Markets | NGI All News Access | NGI The Weekly Gas Market Report

Consensus for Static, Lower U.S. NatGas Prices Through 2015

It’s turned into a general consensus among the leading energy prognosticators: natural gas prices aren’t headed upward for a sustained period anytime soon.

Since the start of this month it’s been like a line of dominoes as one analyst after another has dropped forecasts for the remaining months of 2014 and through the coming year. Given all of the unexpected issues — cooler summer temperatures and a flood of onshore production — there was no way for gas prices to strengthen, said Barclays Capital’s Christopher Louney and Michael Cohen.

In a note on Friday, the Barclays analysts admitted that the market isn’t as anxious as it used to be about the gas storage situation.

“Overall, the lull in prices thus far this summer leads us to mark to market our 3Q2014 and 4Q2014 price forecasts down to $3.93 and $3.95/MMBtu, respectively, bringing our 2014 average price forecast down to $4.30/MMBtu,” the duo wrote.

Because of “shifting demand sources and continued production growth” and to balance storage in 2015 to a “more normal 3.8-3.9 Tcf level, we now believe prices will average $4.01/MMBtu in 2015, versus $4.24/MMBtu previously.”

Over the injection season, storage caught up more quickly than the Barclays analysts had expected. Storage should be around 3.5 Tcf at the end of October. At this level, combined with an “added cushion” of continuing output and an assumed normal winter forecast, it should get the country through the season “and means that storage should be able to rebuild” to more normal levels in 2015.

Last week analysts with Tudor, Pickering, Holt & Co. (TPH) said they are thinking it’s about time to move in with the bears as well. They noted that they’d stuck with their 2015 gas price forecast of $3.75/Mcf until this month “despite the polar vortex induced euphoria.”

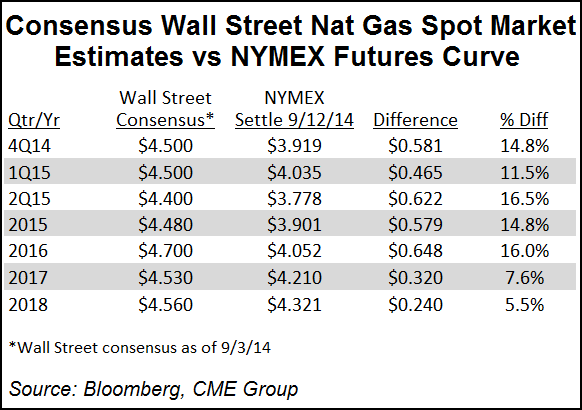

However, over the past couple of months, “market sentiment has turned 180 degrees from an extremely bullish to decidedly bearish stance. While the Street consensus is still $4.50/Mcf, recent sell-side updates are dropping forecasts into the high $3.00/Mcf range (similar to our $3.75).”

That’s “all good except we’ve become incrementally bearish on 2015 pricing. We see $3.75 as a possibility now, but this seems more like an upside case.” The TPH team isn’t making a change yet to the “official” forecast for 2015, but a full-year $3.50/Mcf average “seems more realistic with parts of the year hovering near $2.50,” which would be “needed to incent coal-gas switching.”

Cuts to gas price forecasts hold implications for exploration and production (E&P) cash flow, noted the TPH analysts. The consensus will be for the Street to reduce gas-weighted E&P estimates over the next six months as the current call is based on a $4.50/Mcf price, they noted. Adjusting for a $3.50 gas price would reduce cash flow for the group by 17%, or around $3.7 billion.

“A 10-15% pullback from here is very possible,” with gas-weighted names most at risk, said the TPH analysts.

Barclays’ Louney and Cohen noted that the contango in the curve has increased mostly in line with their view for stronger fundamentals toward the end of the decade, with upside to their base case for 8 Bcf/d of liquefied natural gas exports by the end of 2020. As well, there’s more optimism for President Obama’s Clean Power Plan to influence higher gas demand.

“That said, such factors will likely not be priced into the curve until more clarity on timing emerges,” the duo wrote.

The Barclays analysts have questioned whether recent gas prices are low enough to incite widespread coal-to-gas displacement because they aren’t convinced it would reach the levels of 2012 and 2013.

“In fact, our models indicate that implied coal displacement will be somewhere in the neighborhood of 2.5 Bcf/d on average over the course of 2014 (roughly 74% of that in 2013), and will be marginally higher in 2015, closer to 2.7 Bcf/d,” they wrote. Gas-fired power generation is forecast to drop by 0.21 Bcf/d year/year on average in 2014, but in 2015, coal retirements and normal weather likely would more than offset that increase in underlying power demand for natural gas.

“Barclays utility equity analysts estimate that 48 GW of coal-fired generation will be retired between 2015 and 2017 in their base case scenario,” said Louney and Cohen. “In our calculations, we have assumed about 30 GW of that will occur in 2015, boosting gas demand in the power sector by 1.5 Bcf/d year/year in 2015.”

Last week the U.S. Energy Information Administration lowered expectations in 2014 for average Henry Hub gas prices to $4.46/MMBtu and in 2015 to $3.87/MMBtu, 13 cents lower than it had forecast in August (see Daily GPI, Aug. 12). Since the start of the month, several analysts, including Raymond James & Associates and Stern Agee, also have reduced their outlook for gas prices through 2015 (see Daily GPI, Sept. 4; Sept. 8).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |