E&Ps, Oilfield Services Walking Tightrope, With M&A to Cushion Fall, Says Deloitte

Balance sheet stress is intensifying in the U.S. natural gas and oil sector, which means more takeovers and asset sales are likely by the end of this year, researchers said Thursday.

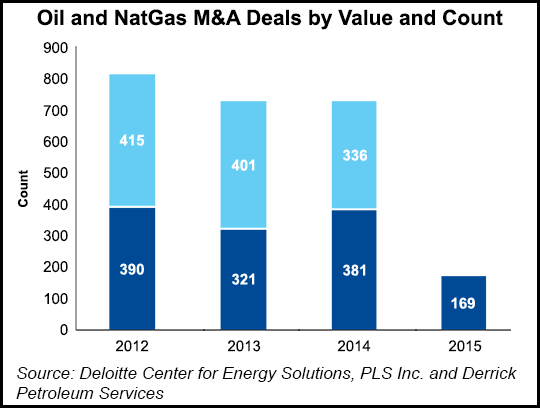

Merger and acquisition (M&A) activity overall has fallen dramatically since the start of the year versus prior periods, as operators adjusted to lower prices by prioritizing organic adjustments, the Deloitte Center for Energy Solutions said in a report on deal activity.

“Expectations that the downturn would be of relatively short duration encouraged companies to focus on internal, organic responses, such as cost-cutting, dropping rigs and renegotiating service contracts, delaying large new capital programs, deferring completions and reducing new drilling,” said Deloitte Vice Chairman John England, the firm’s U.S. oil and gas leader.

Many operators also have protected their cash flows into late 2015 through hedging programs, which has assisted in limiting impacts arising from the spring borrowing base redetermination season. That has meant the pressure was mitigated to raise cash for many operators. Sellers still have expected to receive premiums for their assets, while buyers have been less interested in the marginal properties. But — and it’s a big one — these mitigating factors are weakening as the fourth quarter approaches, with no price relief in sight.

“Forward hedges with prices well above 2015 levels, are rapidly rolling off and cannot be replaced with positions at equivalent oil prices,” according to Deloitte. “As a result, balance sheet stress is increasing, particularly for the more highly leveraged companies.” As well, fall borrowing redeterminations are about to begin, while asset/reserve impairments, continuing cash flow pressure and weakening balance sheets “will all contribute to a likely shift in focus to the M&A market to raise cash and protect longer-term viability.”

As valuation gaps appear to be shrinking, buyers that have retained cash and/or leverage may feel “justified” in pursuing assets to build portfolios.

The market hasn’t been completely bereft of deals since the start of the year, but they don’t compare with years’ past. Deloitte examined M&A activity since January based on data from PLS Inc. and Derrick Petroleum Services Global Mergers & Acquisitions Database as of July 12. The data represents M&A and swaps with deal values of more than $10 million, including transactions with no disclosure on reserves and/or production. Transactions with no announced value as well as transactions between affiliated companies were excluded.

“The data on the number and value of deals announced in the first eight months of this year show, somewhat surprisingly, a fairly modest level of new deal activity, particularly when the impact of one global-scale deal” is excluded, the European takeover by Royal Dutch Shell plc of BG Group plc, which recently passed European regulatory muster (see Daily GPI, Sept. 3).

“In fact, if the two major oilfield services deals — the combination of Halliburton/Baker Hughes and Schlumberger/Cameron — were also excluded, there would be a consistent downward trend in deal value since the second quarter of 2014, coincident with the decline in oil prices.” Halliburton’s merger with Baker could be completed by the end of this year (see Daily GPI, July 13). Schlumberger last month announced a friendly takeover of Cameron International Corp. (see Daily GPI, Aug. 26).

This trend actually is counter-intuitive to some extent, “particularly if we recall that the great consolidation of the major oil companies with a series of mega-mergers occurred at a time of low oil prices in which the search for scale and efficiency were seen as critical for long-term survival,” Deloitte said.

According to researchers, the psychology of the market had many anticipating that the price downturn would be short-lived, so activity/cost adjustments were seen as sufficient to ride out the storm. In the next six months or so, more pressure is expected, particularly by cash-poor exploration and production companies, to execute asset sales or corporate consolidations.

The industry is walking a tightrope, precariously balanced by cutting costs and drilling in areas with the best prospects for immediate returns, Deloitte said. “The longer the price downturn lasts, and, perhaps more importantly, the longer market participants think it will last, the more pressure builds from lenders for highly leveraged operators to shore up balance sheets with asset sales.”

M&A activity is forecast to increase late this year and into early 2016.

“Historically, transaction data in recent years has shown that the fourth quarter has often been the strongest period of the year for M&A transactions. The convergence of factors…indicates that this historical pattern will be repeated this year, and perhaps even to a greater extent than in previous years.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |