Apache to Sell Kitimat, Wheatstone LNG Projects, Monetize International Portfolio

Apache Corp. is selling the two liquefied natural gas (LNG) export projects in which it has stakes and plans to monetize its international portfolio, excluding parts of Canada, CEO G. Steven Farris said Thursday.

Farris addressed rumors about Apache’s future during a conference call on second quarter results. Last week, major investor Jana Partners LLC called on management to sell all of its international operations and drill exclusively in the United States (see Daily GPI, July 22).

“First, let me state at the outset, that Apache’s future is centered on our tremendous North American resource base,” Farris told analysts. Many of the rumors circulating about what Apache may do to lift the value of the company already are in the works, he said. “And let me be clear, Apache intends to completely exit Wheatstone and Kitimat LNG projects.”

The proposed Kitimat export facility for British Columbia’s (BC) west coast is being developed with Chevron Corp. Interests in the gassy Liard and Horn River formations in BC, considered part of the Kitimat portfolio, also are being marketed. In addition, a 13% stake in the Chevron-led Wheatstone LNG project in Australia has been put up for sale (see Daily GPI, May 5).

Asked what impact Apache’s exit might have on Kitimat, Farris said “a complete exit by Apache should have no impact on the value of Kitimat one way or another. Whether we’re in it or not, it’s a world-class reserve, and Chevron and Apache are well ahead in that arena. We’ve always been in a position that we felt like we could not be in LNG projects” for the long haul.”

Chevron is scheduled to deliver its quarterly results on Friday.

Apache doesn’t plan to exit Canada completely. Assets in the Duvernay and Montney basins, which hold big liquids-rich opportunities, are to be retained, said Farris.

Ways to monetize the international businesses have been on the table for months, but it may not be an outright sale, he said. One option is to spin off the portfolio, allowing the operator to keep some of the cash flow, while another is an outright sale. The overseas portfolio includes assets in Argentina and Egypt.

“Certainly, the way we are looking at it, we would just spin out or set up a company that was above any of relationships that Apache had at a joint venture level,” he said. “We’ve been exploring multiple opportunities, including separation or monetizing…through the capital markets.”

It’s become more obvious to management that North America offers the best opportunities, particularly in the Permian Basin, where Apache has 1.7 million net acres.

Global ambitions have been superseded by the overwhelming potential in North America’s onshore. Apache averaged 115 rigs worldwide in the period, 82 of which were in North America’s onshore. The company completed 440 gross wells, 360 of which also were in North America, mostly in the Permian.

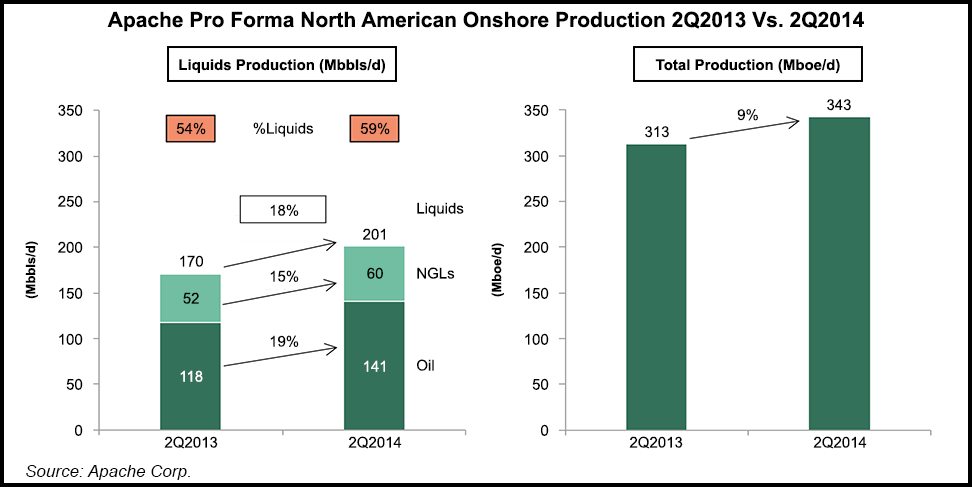

North America onshore regions increased pro forma (for sales) liquids production by 31,000 b/d from 2Q2013. Total pro forma production averaged 201,000 b/d.

The Permian Region achieved record production averaging 155,000 boe/d, up 265 year/year. The region averaged 37 operated rigs during the quarter and drilled 164 gross operated wells, including 74 horizontals.

“The cornerstone of the North American onshore success is the outstanding performance in the Permian Basin…We have reached our performance goals ahead of plan, and recently reached a significant milestone with liquids production of 150,000 b/d net…We’ve come a long way since we launched the region just four years ago…Production has been up 200% since that time, 17 out of the last 18 quarters and the last 11 quarters consecutively.”

Cash flow from the Texas-New Mexico basin is strong enough “to fund our capital program through the year,” with 23% liquids growth and 20% boe growth now expected year/year.

“In the past, the North American business was one large resource of many different plays…But we allocate resources to the best opportunities in the portfolio,” Farris said. “We have significant opportunities before us in North America’s onshore.”

North American onshore liquids production grew 18% in the latest quarter from a year ago, and rose 3% sequentially. Total onshore liquids volumes reached a record 201,400 b/d. Worldwide output averaged 636,000 boe/d, while liquids production comprised 59% of the total, up from 58% in 1Q2014.

Apache reported a 50% decline in quarterly earnings from a year ago, partly on a long list of asset sales, with revenues sliding 18% to $3.48 billion. Over the past year the operator has sold producing assets in the Gulf of Mexico, Canada, Argentina and in Egypt.

Profits in 2Q2014 were $505 million ($1.31/share), versus year-ago earnings of $1.02 billion ($2.54). Oil revenues dropped 5.8% year/year to $2.95 billion, while gas revenue plunged 18% to $589 million. Net cash provided by operating activities totaled $2.3 billion, versus year-ago cash of $2.8 billion.Total reported worldwide net daily production of oil, natural gas and natural gas liquids averaged 636,000 boe/d, with pro forma production averaging 550,000 boe/d.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |