Marcellus | E&P | NGI All News Access | Utica Shale

After Historic Production, West Virginia Waiting For Curve to Flatten

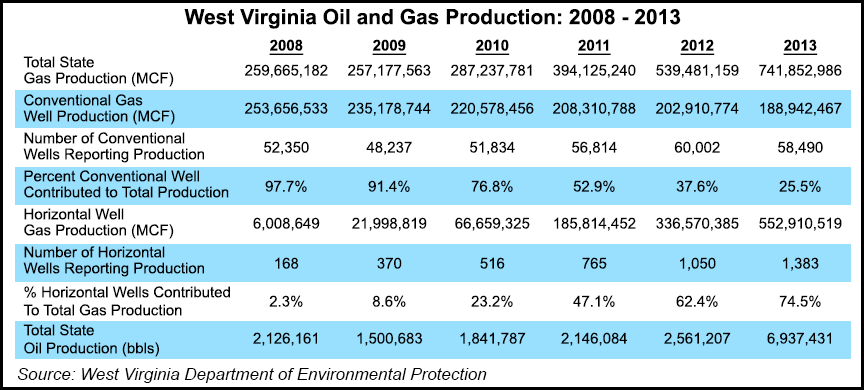

Oil and natural gas production increased markedly in West Virginia between 2012 and 2013, the latest year for which data is available, with shale drillers not surprisingly accounting for an overwhelming majority of the gains, according to data compiled by state regulators.

But while overall natural gas production in the state increased by about 38% year over year, and even as industry representatives expect a similar jump when 2014 totals are released later this year, production is soon expected to flatten or drop-off with the downturn in commodity prices (see Shale Daily, Feb. 6).

Combined conventional and unconventional natural gas production in West Virginia went from roughly 539.5 Bcf in 2012 to 741.9 Bcf in 2013. Unconventional natural gas accounted for nearly 75% of all volumes in 2013, with shale drillers reporting about 552.9 Bcf of production, up from 336.6 Bcf the year before.

“I believe you’ll continue to see an increase for 2014, but unfortunately in early 2015 you might see a decline, simply because the price of gas has declined,” said West Virginia Oil and Natural Gas Association Executive Director Corky DeMarco. “Operators won’t be running as many rigs. It won’t be a huge drop, and once prices begin to elevate again, I think you’ll see us back drilling with the same tenacity we’ve had — if not greater.”

Oil and gas production data is reported annually each March to the West Virginia Department of Environmental Protection (WVDEP). Although it’s available publicly, WVDEP provides the data in a dizzying spreadsheet that lists production from both conventional and unconventional wells in more than 58,000 columns. The WVDEP Office of Oil and Gas provided a synthesized version at the request of NGI’s Shale Daily.

“Because of an abundance of information and the time required to process that information, more frequent reporting is not possible at this time,” said agency spokeswoman Kelley Gillenwater, when asked if the agency or state legislators had considered providing data on a monthly or quarterly basis.

Ohio began providing quarterly production reports in 2014, while Pennsylvania is expected to switch to monthly reporting sometime this year (seeShale Daily, Dec. 2, 2013). In any event, the state’s data shows that West Virginia is the second-largest oil and gas producer in the Appalachian Basin.

In 2013, the Marcellus juggernaut in Pennsylvania produced 3.3 Tcf, up from 2.04 Tcf in 2012 (seeShale Daily, Feb. 20, 2014). In Ohio, shale producers helped push overall natural gas production from 86 Bcf in 2012 to 171 Bcf in 2013 (see Shale Daily, July 2, 2014). Overall, oil production in Pennsylvania has been marginal, while in Ohio it went from 5 million bbl in 2012 to 8 million bbl in 2013.

Combined conventional and unconventional oil production in West Virginia spiked sharply during those years, going from about 2.6 million bbl to 6.9 million bbl. WVDEP Environmental Resource Analyst John Kearney, however, noted that natural gas liquids (NGL) totals are included in the state’s crude oil reports.

DeMarco said that although NGLs have tumbled along with the fall in oil prices, he still expects operators to continue producing liquids at a healthy rate in the western part of the state where the Marcellus is shallower than in the east, where he expects more dry gas production to occur this year.

“You could get a shift, sort of like when oil went way up and liquids and wetter areas of the Marcellus were more important,” said Doug Patchen, director of West Virginia University’s Appalachian Oil and Natural Gas Research Consortium. “Now, as oil prices fall, you might expect that perhaps a similar shift back east would occur with more interest in dry gas. I would imagine there’s a possibility that gas production just stays flat. Of course, a lot of wells came online in 2014 and are still shut in. There’s still a big push to get infrastructure built in West Virginia.”

Between 2008 and 2013, gas production has continued to climb in the state, with the exception of 2009 when it dropped slightly during a similar plunge in commodity prices. From 2008-2010, production hovered around 260 Bcf annually, before spiking to nearly 400 Bcf in 2011. It has only climbed higher since then.

While the year-over-year rig count in Ohio and Pennsylvania was flat last week at 39 and 54, respectively, rigs in West Virginia were down to 19 from 29 over the same period, according to Baker Hughes Inc.

DeMarco said operators still have significant long-term potential in West Virginia that will push annual natural gas production well beyond 2013’s historic levels. In addition to the Marcellus, Utica and Upper Devonian shales, some operators from Kentucky to West Virginia have been busy scooping up deep mineral rights for the Rogersville Shale — part of a deep, narrow subbasin called the Rome Trough — which contains other source rocks extending northeastward into Pennsylvania and southern New York.

Along with the Trenton-Black River, those formations run anywhere from 10,000 to 30,000 feet below ground in the state. It’s only a matter of time, DeMarco said, before operators eventually have the technology to tap and produce them with modern completions.

“Everybody’s [capital expenditures] are down — they’re reducing — but that’s temporary. Once the market rebounds, I believe we’ll continue to see companies looking at further development in the Appalachian Basin,” he said. “I think attitudes are fine. People are reducing their land acquisition folks or contractors they use for those sorts of things, but there haven’t been a lot of layoffs in operations here. We’ve also still got a lot of infrastructure to build out.

“This downturn gives us the opportunity to focus on other parts of this industry that are pivotal to its future here.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |