Marcellus | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Utica Shale

Southwestern Idles All Rigs, Forecasts Sharp Decline in NatGas-Weighted Production

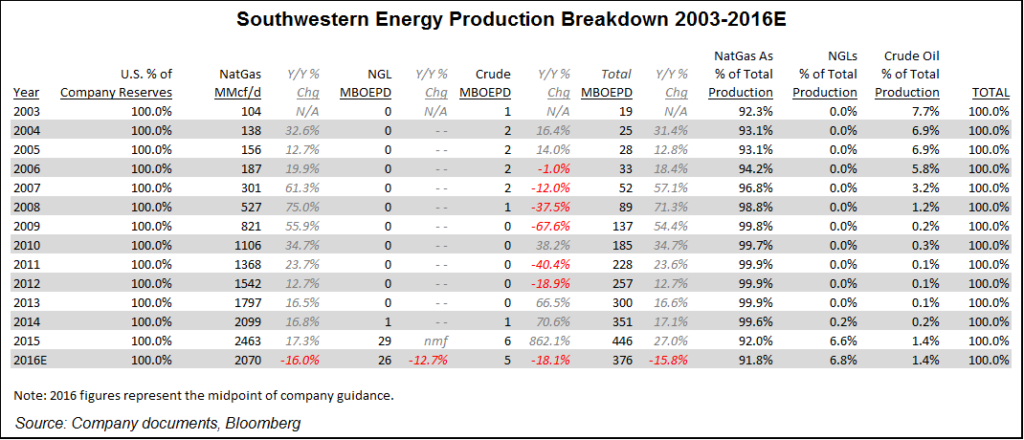

Southwestern Energy Co., the fourth largest natural gas producer in the United States, expects total output to decline by 14-17% this year as it pulls back on new development and concentrates only on completions. To help defray costs, the producer also has secured lower transport rates for its West Virginia production.

The Houston-based independent’s gas production, which accounts for 92% of output, is forecast to decline by 16% from 2015 levels.

“Our strategic plan will enable us to optimize the business in today’s constrained environment while positioning us to outperform when commodity prices improve,” CEO Bill Way said during a conference call to discuss fourth quarter results. “Looking ahead, we are dedicated to…remaining flexible as we continue to pursue our objective of keeping our investing levels within cash flow.”

The plan is to maintain capital discipline by investing only in projects that exceed Southwestern’s 1.3 present value index (PVI) threshold at strip prices. PVI refers to the ratio of the net present value of a project to the initial investment required. All investment “has been deferred” on the 3.7 million net acres of onshore exploration opportunities. Asset sales are on the table, Way said.

“We’ve had a number of different inquiries,” he said during the conference call. “I think we had originally planned on a large portfolio” to sell, but “what we’re seeing is interest in individual pieces of that…We’re looking at other candidates for sale including some of our other new venture portfolio assets, and obviously, market conditions affect the choices on the assets that we will look at. But we want to identify opportunities to pull value forward.” He offered no specifics on what may be on the market, but when asked if selling the company outright was possible, Way said “looking to sell the company is not a priority…”

Capital spending has been reduced to $1.8 billion, a reduction of 30% from guidance issued at the start of 2016 and $50 million below recent public guidance. Last month Southwestern laid off 40% of its workforce, cutting an estimated 1,100 people (see Shale Daily, Jan. 21). In addition, Southwestern renegotiated with Williams earlier this month to reduce existing rates for gathering, transportation and processing activities in West Virginia.

The rate changes are expected to reduce costs this year by more than $35 million. In addition, Southwestern agreed to dedicate to Williams more gathering rights for its wet gas acreage in the Marcellus Shale in West Virginia and dry gas Utica Shale gathering rights in the northern part of the state. The company would be subject to minimum volume commitments only as it directs Williams to construct wet or dry gas infrastructure. Southwestern retained some dry gas Utica acreage not dedicated in the southern portion of its West Virginia position.

New York Mercantile Exchange (Nymex) gas prices are expected to be challenged this year, but Appalachian Basin revenues should be positively impacted year/year by new pipelines coming into service. Northeast Appalachia discounts to Nymex of $1.04 are expected to fall to 95 cents, while Southwest Appalachia prices are forecast to decline from 74 cents to 70 cents. The expected improvement would increase revenue by about $35 million using forecasted 2016 volumes. Discounts to Nymex are expected to improve even further as additional pipelines are placed in service in 2017 and beyond.

Appalachia is expected to be the growth driver for years to come, with the swing provided by the Fayetteville Shale and midstream businesses for base cash flow to fund growth.

“The company’s plan is flexible and designed to be responsive to any commodity price strengthening,” Way said. Using a $2.35/Mcf gas price and a $35/bbl oil price, an increase of 25 cents/Mcf in gas prices would increase cash flow by around $185 million, while an oil price increase of $5.00/bbl would lift cash flow by $15 million. Assuming the added cash flow is invested into additional completion activities, production could increase by about 70 Bcfe for the first year.

Last year’s gas and oil output was a record and 27% higher than in 2014. Net production in 4Q2014 totaled 249 Bcfe, up 24% year/year from 201 Bcfe. In the Fayetteville Shale, gas output declined to 112 Bcf from 125 Bcf, while Northeast Appalachia gas production increased to 97 Bcf from 69 Bcf. In Southwest Appalachia, where the company has escalated its liquids growth, production rose year/year to 40 Bcf from 3 Bcfe. However, production overall is on a sharp, downward track this year.

Assuming average gas prices are $2.35/Mcf and oil prices are $35.00, Southwestern is expecting total production of 815-835 Bcfe net in 2016, which would be 14-17% lower than in 2015 when it was 976 Bcfe net. Overall gas production is forecast to be 16% lower this year at 749-766 Bcf net from 2015’s 899 Bcf net.

“The simple fact that our production is declining from a company as large as ours, is itself, a market signal,” Way said. “If you look at our current portfolio, every 25 cent movement in gas adds $200 million in cash flow to our bottom line. And with our mandate to invest within cash flow, as we see prices improve, one of the opportunities for us is to get back into and restart our drilling and completions.

“We would certainly prioritize our work to wells that are currently drilled but not completed and then prioritize across the company in terms of the highest PVI projects and how that exactly would work. I think what we want to do is let 2016 play out a little longer…We have the capability to restart fairly quickly.”

In terms of where to invest, “certainly, the economics in the Northeast tend to be the strongest economics we have and as we have demonstrated just by our well performance over the last couple of years, it takes far fewer rigs to drill and complete wells that have growing production than our original plan. So, the number of rigs, the number of wells, all of that, we’re continuing to work and we’ll talk more about that as we move forward.” In Northeast Appalachia, total net production is expected to be 324-332 Bcf, while in Southwest Appalachia it is forecast at 125-130 Bcfe, about half natural gas liquids. Total net production from the Fayetteville Shale is expected to be 364-371 Bcf.

Southwestern recorded net losses in 4Q2015 of $2.1 billion (minus $5.58/share), versus income in the year-ago period of $312 million (88 cents). Adjusted for a proved reserves revision writedown of $2.6 billion, net losses in 4Q2015 were $6 million (minus 2 cents/share) from year-ago profits of $185 million (52 cents). Net cash provided by operating activities was $306 million versus $570 million in 4Q2014.

Operating losses from the exploration and production segment were $64 million, compared with year-ago income of $196 million. Including the effect of hedges, average realized gas prices in 4Q2015 were $2.07/Mcf from $3.52 in 4Q2014. As of late February, the company had 37 Bcf of its 2016 production hedged at an average price of $2.60/Mcf.

Similar to most producers, Southwestern typically sells its natural gas at a discount to Nymex settlement prices. Disregarding the impact of hedges, the average price received for fourth quarter gas production was 79 cents/Mcf below average Nymex settlement prices, versus 74 cents/Mcf in 4Q2014.

Southwestern’s lease operating expenses actually rose by 1 cent year/year to 91 cents/Mcfe because of “higher operating costs in Southwest Appalachia associated with liquids production.” General and administrative expenses fell 4 cents from a year ago to 20 cents/Mcfe because of the increase in production volumes. Year-end reserves decreased 42% to 6,215 Bcfe from 10,747 Bcfe at the end of 2014 because of the downward price revisions.

Operating income for the midstream services segment fell 19% year/year to $72 million, attributed mostly to the decline in gathered volumes from the Fayetteville and the sale of some Pennsylvania gathering assets. At year-end 2015, the segment was gathering 1.9 Bcf/d through 2,044 miles of gathering lines in the Fayetteville Shale.

Southwestern had $1.9 billion of undrawn capacity on its $2 billion unsecured revolver at the end of 2015.

“The drawing on that liquidity to invest in wells that have marginal economics in today’s price environment does not make sense to us,” Way said. “We will continue to watch prices as we get further into the year and we can adjust accordingly…Strengthening the balance sheet is a key priority for us in 2016. We do not plan to add to debt and are actively pursuing a number of options to reduce to our debt levels.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |