Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

Prairie State Pipeline Would Give Chicago, Midwest Multi-Basin Access

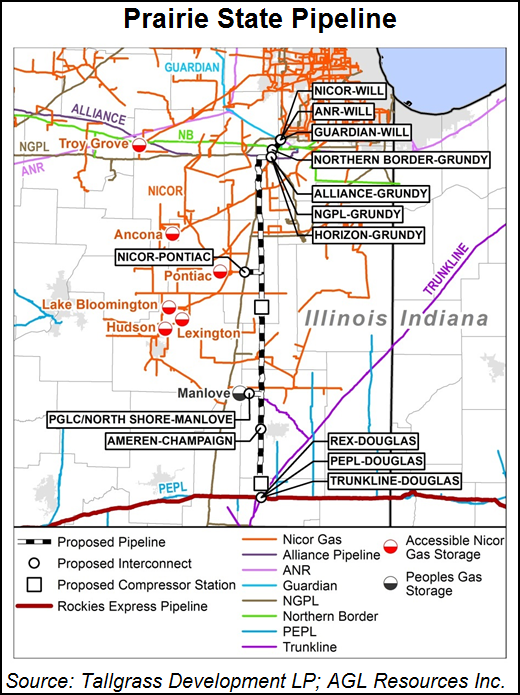

Tallgrass Development LP and AGL Resources Inc. are proposing the 140-mile, 1.2-1.5 Bcf/d Prairie State Pipeline to connect the Illinois and Midwest markets with natural gas from the Rockies, Midcontinent, Gulf Coast as well as growing Appalachian Basin shale plays.

The partners said they’ve received an expression of interest for 400 MMcf/d of the planned capacity and are holding a nonbinding open season. The pipeline could be in service Nov. 1, 2017.

The project would connect interstate pipelines in Douglas County, IL, to gas distribution systems, storage fields and interstate pipelines in the Chicago Market Center, a trading hub served by multiple interstate pipelines that access gas from Canada, the Midcontinent and the Gulf of Mexico for redelivery to local demand centers and to downstream markets in Wisconsin, Indiana and Michigan. Prairie State Pipeline said it would provide “unique access” to more than 4 Bcf/d of delivery points.

Downstream interconnection points could include citygate and storage interconnects with Nicor Gas, The Peoples Gas Light and Coke Co., Ameren, North Shore Gas Co. and possible interstate pipeline interconnects with ANR Pipeline, Guardian Pipeline, Northern Border Pipeline, Horizon Pipeline, Alliance Pipeline and Natural Gas Pipeline Company of America (NGPL).

Average daily demand for the points along the pipeline is estimated to exceed 3.5 Bcf/d, with peak day winter demand at up to triple that level, according to the companies. Atlanta-based AGL Resources serves about 2.2 million utility customers in Illinois via its Nicor Gas Co., the largest gas distributor in the state. Illinois consumes nearly 1 Tcf of gas per year and ranks second in the United States for number of industrial gas consumers, according to Tallgrass Energy and AGL Resources.

There is 303 Bcf of working gas storage capacity in the project area, with a maximum daily deliverability of 6.3 Bcf, according to the companies. Prairie State Pipeline would access about 200 Bcf of utility storage, of which 150 Bcf of underground storage is operated by Nicor Gas. In addition to direct-access utility storage, capacity would be accessible through interstate pipeline connections with NGPL and ANR.

On the upstream end of the project, Prairie State could interconnect with Tallgrass-operated Rockies Express Pipeline, Trunkline Gas Co. and Panhandle Eastern Pipe Line.

“By providing the Chicago market a single source for Appalachian, Rockies, Midcontinent, and Gulf Coast production, the Prairie State Pipeline will ensure that Chicagoans have access to a greater supply of gas at highly competitive prices,” the companies said. “The supply zones directly connected to Rockies Express alone produce a combined 23 Bcf/d today, and are expected to grow materially going forward. Particularly, the Appalachian production basin is experiencing spectacular growth — currently producing 15 Bcf/d, up from 4 Bcf/d in 2011, and expected to increase to 20 Bcf/d by 2018.”

Prairie State Pipeline anticipates applicable reservation rates for transportation along the full length of the project may be between $0.26 Dth/d and $0.29 Dth/d. Prairie State Pipeline currently estimates a fuel percentage of 0.85% based on current design assumptions. Rates are subject to change.

AGL Resources has a stake in a few recently announced pipeline projects. PennEast Pipeline would be a 100-mile pipeline from the Marcellus Shale to delivery points in Pennsylvania and New Jersey (see Daily GPI, Aug. 12). AGL Resources has invested in the Dalton Lateral portion of Williams’ expansion of its Transco system in order to deliver Marcellus and Utica shale gas to Georgia markets (see Shale Daily, April 21). And along with Dominion, Duke Energy and Piedmont, AGL Resources is participating in the Atlantic Coast Pipeline to connect Marcellus gas with markets in Virginia and North Carolina (see Daily GPI, Sept. 2).

For information on the Prairie State open season, visit www.tallgrassenergylp.com/pipelines/prairiestate.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |