Regulatory | LNG | NGI All News Access | NGI The Weekly Gas Market Report

DOE Streamlining LNG Export Review Process

The U.S. Department of Energy (DOE) said Thursday it will modify its liquefied natural gas (LNG) export review process, effectively taking a backseat to FERC and redirecting the spotlight to a smaller volume of exports that have final, multi-agency authorization.

The agency also said it will hire consultants to study again the impact of LNG exports on the domestic gas market, only at higher volumes than previously considered. And it threw a couple of bones to export opponents who have challenged projects on the grounds that they would stimulate more “dirty” gas drilling.

DOE proposed modifying its procedure for reviewing applications to export liquefied domestic natural gas to countries that are not parties to free trade agreements (FTA) with the United States. The agency will no longer grant “conditional” authorizations and will only approve proposals after they have undergone National Environmental Policy Act (NEPA) review.

“The proposed changes to the manner in which LNG applications are ordered and processed will ensure our process is efficient by prioritizing resources on the more commercially advanced projects, while also providing the department with more complete information when applications are considered and public interest determinations are made,” wrote DOE’s Christopher Smith, principal deputy assistant secretary for fossil energy, in a blogpost.

Smith said DOE will initiate an updated economic study and is releasing two environmental reports that address the footprint of unconventional natural gas production and the lifecycle greenhouse gas impacts of exports. DOE will make the proposed procedural change and environmental reports available for a 45-day public review and comment period.

Smith said DOE’s practice of issuing conditional authorizations to export LNG to non-FTA countries was designed to provide regulatory certainty before project sponsors and the Federal Energy Regulatory Commission (FERC) spent significant resources required for NEPA review.

But project backers have not wanted to wait to get their NEPA reviews started, so DOE plans to make its final public interest determination under the Natural Gas Act (NGA) only after the NEPA process has concluded. It will no longer issue conditional authorizations.

“By removing the intermediate step of conditional decisions and setting the order of DOE decision-making based on readiness for final action, DOE will prioritize resources on the more commercially advanced projects,” Smith said.

By focusing on projects “that are more likely to actually be constructed,” DOE will make better use of resources and be better able to judge the cumulative market impacts of authorized projects, Smith said. “While it is not assured that all projects for which NEPA review is completed will be financed and constructed, projects that have completed the NEPA review are, generally speaking, more likely to proceed than those that have not.”

Analysts at ClearView Energy Partners LLC said in a note Thursday that the move by DOE relieves the potential for project timeline conflicts between DOE and FERC. “We have long held that FERC represents the primary regulatory gate through which prospective facilities must pass,” ClearView said.

The analysts said under DOE’s old procedure, projects that had completed FERC review but had yet to receive DOE non-FTA authorization “…could have been caught in a ”limbo’ that could have impaired contracting, financing and/or final investment decisions.” They added that the revision to procedure frees “stranded” applicants from the DOE’s sequencing protocol, which was issued in 2012.

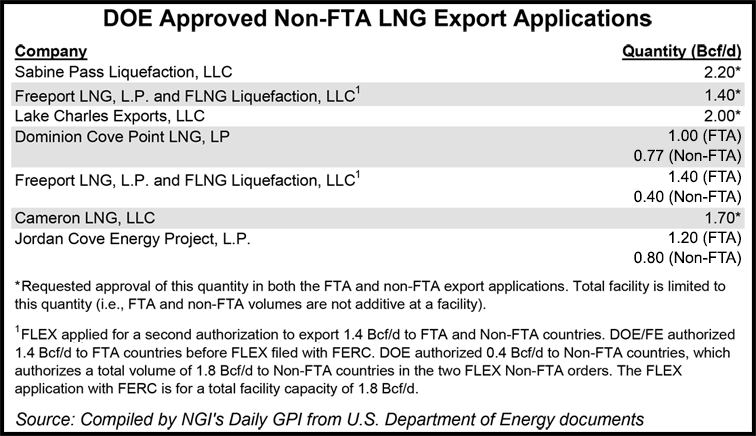

The change in procedure also has political ramifications for the export debate as it effectively resets the volume of approved exports down from 9.27 Bcf/d (DOE final/conditional export approval) to 2.2 Bcf/d (approved capacity), ClearView said. The latter volume “hews more closely to economic reality” as the DOE authorization is just part of a process that includes FERC review, contracting, financing and construction, the analysts said. Only one project, Cheniere’s Sabine Pass brownfield export project in Louisiana has cleared the FERC hurdle and is under construction. Fourteen others remain under FERC review.

The 9.27 Bcf/d volume was approaching the upper portion of the volumetric band (6-12 Bcf/d) of exports studied by DOE and its hired consultants in their study issued in 2012. Alarm bells began ringing for some at around 6 Bcf/d (see Daily GPI, Sept. 13, 2013).

“Closing the rhetorical gap between 9.27 Bcf/d that could be exported and 2.2 Bcf/d fully approved for export (and also under construction) may serve to assuage the concerns of skeptics,” ClearView said. “At the same time, making FERC approval tantamount to non-FTA authorization still enables the [Obama] administration to point to a substantial volume of pending projects…”

DOE issued a Notice of Proposed Procedures for LNG Export Decisions for a 45-day public comment period while it continues to evaluate projects that have already received conditional authorizations and completed their NEPA review. DOE will continue to act on requests for conditional authorization currently under review while the proposed procedural changes are being considered.

DOE said its economic study would look at how exports of between 12 and 20 Bcf/d of liquefied gas could affect the public interest. Using more recent data from sources like the Annual Energy Outlook 2014, the Energy Information Administration (EIA) will update its 2012 LNG Export Study, which only looked at export cases of 6 and 12 Bcf/d (see Daily GPI, Dec. 7, 2012).

Following the EIA update, DOE will again contract for an external analysis of the economic impact of this increased range of LNG exports and other effects that LNG exports might have on the domestic gas market.

As far as updating the export study to look at greater volumes of export, DOE was beaten to the punch earlier this year by LNG developer Cheniere Energy Inc. when it hired NERA Economic Consulting to revise the earlier study it had conducted for DOE. That effort found “…that there is no support for the concern that LNG exports, even in the unlimited export cases [of the study], will obstruct a chemicals or manufacturing renaissance by moving the United States so far up the global supply curve that competitors in natural gas-importing regions will have lower costs [see Daily GPI, March 11]”

By conducting yet another study, DOE avoids conflict of interest perceptions that could ensue from the Cheniere-funded study, ClearView said.

To date, DOE has issued final authorization for export to non-FTA countries at a rate of 2.2 Bcf/d. If at any future time the cumulative export authorizations approach the high end of export cases examined, DOE said it will conduct additional studies as needed.

Critics of LNG exports have often argued that their stimulus of natural gas production will lead to more drilling in unconventional gas plays using horizontal drilling and hydraulic fracturing well stimulation. This, they have said, will harm the air and water due to associated emissions and wastewater disposal. While challenges to LNG export projects on these grounds have been rebuffed by regulators, DOE said Thursday it was issuing two reports to address the matter.

The first report reviews unconventional natural gas exploration and production activities and is titled “Draft Addendum To Environmental Review Documents Concerning Exports Of Natural Gas From The United States.”In keeping with President Obama’s Climate Action Plan and the administration’s commitment to mitigate greenhouse gas emissions, DOE completed a second report titled “Life Cycle Greenhouse Gas Perspective on Exporting Liquefied Natural Gas from the United States.”

The rethink by DOE is something at least a few politicians have been looking forward to.

Sen. Ron Wyden (D-OR) praised the move to revise the agency’s economic study, adding that it’s something he’s said the agency should have done a while ago. “I have long said that the studies DOE has need to be updated to reflect current market conditions and data. I am pleased to see DOE has taken my suggestions to heart and that we will look before we leap in order to maximize the economic and environmental benefits of natural gas,” Wyden said. “A clearer process will mean more certainty for developers and workers about which projects are commercially viable.”

Sen. Mary Landrieu (D-LA) has been a strong proponent of exports; many of the projects would benefit her energy state. “The studies show and I believe that we can do this [exportation of LNG] while still maintaining a cheap, abundant supply of natural gas at home necessary to fuel America’s manufacturing renaissance,” she said. “However, I am also encouraged that DOE will initiate an updated economic study to ensure the domestic price of natural gas stays affordable for consumers.” Her statement was accompanied by a reminder that Landrieu in March called on DOE to streamline its export approval process (see Daily GPI, March 25).

Rounding out a the “told you so” trio of lawmakers was U.S. Sen. Lisa Murkowski (R-AK), the top Republican on the Senate Energy and Natural Resources Committee.

“I have long warned that the United States faces a narrowing window of opportunity to enter the global gas trade,” she said. “Projects have languished in the so-called ‘queue’ awaiting approvals from two separate agencies in a parallel process that often did not function well. This proposal for reform is a positive step toward fixing a needlessly confusing regulatory review that had become disengaged from economic reality.

“I continue to oppose delays to the buildout of our export capacity, which I firmly believe to be in the national interest, and do not believe additional study is necessary. Multiple studies have confirmed time and again that the nation as a whole would benefit in both security and economic terms as a result of selling American gas to our friends and allies overseas.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |