E&P | NGI All News Access | NGI The Weekly Gas Market Report

May’s Domestic Dry NatGas Production Highest on Record, Says EIA

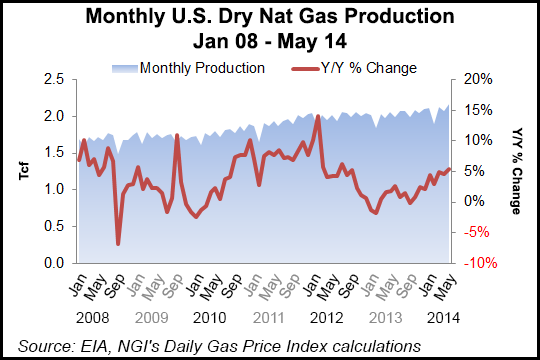

U.S. dry natural gas production in May reached 2,166 Bcf, or 69.9 Bcf/d — the highest on record for any month — according to preliminary figures compiled by the Energy Information Administration (EIA). Lower 48 gas output came in at 78.10 Bcf/d, a 0.92 Bcf/d increase from April.

Including Alaska, total domestic output rose month/month (m/m) to 86.56 Bcf/d. Year/year, Lower 48 output rose 4.55 Bcf/d, 6.2% higher, while total gas production was 4.59 Bcf/d higher — 5.6% more than in May 2013, the EIA reported late Thursday.

The monthly 914 report is prepared in the EIA’s Office of Oil, Gas, and Coal Supply Statistics under the direction of James Kendell.

In the first five months of this year, dry gas production totaled 10,370 Bcf, versus the first five months of 2013, when 9,927 Bcf was produced and the same period of 2012, when the total was 9,907 Bcf.

Total gross withdrawals in 2014’s first five months were 12,986 Bcf, versus 12,394 Bcf for the five-month period of 2013 and 12,364 in the same period of 2012. Marketed production totaled 10,976 Bcf, compared with the five-month period of 2013, 10,457 Bcf, and the same period of 2012, when it was 10,422 Bcf.

The “Other States” category, which includes the Appalachian Basin producers, posted the biggest jump in gas production from May 2013 to May 2014 at 5.14 Bcf/d, a 20.3% increase. Other States also posted the largest volumetric increase, up 0.77 Bcf/d, on the continuous blast of gas from the Marcellus and Utica shales.

Meanwhile, Texas gas output climbed by 0.17 Bcf/d m/m, about 0.7%, to 23.44 Bcf/d, according to EIA. The Railroad Commission of Texas earlier this week estimated final gas production for May at 532.13 Bcf of gas well gas (see Shale Daily, July 30). RRC’s totals did not include casinghead gas or condensate.

According to EIA’s numbers, Oklahoma production also was higher in May than in April, climbing 0.05 Bcf/d, or 0.8%, to 5.86 Bcf/d. Louisiana recorded the largest decline between April and May, down 1.11 Bcf/d, or 16.6%.

Preliminary total gas consumption totals for May indicated a decline to 1,803 Bcf, or 58.2 Bcf/d, from April’s revised 65.1 Bcf/d, EIA said. The figures represent a 3.4% increase from May 2013’s 1,744 (56.3 Bcf/d), making it the second highest on record for the month.

“Deliveries to electric power consumers for May 2014 (647 Bcf or 20.9 Bcf/d) are the second highest on record for May, an increase of 5.6% from May 2013,” said the report. “Other deliveries to consumers volumes were more in line with those from prior years: residential deliveries (196 Bcf or 6.32 Bcf/d) increased only slightly from last May (194 Bcf or 6.26 Bcf/d); commercial deliveries (173 Bcf or 5.6 Bcf/d) rose 3% from May 2013 (168 Bcf or 5.4 Bcf/d); and industrial deliveries (607 Bcf or 19.6 Bcf/d) increased 2% from last May (597 Bcf or 19.3 Bcf/d).

Barclays Capital analysts Christopher Louney and Michael Cohen said in a note Friday that Lower 48 gas production gains are a continuing upside surprise.

“The reported m/m production growth was once again higher than pipeline flow estimates, which showed production growth of just 0.52 Bcf/d in May, a trend that has been consistent thus far this year,” they said. “As of May 2014, production was 2.13 Bcf/d higher than in November 2013, while pipeline estimates show only about 1.26 Bcf/d of growth over the same period.

“Admittedly, pipeline estimates have poor visibility into intrastate pipeline flows, but the EIA data could be revised significantly in the future. Thus, while production is likely exceeding expectations, there are still uncertainties given the possibility of future revisions.”

U.S. gas production “will continue to grow in the coming months, but it may be reduced in June due to pipeline and plant maintenance. We do expect accelerated growth y/y overall in 2014 and for that growth to continue in 2015, but highlight upside risks to our estimates.”

Also in a note Friday, Wells Fargo Securities analysts David Tameron and Gordon Douthat said the 2Q2014 earnings season thus far has resulted in “more Q2 production beats than misses,” but said there was “an even split between companies who have and have not raised full-year production guidance.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |