NGI Archives | NGI All News Access | NGI The Weekly Gas Market Report

North America Onshore Downturn More Severe than Anticipated, Says FMC Chief

FMC Technologies Inc., one of the biggest vendors to North America’s oilfield service (OFS) operators, experienced significant declines in North America land operations during the second quarter and now expects no relief before 2016.

The Houston-based operator’s quarterly revenues fell 15% year/year to $1.7 billion, primarily because of the “continued decline in the North American land market and its severe impact on our Surface Technologies segment revenue,” CEO John Gremp said during a conference call.

FMC, better known by some for its Subsea Technologies segment, is a big operator on North American land as well, offering integrated solutions within its surface wellhead unit, which supplies drilling, completion and production systems. It also is a big supplier of fluid systems for hydraulic fracturing and pad drilling.

Surface Technologies revenues decreased 18% sequentially in the second quarter, impacted by the reduced spending by OFS operators that serve exploration and production (E&P) companies.

“Our customers are the pressure pumpers,” Gremp told analysts. “We’re just one step back in the supply chain. Our customers aren’t the E&Ps. Our customers are the pressure pumpers. We’re encouraged that the pressure pumpers are coming out saying that they’ve seen the bottom,” he said, referring to the tepid outlooks issued over the last few days by Schlumberger Ltd., Halliburton Co. and Baker Hughes Inc. (see Shale Daily, July 21; July 20; July 17). None of them indicated that the uptick had begun, but they said it may begin by the end of the year.

“That’s good news,” said Gremp. “But we can’t say that because our biggest customer is them, and between their reaction to the rig count and their orders with us, are things like inventory levels, their restocking plans and the degree to which they’ve cannibalized assets that are underutilized. We don’t have that kind of visibility so we wouldn’t necessarily want to call the bottom right away until we see the pressure pumpers stabilize and increase their activities through fluid control.”

However, “it’s got to happen,” he said. “Eventually, they run out of inventory, and eventually they have to restock. They can’t cannibalize forever. And we’ll start to see that uptick.”

For the balance of this year, Surface Technologies business activity is expected to be relatively flat.

“We’re a little unsure of fluid control so we don’t want to call it yet. But then we see the recovery starting in 2016 from the restocking…by the pressure pumpers and our most significant business, surface wellhead.”

The Surface Technologies business decline in the second quarter “was across the board,” Gremp said. “When we gave our estimate of what the impact of the downturn would be in Surface, we were reflecting on past downturns. That’s all we had to go on. This downturn is different. The pressure on pricing and what we have had to accept across the board for surface, fluid, control, completions, hub services, has been much more severe than we saw than in the past…

“It’s the severity, and the steepness, and the speed at which this downturn occurred that drove much more aggressive pricing pressure. That’s what made this cycle different from the past and why our 2Q2015 numbers were disappointing from what we thought they would be.

“We’re taking action. We didn’t anticipate this cycle to be different. Now that it is, we’re going through another round of restructuring.” North American land “will remain challenged going into 2016,” the CEO said. To that end, the company is consolidating its business units within the U.S. and Canadian segments to create a more integrated business model, “with greater capability and a lower cost structure.”

Surface Technologies profit in 2Q2015 was $28 million with margin of 7.5%, noted CFO Maryann T. Seaman. The quarter’s results included restructuring costs tied to layoffs. In February the global operator, which employed about 19,000 at the start of the year, said it would fire about 2,000 people in the United States (see Shale Daily, Feb. 11). Layoffs continued through the second quarter and are likely into the rest of the year, Seaman told analysts.

“We have now largely completed the planned headcount reductions associated with the lower activity levels,” she said, but “we do not expect to see much recovery before next year. Therefore, our overall U.S. activity is likely to be lower in the second half of the year when compared with the first half,” resulting in “further headcount reductions.”

Subsea Technologies are pulling FMC through, the management team noted. Although jobs in the Gulf of Mexico are smaller, with many of the new projects tying into platforms already constructed, there’s a lot of work, Seaman said.

“We remain confident in our ability to deliver full-year subsea margins of around 15%,” she said. “Deepwater assets continue to be a significant part of many operators’ portfolios. As project reevaluations move forward, new approaches are beginning to emerge that improve overall project economics. These are placing a greater reliance on vendor-based solutions and integrated field design and development. We expect this will help the positive order momentum that began in the second quarter continue in the second half of 2015 and into next year.”

Surface Technologies second quarter revenue was $363.3 million, down 29% year/year. Operating profit decreased by two-thirds from a year ago to $27.5 million on the North American activity declines, less favorable pricing and $2.8 million of business restructuring costs. Inbound orders plunged almost 40% to $306.2 million. Backlog currently stands at $466.6 million.

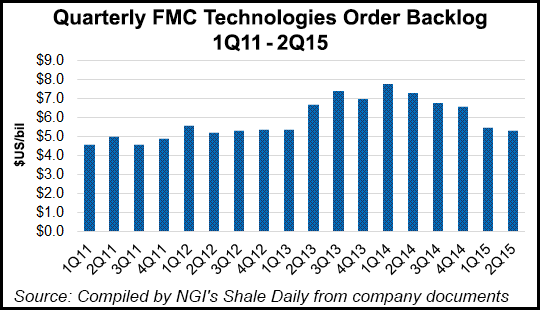

Total inbound orders in the quarter were $1.4 billion, including $1.0 billion in Subsea Technologies orders. Backlog was $5.3 billion, including Subsea backlog of $4.7 billion.

Subsea Technologies revenue in 2Q2015 fell 7% year/year to $1.2 billion. Operating profit was down 5% primarily on the decline in revenue and $5.4 million in business restructuring costs. Energy Infrastructure revenues fell by one-third from a year earlier to $101.4 million, with operating profits slumping 71%.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |