Marcellus | E&P | NGI All News Access

Southwestern Grabs More Marcellus Acreage in Deal with WPX

Southwestern Energy Co. is gobbling up more acreage in the Marcellus Shale in a $300 million agreement with WPX Energy Inc., which has been attempting to distance itself from the play.

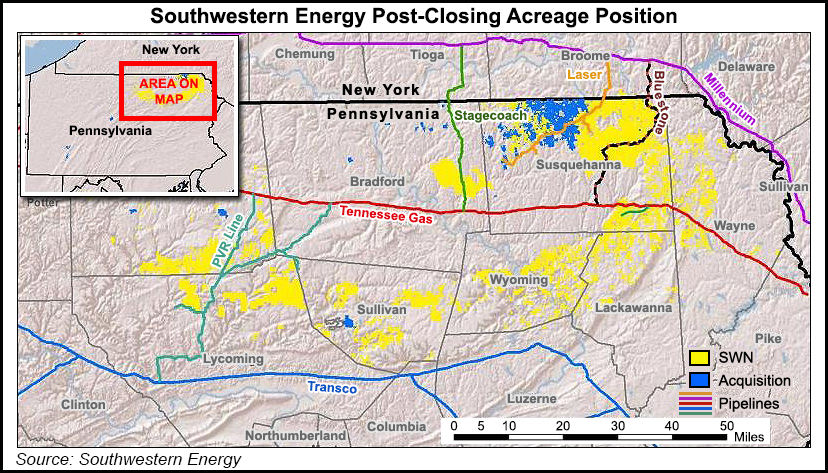

WPX agreed to sell 46,700 net acres in northeastern Pennsylvania that currently produce 50 MMcf/d net from 63 operated horizontal wells. As part of the transaction, Southwestern would assume firm transportation capacity of 260 MMcf/d, predominantly on the Millennium Pipeline, effective when the deal is completed.

“We are very excited about the addition of this asset and firm transportation capacity to our portfolio,” Southwestern CEO Steve Mueller said. “This acreage position complements our existing Marcellus acreage in northern Susquehanna County where we have recently seen very good results from two of our wells, the Hughes North 1H and the Dayton 4H.

“The Hughes North 1H has completed the entire lateral length of 4,981 feet and had a maximum 24-hour rate of 4.7 MMcf/d. The Dayton 4H has a total lateral length of 5,278 feet and tested a maximum 24-hour rate of 4.5 MMcf/d from the first 30% that is completed to date.”

Southwestern’s Marcellus gas production was 66 Bcf in 3Q2014, 47% higher year/year (see Shale Daily, Oct. 24). Eighteen wells ramped up in the three-month period, with gross operated output of 840 MMcf/d. Last month DTE Energy Co. agreed to expand ts in-field gas gathering system in Susquehanna County by half under an agreement with Southwestern (see Shale Daily, Nov. 19). The producer’s transportation capacity on the Bluestone Pipeline also is to increase.

With the additional capacity from WPX, Southwestern would have 1.3 Bcf/d, and it expects to have 1.4 Bcf/d by the end of 2016, Mueller said.

“The immediate availability of this firm transportation provides the pathway for ongoing growth in production over the next three years and the added acreage solidifies future value through a growing well inventory.”

The transaction now is set to close by the end of March, but it is conditioned on receiving a waiver from the Federal Energy Regulatory Commission regarding the firm transportation capacity transfer.

Southwestern intends to use its revolving credit facility to finance the acquisition, which comes less than two months after a $5.38 billion deal with Chesapeake Energy Corp. to buy 413,000 net acres and 1,500 wells spread across southern Pennsylvania and northern West Virginia (see Shale Daily, Oct. 16). As part of the transaction, Southwestern also assumed part of Chesapeake’s firm transportation and processing capacity commitments.

Southwestern in 2013 also paid Chesapeake $93 million for a string of leaseholds in Pennsylvania that together equaled about 162,000 net acres (see Shale Daily, April 30, 2013). That transaction almost doubled Southwestern’s leasehold to more than 337,000 net acres.

Tulsa-based WPX has been attempting to extricate itself from Appalachia. In October, the independent announced it would keep the drillbit going in only three states — North Dakota, New Mexico and Colorado — with the balance of the portfolio, including Appalachia, on the sales block (see Shale Daily, Oct. 9).

“The transformation of our company continues as we execute our strategy,” WPX CEO Rick Muncrief said of the Southwestern sale. “We’re heading into 2015 reshaped, refocused and ready to grow margins, develop our highest returning assets and build the long-term value of the company.”

WPX’s first transaction involving its Marcellus operations marks the company’s sixth significant agreement it has entered into since May to narrow its business focus, increase scalability of core assets, bring value forward and further strengthen its balance sheet. Once the firm capacity transfer is completed, WPX would be released from about $24 million/year in annual demand obligations.

The sales price was disappointing, according to Tudor, Pickering, Holt & Co. (TPH). Analysts backed out production, assuming $4.00/Mcf flowing, which implies $100 million for $47,000 net acres at $1,000-2,000/acre, and the firm transportation contracts.

“We were modeling $5,500/acre based on our 7 Bcfe type curve,” analysts said. The transportation contracts “likely lost value over the years as regional basis has widened at every hub, making Millennium capacity less valuable.”

For Southwestern, the transaction is a positive “but financing remains a key overhang.” The operator is getting “good acreage,” and “can either grow its northeastern Pennsylvania volumes in 2015-16 versus prior flattish case or make margin off of the capacity,” TPH analysts noted. However, the stock “will remain in limbo” until there’s more clarity on the Chesapeake closing. Chesapeake’s partner Statoil ASA didn’t exercise its preferential rights on the acreage being sold “but has yet to provide consent.” The “walk away” date for the Southwestern deal with Chesapeake is March 15.

WPX’s remaining operations in the Marcellus primarily consist of physical operations in Westmoreland County in southwestern Pennsylvania and additional firm transport capacity on the Transcontinental Gas Pipe Line Corp., or Transco, Northeast Supply Link, owned by WPX’s former parent Williams. Those assets also are targeted for sale.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |