NGI Archives | NGI All News Access

Continental Has ‘Encouraging’ 2Q, Expands SCOOP Play Activity

Continental Resources Inc. reported “encouraging” results from enhanced well completion methods in the Bakken Shale during 2Q2014 and continued well density and pattern testing there, as production in a legacy shale play in south-central Oklahoma nearly doubled.

As the company was reporting its second quarter results, in another forum a judge barred the media and the public from hearing opening statements in the divorce trial of Continental CEO and 70% owner Harold Hamm, over concern confidential information could be disclosed during the trial and damage the company.

The Oklahoma City-based company Tuesday reported net production of 15.3 million boe (167,953 boe/d) during 2Q2014, a 24.3% increase from the 12.3 million boe (135,700 boe/d) produced in 2Q103, and 10.2% above the 13.7 million boe (152,471 boe/d) produced during the preceding quarter, 1Q2014. Crude oil represented 69% of total net production at 116,441 b/d, while natural gas accounted for 31% (309 MMcf).

Broken down by region, Continental production in the Bakken — in North Dakota and Montana combined — totaled 108,573 boe/d during 2Q2014, up 23.4% from the 87,990 boe/d produced there in 2Q2013, and 11.4% above the preceding quarter, 1Q2014, which saw 97,457 boe/d.

Continental said it participated in completing 224 gross (93 net) operated wells in the Bakken in 2Q2014, and ended the quarter with an inventory of approximately 84 gross (66 net) wells drilled but awaiting completion. By comparison, the company had 100 gross operated wells in the Bakken at the end of 1Q2014. Continental said it expects to complete approximately 870 gross (287 net) wells in the Bakken for full-year 2014, including operated and nonoperated wells.

The company said it had planned to test enhanced well completion methods across 20% of its Bakken wells during 2014 and has already exceeded its goal.

“Various tests are ongoing, including combinations of fluid types, increased proppant volumes and shorter stage lengths,” the company said. “The tests completed to date have yielded encouraging early results…[our] Bakken team continues to evaluate the performance and overall well economics for [our] enhanced completion program, which thus far has averaged an additional cost of $1.5 million to $2.0 million per well.”

Continental cited one area of the Bakken where three slickwater completions resulted in an average yearly cumulative production increase 35% higher than the production trend for Continental’s 603,000 boe estimated ultimate recovery (EUR) model for North Dakota. The slickwater completions were also 25% above the production trend for nearby offsetting wells completed with its standard design.

“We’re pleased with several of the new completion methods we are testing and early results show significant improvements in well performance,” said COO Winston Bott. “We are studying the broader implications of applying enhanced completions across the play…”

Last year, Continental began well density and pattern tests in the Bakken targeting the Middle Bakken (MB), Three Forks One (TF1), Three Forks Two (TF2) and Three Forks Three (TF3) benches.

The company said its Hawkinson unit, located in Dunn County, ND, “continues to be a strong producer with all of the 14 wells trending on average 50% above [our] 603,000 boe EUR model after 190 to 250 producing days,” and its Rollefstad unit in McKenzie County, ND, “is also performing well, with 10 of the 11 wells on the unit producing an average rate that is 10% above the 603,000 boe EUR model after approximately 60 producing days.”

But Continental said that while wells targeting the MB and TF1 from its Tangsrud unit, located in Divide County, ND, were producing similarly to neighboring wells in the area, the unit’s TF2 and TF3 wells “continue to underperform offset MB and TF1 producers and do not appear to deliver economic results that compete with [our] substantial inventory of high rate-of-return development opportunities, based on current technology and cost structure.”

Continental said it began producing from its first 660-foot inter-well spacing test at its Wahpeton unit in McKenzie County in May. Twelve new wells — completed using the company’s standard completion design of 30 stages and with 100,000 pounds of proppant per stage — had initial production of approximately 1,015 boe/d; three wells targeting the MB averaged about 1,730 boe/d.

“It is too early to estimate recoveries at the Wahpeton pilot,” Bott said. “However, we are encouraged by the early performance and potential for 660-foot inter-well spacing.”

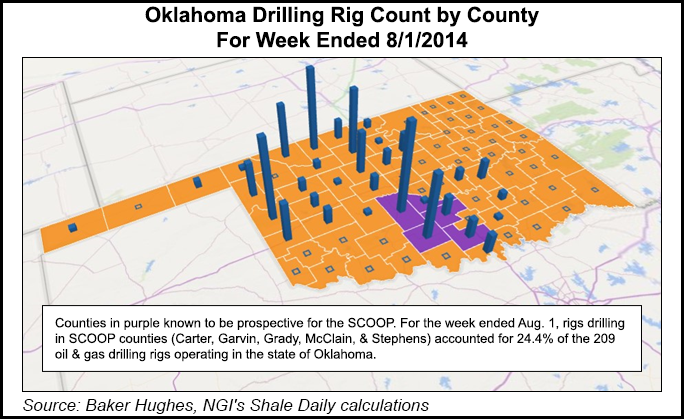

In the South Central Oklahoma Oil Province (SCOOP) — a legacy shale play that Continental claims is geographically similar to the Bakken, Marcellus and Eagle Ford shales (see Shale Daily, Oct. 11, 2012) — net production was 34,265 boe/d during 2Q2014, up 16.7% from 29,363 boe/d in 1Q2014. SCOOP production nearly doubled from 2Q2013, when it totaled 17,547 boe/d.

Continental attributed its production growth in the SCOOP to the addition of 19 gross (14 net) operated and 16 gross (two net) nonoperated wells during the quarter.

“In SCOOP, [our] primary focus continues to be exploration and appraisal, as well as drilling to hold acreage by production, with an increasing shift to 1.5- to two-mile extended lateral wells for superior returns,” the company said, adding that about 50% of its current operated well activity included extended laterals. “Operated well costs in the play are targeted by year-end 2014 to be approximately $8.7 million for an average one-mile lateral across the play and approximately $13.5 million for an average two-mile lateral.”

Continental has started working on its first well density pilot program in the SCOOP, in northeast Stephens County, OK. The program will include 10 wells — five targeting the upper zone of the Woodford Shale and five targeting the lower zone — with each well spaced approximately 1,000 feet apart within the same area. The wells are being drilled on five separate two-well pads. Production is expected to begin toward the end of 4Q2014.

The company also reported average initial one-day test rates from four operated wells in the SCOOP during 2Q2014 — two targeting the oil fairway and two targeting the condensate fairway.

In the oil fairway, the Kolt 1-17H well (46% working interest) in Grady County, OK, initially tested at 668 boe/d (77% oil) and had a 30-day average rate of 435 boe/d, while the Mackey 1-28H well (94% WI) in Garvin County, OK, initially tested at 620 boe/d (70% oil) and had a 30-day average rate of 423 boe/d. The wells were completed with laterals of 4,283 and 4,195 feet, respectively.

The two wells in the condensate fairway — Lambakis 2-11-2XH (77% WI) and Goff 1-15-10XH (65% WI) — were both drilled in Grady County. The Lambakis well initially tested at 14.0 MMcfe, including 320 bbl of oil, and had a 30-day average rate of 13.2 MMcfe/d with pipeline limitations. Meanwhile, the Goff well initially tested at 9.3 MMcfe/d, including 140 bbl of oil, and had a 30-day average rate of 8.8 MMcfe/d, also with pipeline limitations. The wells were completed with laterals of 9,793 and 8,183 feet, respectively.

Continental’s proved reserves were an estimated at 1.2 billion boe, up 11% from the end of 2013 and 31% from mid-year 2013. Net income for 2Q2014 was $104 million ($0.56/share). Adjusted net income was $277 million ($1.50/share), a 13% increase over the $246 million ($1.33/share) of adjusted net income reported during the previous second quarter.

The company has scheduled an investor and analyst day for Sept. 18 in Oklahoma City.

According to reports, Oklahoma County Court Judge Howard Haralson asked the media and the public to leave the courtroom Monday before opening arguments in Hamm’s divorce trial. But he said he did not intend for the entire proceeding, which could take several weeks, to take place behind closed doors.

“There’s no sense in destroying a company over a divorce trial,” Haralson said, according to reports. He said he was taking the action to “protect the third party,” which is Continental, but he later added “I sure don’t believe in things being done behind closed doors.”

Forbes lists Hamm, 68, as the 40th richest person in the world for 2014, with an estimated net worth of $18.2 billion. He owns a 70% stake in Continental. He married Sue Ann Hamm, who has held executive roles within the company, in 1988. She filed for divorce in 2012.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |