Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

Massachusetts Power Generators Will Need More NatGas Pipes, Study Finds

More pipelines are needed to deliver natural gas to power generators in Massachusetts if the state is to meet its energy requirements through 2030, according to a report conducted by Synapse Energy Economics.

An analysis of eight different scenarios indicated that through 2019 “electric generators have insufficient supply of natural gas, which results in spiking natural gas prices,” according to the report, which was released Thursday by outgoing Gov. Deval Patrick (D).

“Scarcity-driven high natural gas prices will force economic curtailment of natural gas-fired generators in favor of oil-fired units. The combination of increased oil utilization for electricity generation together with the use of emergency measures such as demand response and the ISO-NE [Independent System Operator of New England] Winter Reliability program (through January 2018) will allow electric demand to be met. From 2020 to 2030, existing and planned capacity plus incremental pipeline capacity balances system requirements.”

Known measures — demand response or the addition of new natural gas pipelines — would allow winter peak hour gas shortages to be met between 2020 and 2030, but there is a five-year gap in the short term that will be more problematic, according to the analysis.

“Critical to this result is the assumption that winter peak hour gas shortages cannot be addressed using known measures…in years 2015 through 2019 and, as a result, gas prices are expected to reflect an out-of-balance market in those years. The electric sector responds to these high prices by shifting dispatch from gas to oil generation in the peak hour, reducing reliance on natural gas.”

The amount of pipeline additions required for the state to meet its looming energy requirements varied between scenarios, the analysts said, from lows of 600 MMcf/d in both 2020 and 2030, to highs of 800 MMcf/d in 2020 and 900 MMcf/d in 2030. The lower numbers were achieved in scenarios that included 2,400 MW of incremental Canadian transmission.

The scope of the study was restricted to expected Massachusetts natural gas demand and capacity only. “We did not examine gas constraints in the wider region, nor did we examine the effect of expected gas demand or capacity constraints outside of the Commonwealth,” the analysts said.

“This report underscores the urgent need for more natural gas infrastructure capacity, not only in Massachusetts, but throughout New England,” said Dena Wiggins, CEO of the Natural Gas Supply Association. “Massachusetts is to be commended for taking on this initiative to assess the need for infrastructure.

“Under the study’s every scenario, even those based on a low demand for natural gas, the report revealed that more pipeline capacity is critically needed in order to supply the natural gas required to meet the state’s peak winter demand for energy after 2020. In fact, the need for new capacity would have been even greater had the report looked at the requirements to serve the whole region.”

The report, issued on Patrick’s final day in office (Republican Charlie Baker was sworn in as the state’s 72nd governor later the same day), came nearly a year after the governors of six New England states called on grid operator ISO-NE to provide technical support and assistance with necessary tariff filings for new electric and natural gas infrastructure in the region (see Daily GPI, Jan. 23, 2014). The governors have vowed cooperation to improve New England’s energy infrastructure (see Daily GPI, Dec. 6, 2013).

But the states don’t always see eye-to-eye on pipeline projects. In September, Massachusetts questioned the need for Tennessee Gas Pipeline LLC’s offer of a 20-year capacity deal to Maine on its proposed Northeast Energy Direct expansion (see Daily GPI, Sept. 18, 2014).

Pipelines are being built to carry natural gas away from the Marcellus and Utica shale producing areas, but not enough of them are designed to serve New England, a growing concern for a region increasingly reliant on natural gas, according to ISO-NE (see Daily GPI, Sept. 9, 2014). The grid operator “has immediate and growing concerns about the availability and flexibility of generating resources — particularly natural gas and oil-fired resources — to reliably serve the daily, round-the-clock demands of electricity consumers in New England,” according to a draft of the ISO’s annual Regional System Plan.

New England turned to natural gas to fuel 42.8% of its capacity and 45.1% of its electric energy production in 2013, with oil (22.3% capacity, 0.9% electric energy), coal (7.2% capacity, 5.6% electric energy), nuclear (14.6% capacity, 33.2% electric energy) and a mix of hydro, pumped storage and renewable resources (13.1% capacity, 15.3% electric energy) all much smaller pieces of the fuel mix pie. Gas has risen to dominance in the region’s power generation sector as a result of the addition of new, efficient gas-fired units over the past 13 years, the displacement of less efficient oil-and gas fired units, and the relatively low price of gas. And the use of natural gas is expected to grow, reaching about 48% of New England’s system capacity mix as early as 2017, according to ISO-NE.

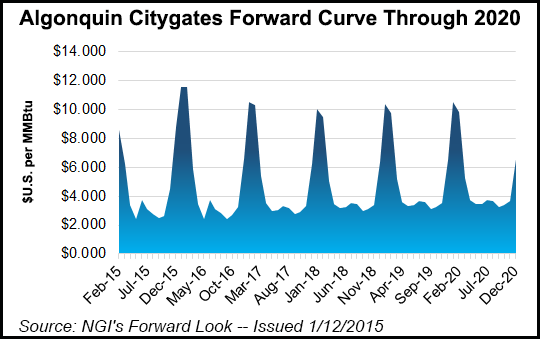

Forward markets at the Algonquin Citygates hub serving Boston seem to confirm the expectation that winter shortages will continue for a while. The markets currently expect prices to spike as high as $11.557 in January of 2016, and for the trend of high winter gas prices to continue at least five years out the curve.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |