NGI Archives | NGI All News Access | NGI The Weekly Gas Market Report

Apache’s Permian Delivers Record-Setting Performance

Apache Corp. took a gamble when it upended its global exploration strategy, marketing some of the more contrary (political) and expensive (deepwater) pieces within its portfolio, but the decision to remain — and expand — in the U.S. onshore has proven to be a profitable bet.

North American onshore liquids output rose 21% year/year in the first quarter, with liquids volumes hitting a record 198,500 b/d. Worldwide output averaged 640,000 boe/d; 672,000 boe/d including discontinued operations.

“A record setting performance by our Permian region continues to drive strong overall results for the company,” said CEO G. Steven Farris. “We remained the most active driller in onshore North America, operating an average of 82 rigs during the quarter.”

Apache “intensified” its focus on North America’s liquids targets by selling off its Argentina business and some of the conventional natural gas properties in Western Canada. That intensity grew higher on Thursday after Apache agreed to sell a big chunk of its deepwater Gulf of Mexico portfolio to Freeport-McMoRan Gold & Copper Inc. for $1.4 billion (see Daily GPI, May 8). The rest of the U.S. deepwater properties remains up for grabs as well, Farris said.

More details of what Apache is planning operations-wise should be revealed during an analyst presentation in the next few days. However, the CEO and his executive team made it clear that there’s not going to be any let-up in North America.

Quarterly production remained ahead of the internal plan, said Farris. “We remain on track to deliver within our previously stated production guidance for the year at 15-18% North American onshore liquids growth, and 5-8% global boe growth on our pro forma 2013 production of 537,000 b/d.” North American liquids represented 53% of Apache’s total worldwide liquids output and 31% of total overall production.

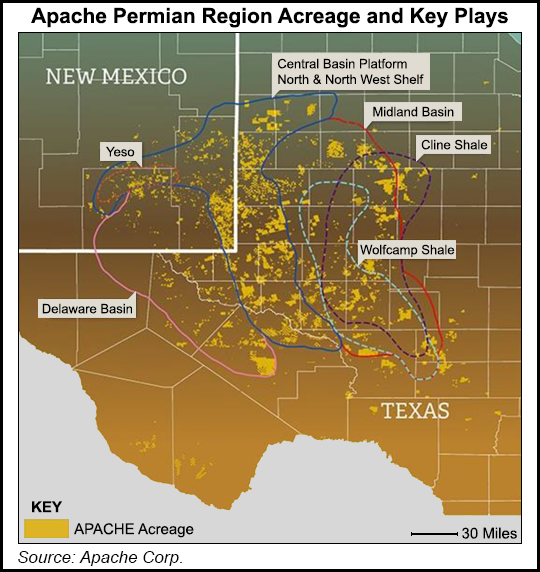

Most of that liquids growth is coming from an unsurprising source: the Permian Basin and its prolific sub-basins, the Midland and the Delaware. Production in that region alone increased almost 15,000 boe/d, 12% more than in 4Q2013. Of note was the Wolfcamp Shale within the Midland, where Apache drilled 43 new horizontals and delineated more acreage with seven rigs running. The Delaware Basin’s Bone Spring play also proved a good performer — and the recipient of more cash and rigs this year.

Specifically in the Wolfcamp, Apache is seeing improvement in all of its wells, driven by completions, said North America COO John Christmann. “We have added five horizontal rigs that we started adding late last year and are kind of starting to hit our strides in most of counties, Midland, Upton and Reagan,” he told analysts.

“The thing about Wolfcamp is you’ve got multiple benches, and we’re still early in understanding exactly how many wells we can drill per section, how many laterals and that sort of thing. So I am excited about all of it. Our whole portfolio in the Permian is having great results, not just in Wolfcamp.“

Within the Delaware Basin, three rigs are running, mostly targeting the Bone Spring.

Asked which part of the Permian might draw more incremental capital, the Delaware or the Midland, Christmann said it would be “easier” to increase funding the Midland because two-thirds of the rigs are operating there.

“That’s driven based on just where we can put in [rigs] immediately,” Christmann said. “I think the economics are very comparable in both basins though. As the year unfolds, mostly it’s getting more active in the Delaware.”

Further southeast, in the emerging new area of the Eagle Ford Shale, where Apache has around 400,000 acres (gross), nine wells were drilled in the quarter, including an impressive performer in Brazos County north of Houston. The McCullough-Wineman over 30 days produced at a rate of 1,455 boe/d, above the type curve. The results were strong enough that Apache plans to double the rig count to eight from four by the middle of the year.

“Based on the strong results we’ve seen in the Permian so far, and the Eagle Ford and our Gulf Coast regions, we are evaluating the programs with an eye toward reallocating capital for those regions,” said Farris. Reallocating some of the capital may be as soon as the “next couple of weeks.”

“We are currently testing new plays and completion ideas along the Gulf Coast and are encouraged by early results in Canada, where a focus on liquids-rich plays contributed to a 10% increase in crude oil and natural gas liquids compared with the preceding quarter,” Farris said.

There were some impacts from the frigid weather. Apache had been planning to drill a total of 418 wells in its central region, which includes the Permian, noted Christmann. The original plan was to drill 418-plus wells in 2014. However, only 44 net wells were completed by the end of March. Most of the lag should be made up over the course of the year as more funds are directed to the region, he said.

Property sales over the past year impacted the bottom line, but excluding the one-time items, it earned $753 million ($1.90/share) from continuing operations on cash flow of $2.3 billion. In the year-ago period, profits from continuing operations were $759 million ($1.91/share) with $2.6 billion in revenue.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |