E&P | NGI All News Access | NGI The Weekly Gas Market Report

In Swap, Chesapeake Grabs Bigger Position in Southern PRB

Chesapeake Energy Corp. has agreed to swap property and producing wells in the Powder River Basin of Wyoming with RKI Exploration & Production LLC, the company said Tuesday.

Under the agreement, Chesapeake would convey 137,000 net acres and its interest in 67 gross wells, with an average working interest of 22%, in the northern portion of the PRB to RKI, the designated operator. In exchange, RKI would part with 203,000 net acres and its interest in 186 gross wells, with an average working interest of 48% in the southern portion of the PRB, where Chesapeake is designated operator.

In addition to the swap, set to close in August, Chesapeake is paying RKI $450 million in cash.

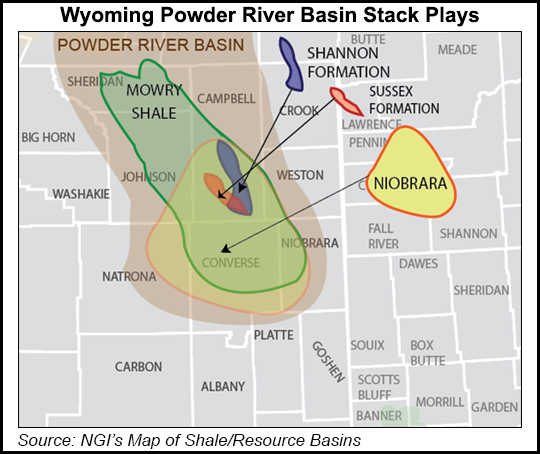

“Excellent results to date from the Niobrara and Sussex formations, coupled with additional stacked pay potential in other Upper Cretaceous sands as well as the Frontier and Mowry formations, demonstrate the potential of the Powder River Basin to be a major oil growth engine for the company,” said Chesapeake CEO Doug Lawler.

Chesapeake’s acreage in the basin after the deal is done would be concentrated in the southern PRB, and it would operate 100% of the total 388,000 net acres. It also would hold an average 79% working interest in the property.

Chesapeake now holds around 322,000 net acres in the basin with a 38% average working interest. The transaction basically increases the PRB holdings by 66,000 net acres.

The multiple stacked oil pay zones offer potentially recoverable gross resource estimated to be more than 2 billion boe, according to Chesapeake. Incremental production with the exchange would be around 4,500 boe/d.

Chesapeake management highlighted some of the company’s most recent results in the PRB. Among other things, Chesapeake has achieved a 50%-plus reduction in drilling cost per foot in the Niobrara formation.

“Coupled with planned longer laterals and completion improvements, single-well rate of return potential is targeted to exceed 40%, assuming a constant West Texas Intermediate (WTI) crude oil price of $90.00/bbl and a Henry Hub natural gas price of $4.00/Mcf,” management said.

The producer also recently drilled a record 9,600-foot lateral Niobrara well in 32 days at a drilling cost of $5 million, compared with “2013 vintage Niobrara wells with an average lateral length of 5,300 feet and average drilling cost of $6.6 million,” it said.

As well, the initial Sussex formation test well, placed online in January, has produced about 232,000 boe in 150 production days “and continues to produce in excess of 1,500 boe/d.”

Another delineation well in Sussex (No. III), 20 miles north of the first well, produced at an initial 24-hour average rate of more than 1,000 boe/d (85% oil). The well “substantially derisks the northern end of the Sussex field,” which is estimated to be 20 miles long by five miles wide.

The Sussex formation is estimated to offer single-well rates of return potential of more than 50%, 75% oil weighted with an API gravity of 40-48 degrees, according to Chesapeake.

Chesapeake also said Tuesday it has agreed in principle to repurchase all of the outstanding preferred shares of its unrestricted subsidiary CHK Utica LLC from third-party preferred shareholders. Under the agreement, Chesapeake is paying $1.26 billion to repurchase 1.06 million preferred shares. The proposed transaction, also set to close Tuesday, would retire the operator’s highest cost leverage instrument and eliminate approximately $75 million in annual cash dividend payments to third-party preferred shareholders.

CFO Nick Dell’Osso said the company would “continue to execute on our strategy of eliminating financial complexity, [and] we believe that this is an opportune time to repurchase the remainder of the CHK Utica preferred shares at a price that is accretive to net present value.”

Chesapeake would fund the cash portion of the RKI acreage exchange, and the CHK Utica share repurchase, with available liquidity, including nearly $1.5 billion of unrestricted cash held on its balance sheet at the end of June.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |