E&P | Eagle Ford Shale | NGI All News Access

Halcon Dropping to One Rig in 2016, to Focus Spending on Williston

Halcon Resources Corp. plans to drop to one operated rig in 2016 as it looks to spend within cash flow to weather the downturn.

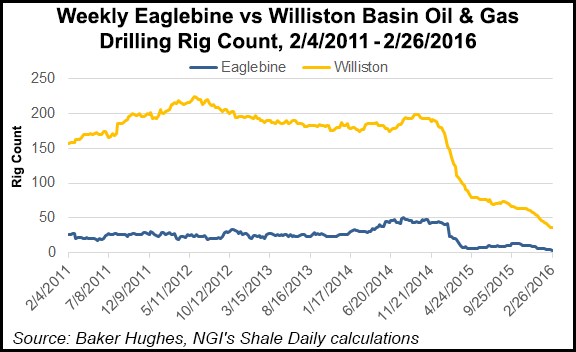

The Houston-based exploration and production (E&P) company said that it plans to drop from an average of one operated rig in its “El Halcon” acreage in the Eaglebine during the fourth quarter to zero rigs by the end of March until commodity prices improve. In the Williston Basin, Halcon said it will drop from an average of two operated rigs to one by by the end of March.

In a 4Q2015 earnings call with investors Friday, CEO Floyd Wilson said Halcon will spend less than $140 million on drilling and completion (D&C) activities in 2016.

“We expect to operate one rig — only one rig companywide — until we see material improvement in commodity pricing,” Wilson said, adding that this approach “will result in only a modest decline in year/year production, less than 10%. This capital program will allow us to be cash flow positive this year, resulting in strong liquidity throughout the year. This approach is appropriate in this environment, and we’ll wait for the macro signals that we need to change this approach.”

Halcon said it expects to spud 15-20 gross operated wells in 2016.

Roughly 80-85% of 2016 D&C spending is planned for Halcon’s Fort Berthold Indian Reservation (FBIR) acreage in the Williston, which the company said is its highest return area. The company put 33 wells online in the FBIR in 2015 with an average estimated ultimate recovery (EUR) of 800 million boe. Wells put online in 2016 are expected to have an average EUR of 900 million boe, the E&P said.

The Bakken Shale and the underlying Three Forks formation are both part of the Williston Basin, which spans portions of North Dakota, South Dakota, Montana, Manitoba and Saskatchewan. Much of the industry development to date has occurred on the U.S. side of the border. While the rig count in the play has dropped precipitously over the last year, production has remained stout, and Lynn Helms, director of the North Dakota Department of Mineral Resources, said in late 2015 he expects current price and production levels to continue throughout 2016. To learn more on the recent trends in the Williston Basin, check out NGI‘s brand new North American Shale & Resource Plays 2016 Factbook.

Wilson said Halcon’s acreage in the Eaglebine is largely held by production, requiring less than $5 million in leasing costs for 2016.

“At El Halcon…we’ve postponed drilling activity there. We continue to see strong results and economic drilling even at current prices. However, it’s just not the right time to drill there,” Wilson said. “Our D&C costs are down to about $6.8 million now. This accounts for longer laterals and increased proppant load there, and we’re continuing to drive those costs down even further on the wells that we haven’t fracked yet. And then when we pick the drilling up again, we’ll see what happens there.”

Halcon said it ended 2015 with $789 million in liquidity, including undrawn capacity on a secured revolver with a $827 million borrowing base. Management said they expect that borrowing base to be revised down to $650 to $700 million during its upcoming spring redetermination.

Although shares of Halcon were trading under $1 Monday, Wilson sounded bullish on the E&P’s financial position as it holds out for better commodity prices, saying the company has “ample liquidity that provides us with two-plus years of runway to continue operating even at the current strip. We have time, and we have optionality.”

Halcon reported average daily production for the quarter of 41,087 boe/d, down from 46,076 boe/d in the year-ago period. For full-year 2015, the company averaged 41,542 boe/d in production, down from 42,107 boe/d in 2014.

Average realized prices for the quarter were $36.94/bbl for crude oil ($80.05/bbl after hedging), $1.83/Mcf for natural gas ($2.86/Mcf after hedging) and $7.43/bbl for natural gas liquids, which did not experience any gains from hedges.

The company trimmed its total operating costs during the quarter to $17.80/boe, down from $21.27 in the year-ago quarter. This included a reduction in lease operating expenses, which fell to $5.91/boe from $8.15/boe in the year-ago quarter. General and administrative expenses fell to $4.15/boe from $4.80/boe in the year-ago period.

For 4Q2015, Halcon reported a net loss of $393.4 million (minus $3.56/share), compared with a net income of $259 million ($2.96/share) in 4Q2014.

For full-year 2015, Halcon reported a net loss of $1.9 billion (minus $18.66/share), compared with a net income of $316 million for full-year 2014.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |