Marcellus | E&P | Haynesville Shale | NGI All News Access | Utica Shale

Chesapeake Makes Hay in $128M Royalties Sale to PE-Backed Operator

Private equity-backed Haymaker Resources LP has agreed to pay Chesapeake Energy Corp. $128 million for a bundle of mineral and royalty interests in 24 states and 324 counties.

The Haymaker Minerals & Royalties LLC unit, based in Houston, secured interests in more than 8,500 wells, some of which are producing. The acquisition includes properties that primarily are in the Midcontinent, Appalachia and Haynesville Shale.

“In the current market environment, operators are focusing on their core assets more than ever before,” Haymaker CEO Karl Brensike said. “I think everyone can agree that there is nothing more noncore to an operator than owning nonoperated royalty interests.”

Brensike said the transaction was complex, but he did not disclose what types of wells were being acquired. He said the deal involved “numerous business units formed over Chesapeake’s 30 years as a very active acquirer of premier oil and gas assets…”

Haymaker, co-founded in 2013 by Brensike, is funded by affiliates of Kayne Anderson Capital Advisors LP and Kohlberg Kravis Roberts & Co. LP. Since its inception, the company said it has completed more than 400 transactions and acquired stakes in 20,000-plus wells across the country.

Brensike began working in the mineral and royalties business in 2004 as a founding member of Cornerstone Acquisition & Management Co. LLC, where he helped to launch Caritas Royalty Funds. In 2009, he co-founded Remora Oil & Gas LLC, an upstream producer privately backed by ESS Funds. Brensike remains a non-active partner in the business, which concentrates its efforts in South Texas.

Chesapeake is scheduled to issue its quarterly results on Wednesday. The second largest natural gas operator in the country has been working to reduce its overhead and its portfolio, as well as restructure debt (see Shale Daily, Dec. 18, 2015). The workforce has been reduced and the dividends discarded (see Shale Daily, Nov. 4, 2015;Jan. 28).

Earlier this month it denied rumors that it would seek bankruptcy protection (see Shale Daily, Feb. 8). Chesapeake’s debt load is close to $9.8 billion, about six times its current valuation, and it has more than $1 billion in debt payments due through the end of 2017. Moody’s Investors Service followed actions by other credit ratings firms on Monday, reducing Chesapeake’s debt rating to “Caa2,” junk status, from “B2,” citing a potential lack of cash flow to repay obligations.

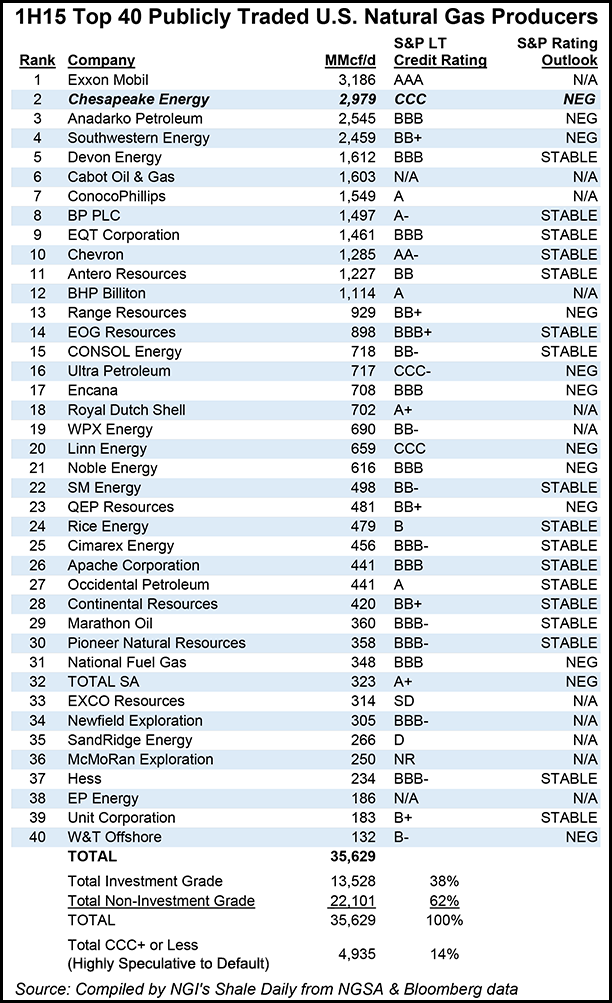

Chesapeake is hardly the only major U.S. natural gas producer to be facing financial difficulties in this commodity price environment. NGI’s Patrick Rau, director of strategy and research, estimates that more than 60% of the total U.S. natural gas production in the first half of 2015 from the top 40 publicly traded U.S producers came from operators that currently hold non-investment grade debt ratings.

“Fourteen percent of the total was the output of companies that presently carry highly speculative credit ratings or are in default, which we define a companies with a Standard & Poor’s long-term local currency credit issuer rating of ”CCC+’ or less,” Rau said. “This latter group includes Chesapeake (No. 2 overall), Ultra Petroleum (16), Linn Energy (20), Exco Resources (33), and SandRidge Energy (35).”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |