Eagle Ford Shale | Haynesville Shale | NGI All News Access | Permian Basin

BHP Cuts U.S. Drilling Program, to Focus on Liquids

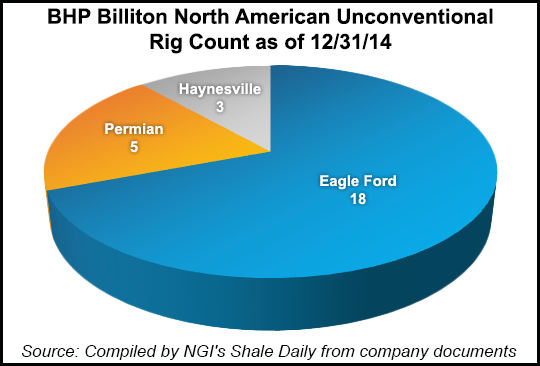

In response to weak commodity prices Australia’s BHP Billiton Ltd. is dialing back operations in U.S. shale plays, with plans to cut its operated rig count to 16 from 26 by the end of June, a nearly 40% reduction.

Most of the revised drilling program would target the company’s liquids-rich Black Hawk acreage in the Eagle Ford Shale. In BHP’s Hawkville portion of the Eagle Ford and in the Permian Basin, activity would be limited to that needed to hold acreage, the company said Wednesday.

“The revised drilling program will benefit from significant improvements in drilling and completions efficiency,” said CEO Andrew Mackenzie. “Our ongoing shale investment program will remain focused on our liquids-rich Black Hawk acreage. However, we will keep this activity under review and make further changes if we believe deferring development will create more value than near-term production.”

The company’s dry gas development program would be cut to one operated rig in the Haynesville Shale, with a focus on continued drilling and completions optimization ahead of full field development, BHP said.

The cuts are not expected to impact 2015 financial year production guidance, “and we remain confident that shale liquids volumes will rise by approximately 50% in the period,” BHP said.

Onshore U.S. drilling and development expenditures totaled US$1.9 billion in the December 2014 half year versus $2.1 billion for the year-ago period. An update to the drilling and development budget for the 2015 financial year is to be provided with the release of interim results next month, BHP said.

“Our operational performance over the last six months has been strong. We are reducing costs and improving both operating and capital productivity across the group faster than originally planned,” Mackenzie said. “These improvements will help mitigate some of the impact of lower commodity prices, and we remain alert to opportunities to further increase free cash flow.”

Last fall, BHP said it would sell its assets in the Fayetteville Shale, adding that it would be focusing on liquids production (see Shale Daily, Oct. 27, 2014). “As announced in October 2014, we are actively marketing our Fayetteville acreage and will only pursue a divestment if full value can be realized, consistent with our long-term outlook for gas prices,” the company said Wednesday.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |