Markets | Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

The Cupboard is Nearly Bare, But Gas Storage Refill ‘Doable’

With the country’s “extraordinary winter for natural gas consumption” winding down, thoughts of gas market players have been on what’s left in gas storage caverns and what it will take to refill them in time for winter 2014-2015.

January’s brutal, polar vortex-addled weather drove the country’s natural gas consumption to a record for a single month: nearly 3.2 Tcf. Jan. 7 was the highest consumption day ever seen at about 139 Bcf. Over the past five years or so, a strong demand day during winter’s peak month has typically been about 110 Bcf.

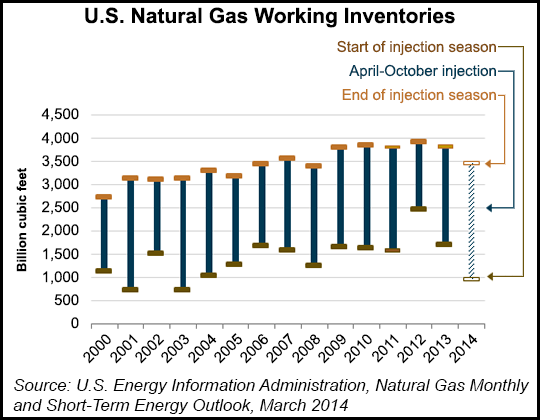

Bitter cold led to a record-breaking natural gas withdrawal season in 2014 (with 2,851 Bcf taken from stores), bringing inventories to a 10-year low. The Energy Information Administration (EIA) is forecasting a robust injection season (April-October) with nearly 2,500 Bcf to be added to inventory.

Although working gas in storage has been poised to dip below 1 Tcf, that threshold wasn’t quite broken with Thursday’s storage report for the week ending March 7, which landed at 1,001 Bcf (see related story). The 1 Tcf level has been breached before, five times, in fact, according to data going back to 1976, when the American Gas Association (AGA) was the keeper of the weekly storage data, AGA’s Chris McGill told reporters during a briefing Thursday.

“The ground isn’t new in terms of being below that magic 1 Tcf number, but the storage position has changed,” said McGill, who is AGA’s vice president for policy analysis.

Gas markets have changed quite a bit in recent years. There is more working gas storage capacity, and the market starts the winter with more gas squirreled away. Production also has grown substantially, thanks to shale plays, and demand has grown, too, particularly among power generators and industrial end-users.

Over the last 15 years, the industry has seen working gas inventories at the start of the heating season grow by about 1 Tcf. “Today the design capacity for natural gas in storage, working gas in storage, is well over 4 Tcf. When AGA was doing the storage report during that period over 10 years ago, our universe of storage was more at about 3.2 Tcf,” McGill said. “So storage itself has grown significantly, and that does have some influence on what we’re seeing in terms of the numbers we’re seeing today.”

While weather-driven activity around gas storage has been falling outside the norm, analysts at Barclays Commodities Research said in a note Thursday that they expect inventories to rebuild to “comfortable levels” by the end of October, thanks to growing production and a predicted slackening in power generation demand for gas due to rising prices.

“…[H]igher prices will mean sharply lower gas demand in power generation,” Barclays said. The low-price trend of gas displacing coal among power generators will switch to “…a significant recovery of coal-fired generation and a drop of gas-fired generation…[T]his should be sufficient to make up for the lion’s share of the current storage shortfall.”

Also supporting the case for refill confidence, EIA’s Short Term Energy Outlook (STEO) projects relatively high gas production growth and moderate demand growth starting in April, which the agency said will allow for a record storage build through October.

“The forecasted April-to-October storage build of nearly 2,500 Bcf would surpass the previous record injection season net inventory build (April-October, 2001) by more than 90 Bcf, to end the injection season at 3,459 Bcf. While the projected storage build for the upcoming injection season would be a record, total Lower 48 end-October inventories in 2014 would still be at their lowest level since 2008. High injections would not fully erase the deficit in storage volumes caused by this winter’s heavy withdrawals.

According to the STEO spot gas prices will be in the low $4/MMBtu area over the summer, a level high enough to limit growth of gas use in the electric power sector. That along with close-to-normal weather this summer should mean that electric power consumption of gas from April to October will be 23.9 Bcf/d, essentially flat compared to year-ago levels, EIA said. Meanwhile, expected dry natural gas production during this period reaches 68.1 Bcf/d, a 2% increase over last year.

McGill said having 3.5 Tcf in storage at the start of withdrawal season is relatively new for the industry and was only reached for the first time in October 2007 and then not again until 2009. But he also pointed out that injection season doesn’t always end at the end of October.

Net injections into gas storage have occurred in late December. “I’m reminding you that just closing the book on net injections into storage on Nov. 1st is probably not the way the system is operating right now,” McGill said. There have also been net withdrawals from storage in the middle of summer to serve power generation demand. “A lot has happened around our traditional view of working gas in storage, particularly in the last four…to seven years.”

A refill of storage during the upcoming 31-week injection season from 800 Bcf to 3.6 Tcf would require 13 Bcf/d on average to be injected, McGill said. “Is that doable? Every indication would say in the physical market that is doable.” He added, though, that there will be some lumpiness in injections, with higher levels injected early in the season when caverns are emptier and easier to refill.

BNP Paribas’ Teri Viswanath, director of commodities strategy, said Thursday in a note that gas production gains will likely fall short of “exuberant” expectations. “Despite the industry’s best efforts to bring additional supplies to market, we believe that it will take more than a single injection season to swing the market back into equilibrium,” she wrote. “…[D]espite record injections over the summer, the current level of storage leaves the industry with just 3.459 Tcf by end October.”

Viswanath is skeptical of the robust supply/gas-to-coal fuel-switching argument. While supply will contribute to realign the market, “…the challenge this time around is that, having become used to low prices, consumers might be less accommodating,” Viswanath wrote. “This means that the period of tightness might persist longer than the market anticipates; this would represent a changed dynamic that has important implications for prices.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |