Markets | NGI All News Access | NGI Data

Little Response Seen to On-Target EIA Storage Report

Natural gas futures were down slightly after the release of government storage figures showing inventory drawdowns to be in line with trader expectations.

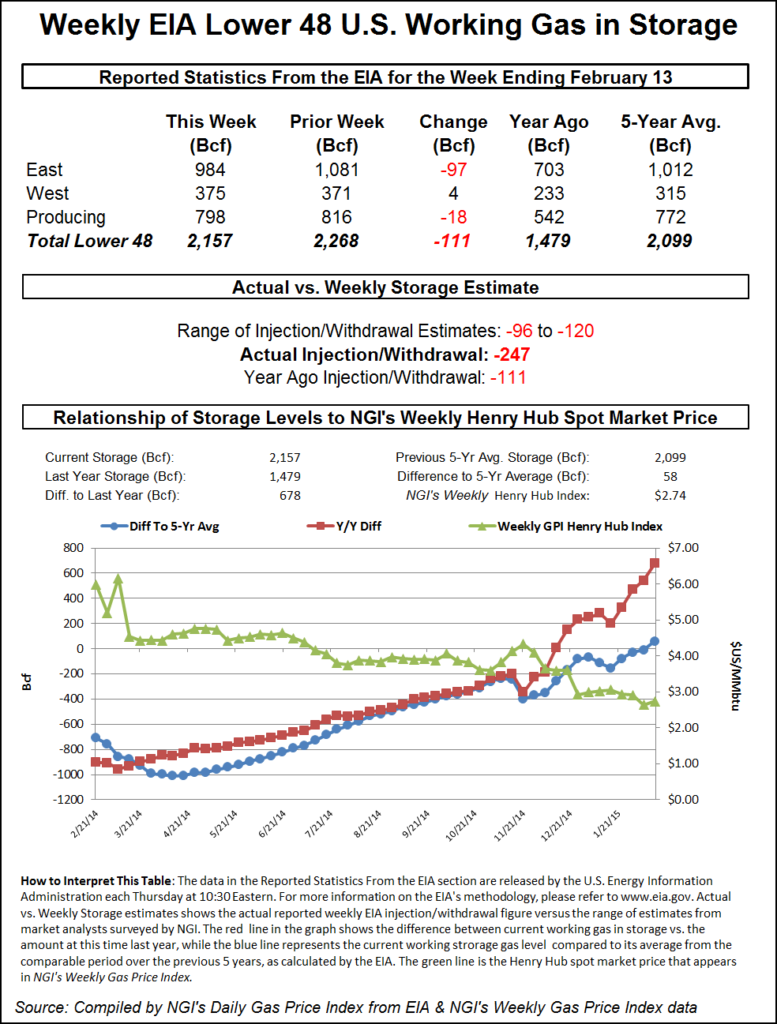

For the week ended Feb. 13, the Energy Information Administration (EIA) reported a decrease of 111 Bcf in its 10:30 a.m. EST release. March futures fell to a low of $2.786 after the number was released and by 10:45 a.m. March was trading at $2.810, down 2.1 cents from Wednesday’s settlement.

Prior to the release of the data, analysts were looking for a decrease encompassing a wide range. Citi Futures Perspective calculated a 96 Bcf withdrawal, but analysts at ICAP Energy were looking for a 113 Bcf pull. Bentek Energy’s flow model predicted a 109 Bcf withdrawal.

“This report was pretty much a yawner,” said a New York floor trader. “We were hearing 110 Bcf, and it came in at 111 Bcf. I think everyone is looking ahead to next week and what impact all this cold is having on demand.”

Tim Evans of Citi Futures Perspective said, “The draw was bearish relative to the five-year average benchmark but in line with the consensus expectation. We think this will allow the market to pivot quickly toward a focus on current and forecast cold, and the larger storage withdrawals that will result over the next two reports.”

Evans’ calculations show a withdrawal next week of 240 Bcf.

Inventories now stand at 2,157 Bcf and are 678 Bcf greater than last year and 58 Bcf above the five-year average. In the East Region, 97 Bcf was withdrawn, and the West Region saw inventories increase by 4 Bcf. Stocks in the Producing Region declined by 18 Bcf.

The Producing Region salt cavern storage figure fell by 9 Bcf from the previous week to 222 Bcf, while the non-salt cavern figure dropped 9 Bcf also to 576 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |