelines to serve electric generation plants exceeded $6 billion, involving six different projects (see Daily GPI,Nov. 3, 2015). She also noted that there were plans for awarding bids in 2016 for major electric transmission projects, and IEnova planned to participate in the bidding competition.

Since Mexico’s reform of its energy sector, there have been a variety of sponsors in the race to supply the country’s growing natural gas demand. A unit of the Mexican Grupo Carso SAB de CV won the bid from CFE to construct and operate the 403-mile, 36-inch diameter Samalayuca-Sasabe Pipeline, a gas system that would run through the country’s Chihuahua and Sonora states (see Daily GPI, Sept. 17, 2015). Howard Midstream Energy Partners LLC is proceeding with plans to construct the 200-mile, 30-inch diameter Texas-to-Mexico Nueva Era Pipeline with joint venture partner Grupo Clisa of Mexico (seeDaily GPI, Aug. 12, 2015). Roadrunner Gas Transmission, a pipeline project of Oneok Partners LP and a subsidiary of Fermacoa Infrastructure BV to transport up to 640 MMcf/d from the Permian Basin to Mexico, is fully subscribed (see Daily GPI, April 1, 2015).

Sempra has run afoul of the Mexican government recently in attempt to buy out a joint venture with Mexico’s state-owned Petroleos Mexicanos, or Pemex. The transaction was among a quintet of buyouts announced last summer, valued at $1.325 billion, which included three gas pipelines, an ethane pipeline, and liquid petroleum gas pipeline and storage facilities. The government had said there should be open bidding for Pemex’s 50% interest (see Daily GPI, Aug. 3, 2015).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |