Soft Markets Scuttle BC LNG Project

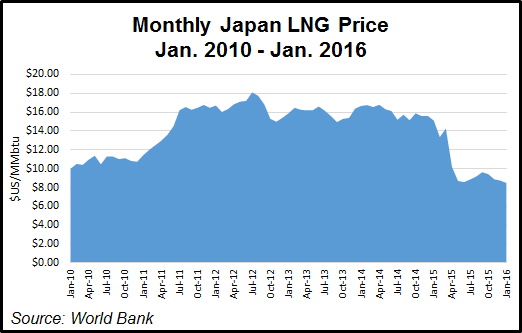

Deteriorating markets inflicted the second industrial casualty this month on British Columbia when an international consortium halted work on a highly regarded liquefied natural gas (LNG) project on the northern Pacific Coast.

Calgary midstream processing and transportation firm AltaGas Ltd., Japanese energy conglomerate Idemitsu Kosan, Belgian LNG specialist Emar NV and French global merchant EDF shelved DC LNG, named after the Douglas Channel tanker route to their proposed Kitimat terminal.

A one-sentence statement in AltaGas’s fourth quarter 2015 financial report blamed the halt on “adverse economic conditions and worsening global energy price levels.” The group did not predict when markets would recover enough to revive the project.

The withdrawal from the BC lineup in the gas sales race to Asia came only six weeks after the National Energy Board (NEB) awarded DC LNG a 25-year license to export up to 1 Bcf/d (see Daily GPI, Jan. 19). A sunset clause will keep the permit valid until 2025.

The AltaGas group stood out as a contender to make the first overseas tanker deliveries of BC production with a compact, economical package designed to start small and grow in response to overseas consumer demand. The plan called for shipments to start at 110 MMcf/d from a single floating LNG refrigeration plant fed by the current regional utility pipeline, Pacific Northern Gas.

Shelving the coastal LNG terminal does not end a prominent AltaGas role in Canada’s drilling hot spot, the liquids-rich Montney shale formation straddling northern BC and Alberta, the company said.

AltaGas has Montney processing projects under way for daily output of up to 198 MMcf/d of gas and 40,000 bbl of liquids, alternative rail and marine shipping plans, and a producer partner in northern BC, plus other target markets in thermal oilsands plants that continue to grow in Alberta.

But the AltaGas activity was offset earlier this month when TransCanada Corp.’s western supply collection network, Nova Gas Transmission Ltd. suspended work on a C$1.9 billion (US$1.4 billion) BC addition.

TransCanada Corp. told the NEB the proposed North Merrick Mainline, for deliveries from BC’s dormant Horn River dry gas shale formation, would stop until shippers Chevron Canada and Australian conglomerate Woodside Energy International Ltd. set a schedule for their BC export terminal project, Kitimat LNG (also known as KM LNG). The Canadian proposal is going through “re-phasing” amid rising costs and falling prices for the companies’ jumbo Australian LNG projects, the NEB was told. As in the DC LNG case, no date was set for reviving the North Merrick pipeline proposal.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |