E&P | NGI All News Access | NGI The Weekly Gas Market Report

EIA Firms Winter NatGas Price Forecast to $3.98/MMBtu

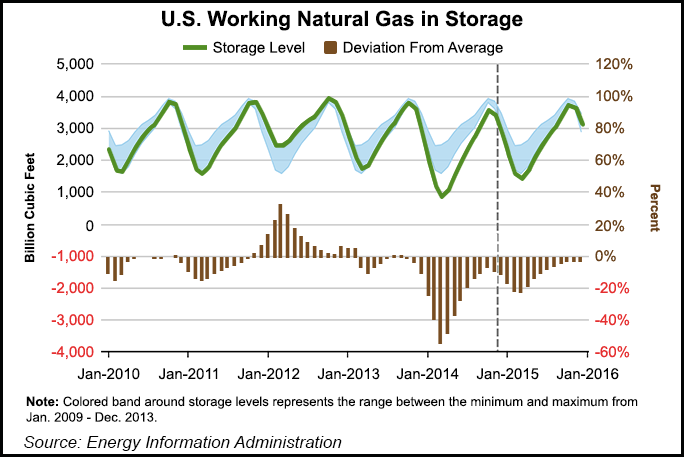

Unseasonably cold weather east of the Rockies in November prompted record high withdrawals of natural gas from natural gas storage, which in turn will keep end-of-March 2015 inventories lower than previously expected, but gas prices this winter will average just $3.98/MMBtu, according to the Energy Information Administration (EIA).

The 162 Bcf storage withdrawal for the week ending Nov. 21 tied a record set last year for the largest November withdrawal. Inventories on Nov. 28 totaled 3,410 Bcf, 227 lower than the same time last year (see Daily GPI, Dec. 24; Nov. 26). As a result, EIA in its latest Short-Term Energy Outlook (STEO) revised downward its March 2015 storage projection to 1,431 Bcf. That’s down 131 Bcf (8.4%) compared with the previous STEO (see Daily GPI, Nov. 12).

EIA’s $3.98/MMBtu price forecast for winter 2014-2015 is up just a penny from the previous STEO. EIA expects spot prices to remain above $4.00/MMBtu through January before declining slightly for the remainder of the winter.

“Natural gas inventories are expected to be lower than previously expected at the end of the heating season next March because of the large withdrawal of gas from storage during November due to colder-than-normal weather in most of the country,” said EIA Administrator Adam Sieminski. “However, natural gas expenditures are still expected to be lower than last winter.”

The Henry Hub spot price averaged $4.12/MMBtu in November, a decline of 34 cents from October. The agency projects Henry Hub prices to average $4.44/MMBtu in 2014 and $3.83/MMBtu in 2015.

Gas futures prices for March 2015 delivery (for the five-day period ending Dec. 5) averaged $3.84/MMBtu. Current options and futures prices imply that market participants place the lower and upper bounds for the 95% confidence interval for March 2015 contracts at $2.40/MMBtu and $6.13/MMBtu, respectively.

At this time last year, the natural gas futures contract for March 2014 averaged $3.98/MMBtu and the corresponding lower and upper limits of the 95% confidence interval were $3.01/MMBtu and $5.26/MMBtu, EIA said.

EIA said it expects natural gas marketed production to grow by an annual rate of 5.5% in 2014 and 3.1% in 2015, with continued strong increases in the Lower 48 states offsetting declines in the Gulf of Mexico. Dry natural gas production was 4.6 Bcf/d greater in September 2014 than in September 2013, according to EIA.

“Production usually declines in September due to seasonal maintenance; however, production this year increased slightly from August to September,” EIA said.

Growing domestic production is expected to continue to put downward pressure on natural gas imports from Canada and spur exports to Mexico. Exports to Mexico, particularly from the Eagle Ford Shale in South Texas, are expected to increase because of growing demand from Mexico’s electric power sector and flat Mexican production.

EIA expects total natural gas consumption to average 73.9 Bcf/d in 2014, an increase of 3.2% from 2013. In 2015, total projected gas consumption is expected to decline as lower residential and commercial consumption offset increase in the power generation and industrial sectors. “Natural gas consumption in the power sector is expected to average 22.1 Bcf/d in 2014, a 0.8% decline compared to last year, reflecting higher natural gas prices this year,” EIA said. The agency expects natural gas consumption in the power sector to increase to 22.7 Bcf/d in 2015.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |